Introduction

In the ever-evolving world of finance, new avenues for investing and speculating are constantly emerging. One such frontier is the realm of Bitcoin options trading, a tantalizing prospect that has ignited widespread interest among crypto enthusiasts and traditional investors alike. Bitcoin, the enigmatic digital currency that has captivated the world, now offers options contracts, opening avenues for managing risk and harnessing market inefficiencies. Embark on this comprehensive journey as we delve into the intricacies of Bitcoin options trading, empowering you with the knowledge and insights to make informed decisions in this uncharted territory.

Image: www.gearrice.com

Understanding Bitcoin Options

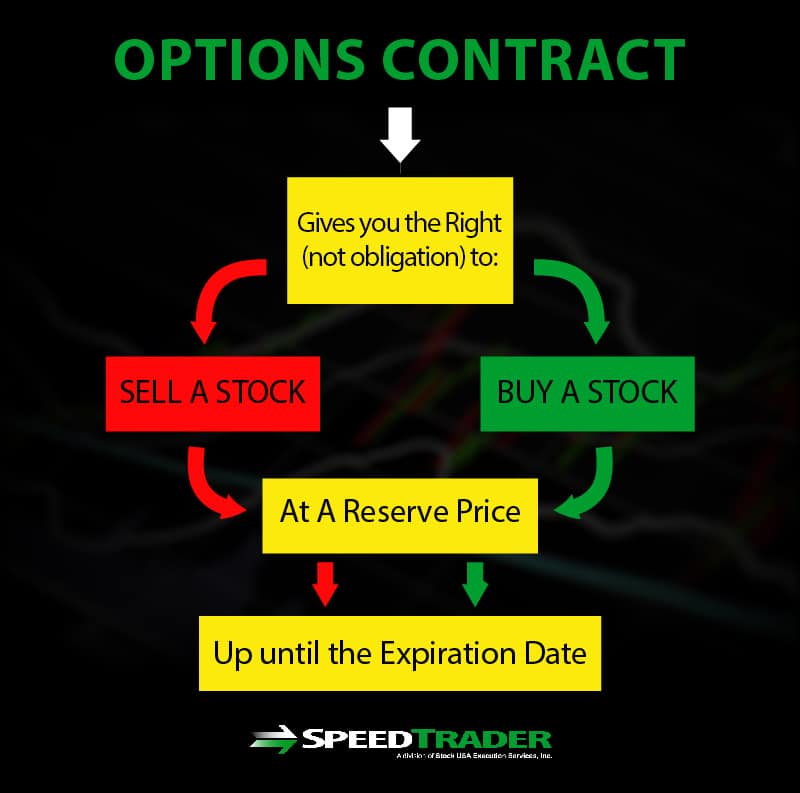

An option contract grants the holder a right, but not an obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (known as the strike price) on or before a specific date (the expiration date). In the context of Bitcoin options, investors can speculate on the future price movements of Bitcoin without committing to purchasing or selling the actual cryptocurrency. This flexibility allows traders to hedge against risk, speculate on price fluctuations, or even generate income through covered calls and cash-secured puts.

A Historical Lens on Bitcoin Options

The concept of Bitcoin options trading has been gaining traction in recent years, paralleling the meteoric rise of Bitcoin itself. Pioneered by regulated exchanges such as Deribit and CME Group, Bitcoin options trading has introduced sophisticated financial instruments to the crypto ecosystem, catering to both institutional and retail investors seeking advanced risk management strategies and opportunities for speculative gains.

Types of Bitcoin Options Contracts

Understanding the different types of Bitcoin options contracts is crucial for navigating this complex landscape. Call options grant the holder the right to buy Bitcoin at the strike price by the expiration date, while put options provide the right to sell Bitcoin at the strike price by the expiration date. Within these categories, traders can choose between European-style options, which can only be exercised on the expiration date, and American-style options, which offer greater flexibility by allowing exercise anytime before the expiration date.

Image: orangmukmin-128.blogspot.com

Trading Bitcoin Options

Participating in Bitcoin options trading involves several key steps. First, select a reputable cryptocurrency exchange that offers options trading services. Cryptocurrency exchanges generally have varying fee structures, trading platforms, and security protocols, so careful research is essential in finding the best fit for your needs. Once the exchange has been chosen, it is time to fund your account and select the specific option contract you wish to trade.

Expert Insights on Bitcoin Options

Navigating the complexities of Bitcoin options trading can be daunting, but the wisdom of experts in the field can illuminate the path. Industry leaders emphasize the importance of understanding the risks involved, recommending that beginners start with small trades and focus on education before diving headlong into the deep end. Additionally, traders are advised to set clear trading goals and adhere to a disciplined risk management strategy, utilizing tools such as stop-loss orders to protect their capital from potential market downturns.

Does Bitcoin Have Options Trading

Image: www.tradingview.com

Conclusion

The world of Bitcoin options trading presents a blend of captivating opportunities and potential pitfalls. By educating yourself about the different types of option contracts, evaluating risk, and adopting sound trading strategies, you can harness the power of this financial instrument to expand your investment horizons and potentially generate significant returns. Remember, knowledge is key in this ever-evolving market, and continuous learning will empower you to navigate the complexities of Bitcoin options trading with confidence and agility. Embrace the allure of the crypto frontier and unlock the potential rewards that await those who embrace its challenges.