In the realm of financial markets, navigating the labyrinthine depths of options can be a daunting task. An option chain, a comprehensive representation of all available option contracts for a specific underlying asset, presents traders with a sea of choices. Amidst the myriad of strikes, expirations, and premiums, understanding and leveraging the power of an option chain is a crucial skill for discerning investors.

Image: seorub.com

Unveiling the Fabric of an Option Chain

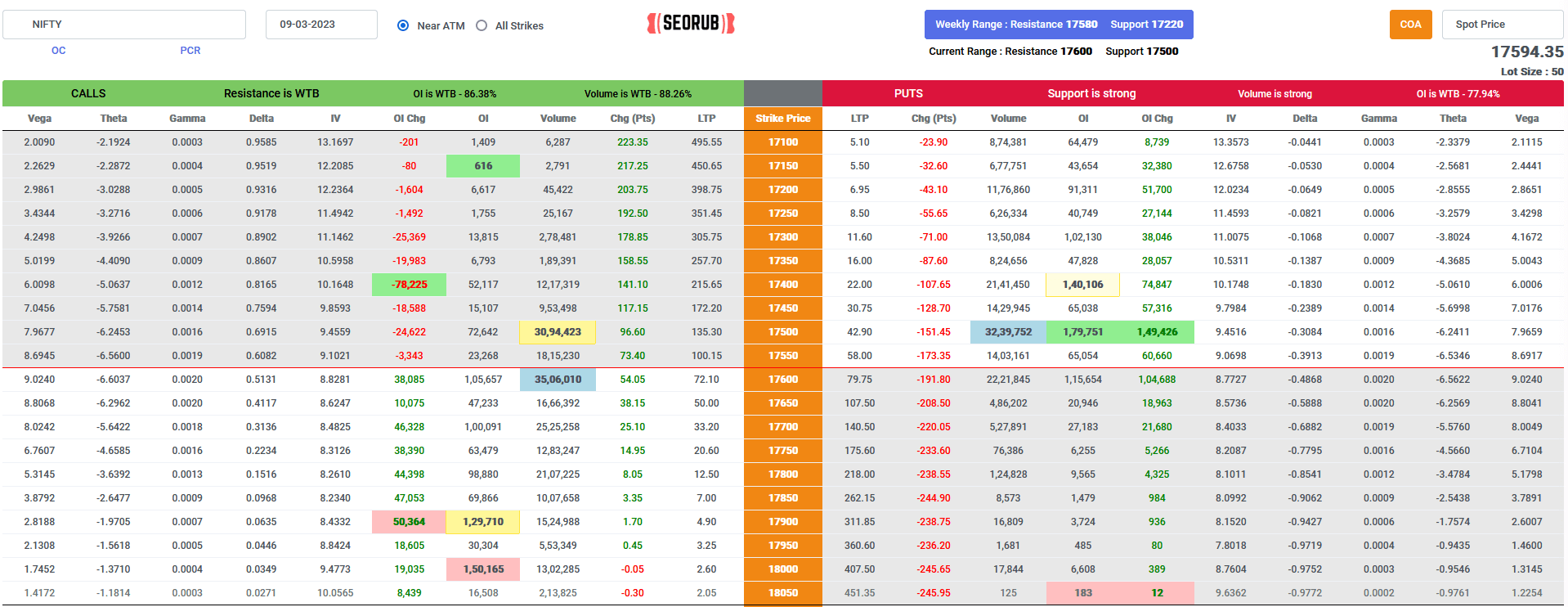

An option chain, akin to a meticulously woven tapestry, is intricately composed of individual option contracts. Each strand represents a different option, endowed with unique characteristics that collectively define the trading universe for the underlying asset. The horizontal axis of the chain displays strike prices, representing specific price levels at which the option can be exercised. The vertical axis, on the other hand, showcases various expiration dates, signifying the time window within which the option can be utilized.

The price of each option contract, termed the premium, is determined by a complex interplay of factors that include:

- Intrinsic value: The inherent value of the option based on its potential to generate profit at its current price.

- Time value: The premium paid for the remaining time until the option’s expiration date. This value diminishes as time progresses.

- Volatility: The level of price fluctuations in the underlying asset. Higher volatility translates into higher premiums as investors seek protection against potential losses.

Empowering Traders with Option Chain Analysis

Discerning analysis of the option chain empowers traders with invaluable insights into market sentiment and potential trading opportunities. By scrutinizing the arrangement of calls and puts at various strike prices, traders can gauge the market’s expectations and biases regarding the future direction of the underlying asset.

- Call-to-Put Ratio: An indicator of market sentiment, the call-to-put ratio reveals the relative prevalence of bullish versus bearish sentiment. A high call-to-put ratio suggests a prevalent optimistic outlook, while a low ratio points towards a pessimistic market mood.

- Open Interest: The number of outstanding option contracts represents the level of market activity for a particular strike price and expiration. High open interest indicates significant interest in a specific option, signaling potential trading opportunities.

- Implied Volatility: Embedded in the option prices, implied volatility gauges market expectations of future price swings in the underlying asset. Elevated implied volatility often indicates heightened uncertainty and elevated trading activity as investors seek to hedge their positions.

Harnessing the Power of Options: Strategic Insights

Armed with a comprehensive understanding of option chains, traders can craft strategic trading plans tailored to their specific objectives. Options offer a versatile toolbox for both speculative ventures and risk management strategies.

- Hedging Strategies: Options provide a means of mitigating risk associated with existing financial positions. By purchasing protective puts or calls, traders can limit their potential losses in adverse market conditions.

- Speculative Trading: The option chain empowers traders to express market views and potentially profit from price movements in the underlying asset. Long calls or puts express bullish or bearish expectations, respectively.

- Income Generation: Option premiums can be a source of income for traders who sell options while maintaining a neutral market outlook. Carefully selected option strategies can generate cash flow while mitigating risk.

Image: 276enriquemayviral.blogspot.com

What Is Option Chain In Trading

Conclusion: Mastery of the Option Chain

Unveiling the intricacies of option chains unveils a world of trading possibilities. By adeptly navigating the tapestry of strikes and expirations, traders