In the dynamic and ever-evolving world of trading, adaptability is paramount. Flexible trading options empower traders with the ability to tailor their strategies based on market conditions, risk appetite, and investment goals. Whether you’re a seasoned professional or a novice seeking to optimize your trading potential, understanding the nuances of these options can significantly enhance your trading outcomes.

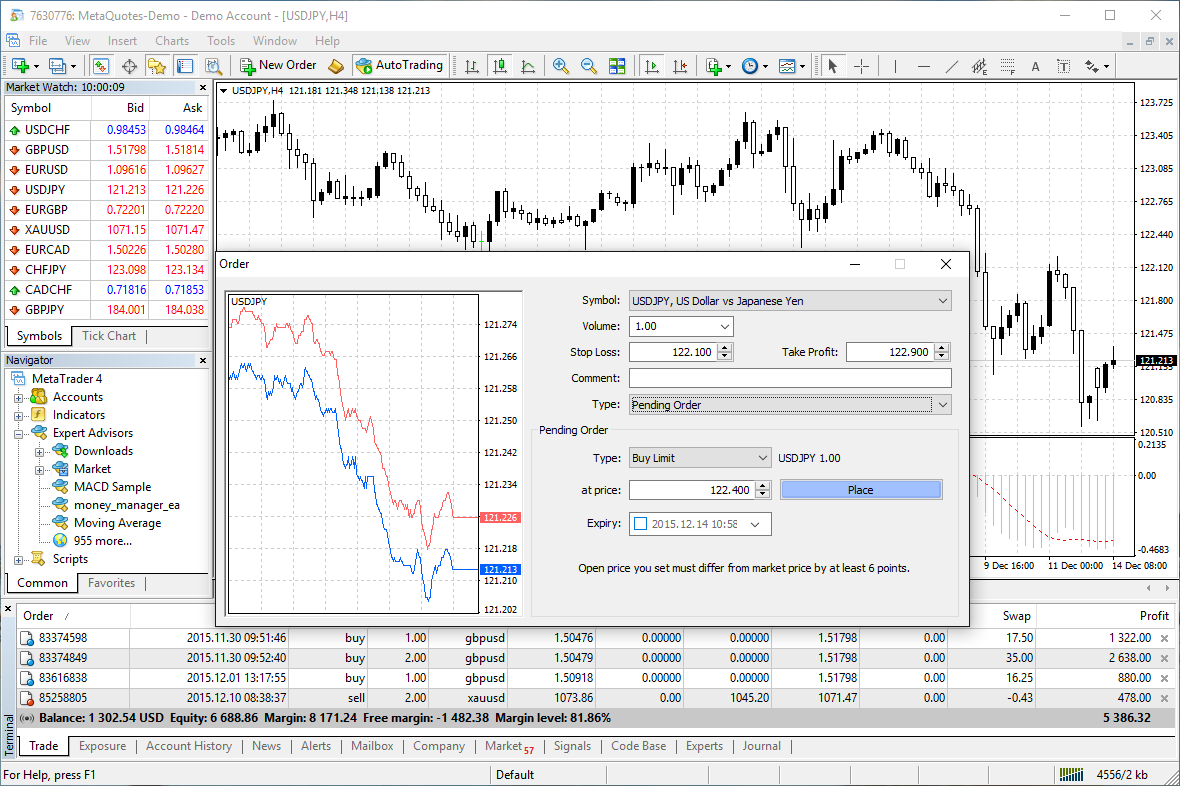

Image: www.metatrader4.com

Flexible Trading Options: A Tapestry of Tailored Solutions

Flexible trading options offer a diverse range of instruments and strategies designed to accommodate the unique trading needs of each individual. These options allow traders to modify trading parameters such as entry and exit points, position sizing, and risk management protocols to align with their specific objectives and preferences. By leveraging flexible trading options, traders can pursue a customized trading approach that maximizes their chances of success while minimizing potential losses.

Unraveling the Flexibility Continuum: From Basic to Advanced

Flexible trading options encompass a wide spectrum of trading strategies, ranging from basic to advanced. Whether you prefer a cautious and conservative approach or are willing to embrace higher levels of risk for potentially greater rewards, flexible trading options have something to offer. Let’s delve into the different types of flexible trading options to provide a comprehensive understanding:

-

Basic Time Frame Trading: Allows you to customize the time frame for your trades, from short-term scalping to long-term investments.

-

Day Trading: Focuses on executing trades within a single trading day, taking advantage of short-term price fluctuations.

-

Swing Trading: Capitalizes on short- to medium-term market trends, involving holding trades for several days or weeks.

-

Position Trading: A long-term investment strategy that involves holding assets for extended periods, aiming to capitalize on major market trends.

-

Algorithms and Automation: Incorporates automated trading systems and algorithms to execute trades based on defined parameters, removing emotional biases and increasing trading efficiency.

Navigating Flexible Trading Options: Unlocking Your Potential

Choosing the right flexible trading option for you requires careful consideration and understanding of your risk tolerance, investment goals, and trading style. While some options may provide higher potential returns, they also come with an increased level of risk. It’s crucial to conduct thorough research, consult with experienced traders, and experiment with different strategies to determine the most suitable option for your needs.

Once you have selected your preferred flexible trading option, the next step is to implement it effectively. Discipline and adherence to your trading parameters are essential to maximize your results. Regularly review your strategies, make adjustments as needed, and stay informed about market conditions to continually improve your performance.

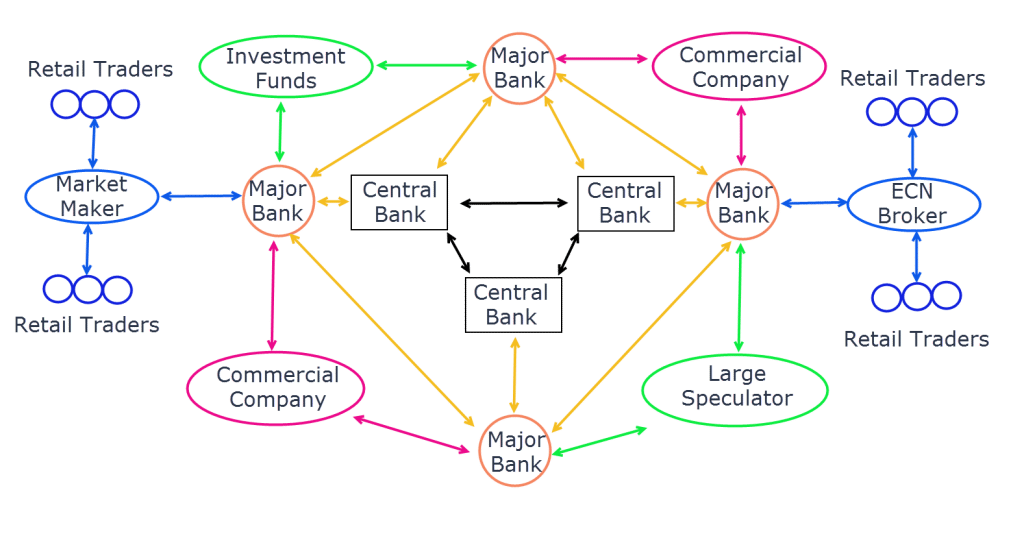

Image: flexitrade.org

Flexible Trading Options

Image: www.tradingwithrayner.com

Conclusion: Empowering Traders with Flexibility

Flexible trading options provide an invaluable tool for traders seeking to customize their trading strategies to match their individual objectives and risk tolerance. By understanding the different types of flexible trading options available and making informed decisions, traders can increase their potential for success in the dynamic trading arena.

Remember, continuous learning, adaptability, and meticulous execution are the key ingredients for navigating the flexible trading landscape. Embrace the power of customization, seize opportunities with confidence, and continuously evolve your skills to excel in the ever-changing trading environment.