Introduction

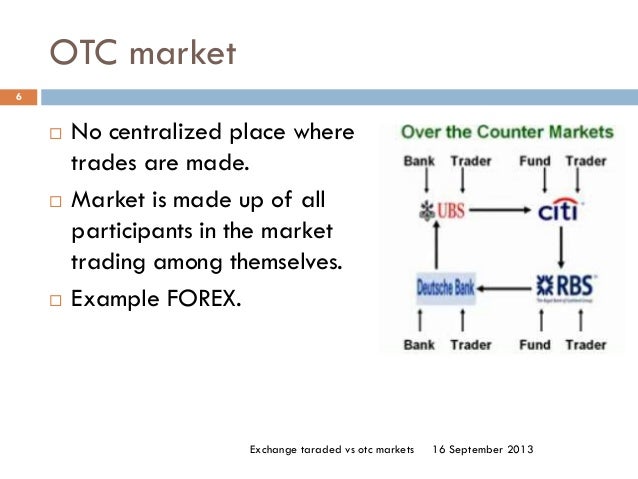

Delving into the realm of financial markets can be a daunting task, especially when faced with the labyrinth of options trading. However, navigating the complexities of over-the-counter (OTC) option trading can be simplified with the proper understanding of its nuances. OTC options offer a flexible and customizable alternative to their exchange-traded counterparts, opening up a world of possibilities for savvy investors.

Image: www.binaryoptions.com

Bridging the gap between the traditional and the modern, OTC option trading empowers traders with the ability to tailor options contracts to their specific needs and risk tolerance. Unlike exchange-traded options, which adhere to standardized parameters set by exchanges, OTC options provide bespoke solutions tailored to the individual preferences of the contracting parties.

Core Concepts of OTC Option Trading

OTC options can be likened to bilateral agreements between two parties, the buyer and the seller. In this arrangement, the buyer pays a premium to the seller in exchange for the right, but not the obligation, to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a specified price (the strike price) on or before a predetermined date (the expiration date).

The charm of OTC options lies in their tailor-made nature. Contract terms, including the underlying asset, strike price, expiration date, and even the payout structure, can be negotiated and customized to suit the needs of the parties involved. This flexibility allows for a wider range of strategies compared to standardized exchange-traded options.

Benefits of OTC Option Trading

The allure of OTC option trading stems from its inherent advantages. Unlike their exchange-traded counterparts, OTC options offer bespoke contracts, increased liquidity, and the ability to hedge complex risks.

- Bespoke Contracts: OTC options provide boundless flexibility, empowering traders to craft contracts that cater to their unique investment objectives and risk appetites.

- Increased Liquidity: Despite being traded off-exchange, OTC options offer substantial liquidity, particularly for thinly traded assets or exotic option types.

- Hedging Complex Risks: OTC options prove invaluable for sophisticated investors seeking to hedge unconventional risks or exposures that cannot be addressed by standardized exchange-traded options.

Common Uses of OTC Option Trading

The versatility of OTC option trading makes it a powerful tool in the hands of various market participants. From risk management to speculative trading, OTC options find application in diverse scenarios.

- Risk Management: Institutions and corporations utilize OTC options to hedge against adverse market movements, protect portfolios, or speculate on price fluctuations.

- Speculative Trading: Seasoned traders leverage OTC options for speculative trading, seeking to profit from anticipated price movements of underlying assets.

- Volatility Trading: OTC options provide a means to trade volatility itself, allowing investors to profit from market fluctuations without taking on directional risk.

Image: www.youtube.com

Risks of OTC Option Trading

While OTC option trading offers compelling opportunities, it is not without its inherent risks. Counterparty risk, liquidity concerns, and regulatory complexities demand careful consideration.

- Counterparty Risk: As OTC options are bilateral agreements, the creditworthiness of the counterparty is paramount. Default by the other party can result in significant financial losses.

- Liquidity Concerns: Unlike exchange-traded options, OTC options may face liquidity challenges, especially for uncommon contracts or during periods of market volatility.

- Regulatory Complexities: OTC options fall under less stringent regulatory oversight compared to exchange-traded options, which may pose risks for inexperienced investors.

Option Trading Otc

Image: s3.amazonaws.com

Conclusion

Over-the-counter option trading presents a world of possibilities for investors seeking flexible and customized financial solutions. With its ability to tailor contracts, enhance liquidity, and hedge complex risks, OTC option trading empowers traders to navigate the financial markets with greater precision. However, it is crucial to proceed with caution, carefully considering the associated risks before venturing into this dynamic and rewarding arena.