Embark on a Journey of Unleashing Market Potential with Free Range Trading

Free range trading options, a revolutionary approach to unlocking the boundless possibilities of the financial markets, have emerged as a transformative strategy for savvy investors and traders. Unlike traditional options trading confined within strict boundaries, free range options offer unparalleled flexibility, allowing traders to roam freely and seize opportunities beyond the conventional confines. This comprehensive guide delves into the fascinating world of free range trading options, unveiling its captivating nuances, advantages, and the path to successful implementation.

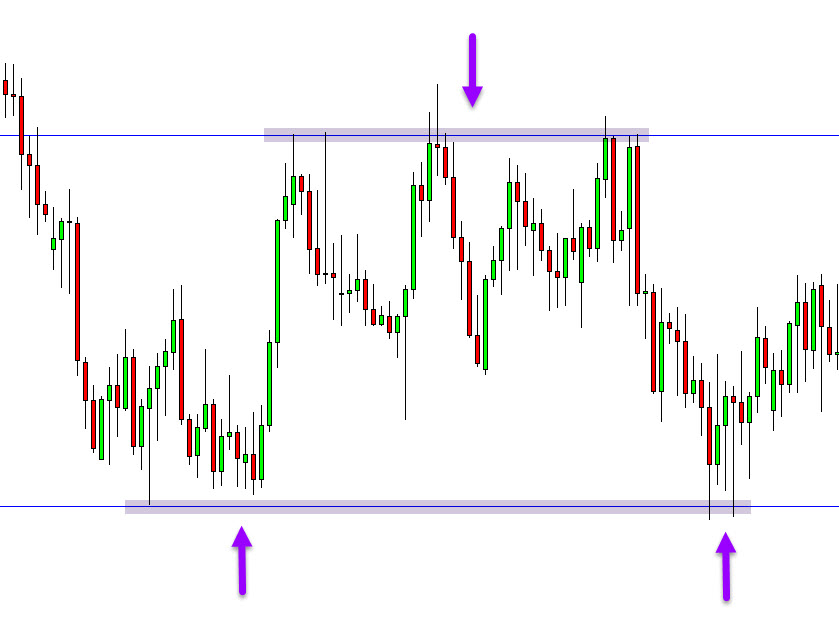

Image: learnpriceaction.com

Unleashing the Power of Free Range Options

Free range trading options, a formidable tool in a trader’s arsenal, introduce a world of boundless possibilities. With free range options, traders can customize contracts tailored to their unique strategies and risk appetites. They possess the freedom to select any underlying asset, be it stocks, bonds, commodities, currencies, or even indices. This unparalleled flexibility empowers traders to capitalize on a diverse range of market dynamics, casting a wider net to capture profit-making opportunities.

Furthermore, free range options eliminate the constraints of standardized options contracts, empowering traders to design contracts tailored to their specific needs. Unlike traditional options with predetermined expiration dates and strike prices, free range options allow traders to specify their own contract terms. This exceptional level of customization grants traders greater control over their risk management and the potential to optimize their profit potential.

Exploring the Mechanics of Free Range Trading

Embarking on the journey of free range trading options requires a firm grasp of its underlying mechanics. These options are typically traded over-the-counter (OTC), facilitating direct negotiations between buyers and sellers through intermediaries such as brokers or market makers. This decentralized marketplace fosters greater flexibility and customization compared to standardized options traded on exchanges.

Additionally, free range options introduce the concept of “Greeks,” advanced metrics quantifying the sensitivity of an option’s price to various market factors. Understanding Greeks empowers traders to fine-tune their strategies, meticulously assessing the impact of changes in underlying asset prices, volatility, time decay, and interest rates on their option positions.

Unlocking the Advantages of Free Range Trading

Delving into the realm of free range trading options unveils a multitude of compelling advantages. These include:

-

Unparalleled Flexibility: Free range options grant traders unfettered freedom to customize contracts, enabling them to align investments with their unique trading strategies and risk tolerance.

-

Enhanced Profit Potential: The ability to tailor contracts and tap into niche market opportunities offers the potential for superior returns compared to standardized options.

-

Unrestricted Underlying Assets: Free range options encompass a vast universe of underlying assets, offering traders access to a broader range of investment opportunities.

-

Precise Risk Management: Granular control over contract parameters empowers traders to fine-tune their risk management strategies, safeguarding their capital and preserving profits.

Image: learnpriceaction.com

Mastering the Art of Free Range Trading

Achieving success in the dynamic arena of free range trading options demands a comprehensive understanding of the underlying principles and skillful execution of trading strategies. Here are some fundamental guidelines to navigate this intricate landscape:

-

Thorough Market Research: In-depth market analysis and understanding of underlying asset dynamics are crucial for identifying profitable trading opportunities.

-

Tailored Contract Design: Carefully tailor contract parameters, including strike price, expiration date, and underlying asset, to align with your investment goals and risk appetite.

-

Comprehensive Risk Management: Implement robust risk management strategies to safeguard your capital and mitigate potential losses, employing techniques such as position sizing and stop-loss orders.

-

Continuous Monitoring and Adjustment: Regularly monitor market conditions and adjust your trading strategies as needed to adapt to evolving market dynamics and safeguard your positions.

Case Study: Free Range Trading Success Story

To illustrate the transformative power of free range trading options, consider the success story of seasoned investor, Emily Carter. As global economic uncertainties loomed, Emily sought innovative strategies to protect her portfolio and capitalize on market volatility. Through extensive research and meticulous planning, she ventured into free range trading options.

Emily customized a free range option contract based on her in-depth analysis of the technology sector. She carefully selected a portfolio of tech stocks as her underlying asset and designed a contract with a favorable strike price and expiration date. As market volatility surged, Emily’s free range option contract soared in value, enabling her to capitalize on the market turmoil and generate impressive returns while mitigating her overall portfolio risk.

Free Range Trading Options

Image: www.wisestockbuyer.com

Conclusion

The world of free range trading options presents a boundless realm of opportunities for investors and traders seeking to unleash their full potential. By embracing the flexibility, customization, and profit-generating possibilities of free range options, individuals can embark on a journey of financial freedom and limitless returns. However, it is imperative to approach this endeavor with a comprehensive understanding of the underlying principles, a strategic mindset, and a commitment to continuous learning and adaptation. Embarking on this path with a thirst for knowledge and an unwavering determination will empower you to navigate the complexities of the financial markets and unlock the transformative power of free range trading options.