In the labyrinthine realm of financial markets, a hidden gem awaits discovery: the enigmatic Weirdor options trading strategy. This unorthodox yet potentially lucrative approach has intrigued traders for decades, promising to navigate the turbulent waters of market fluctuations with finesse.

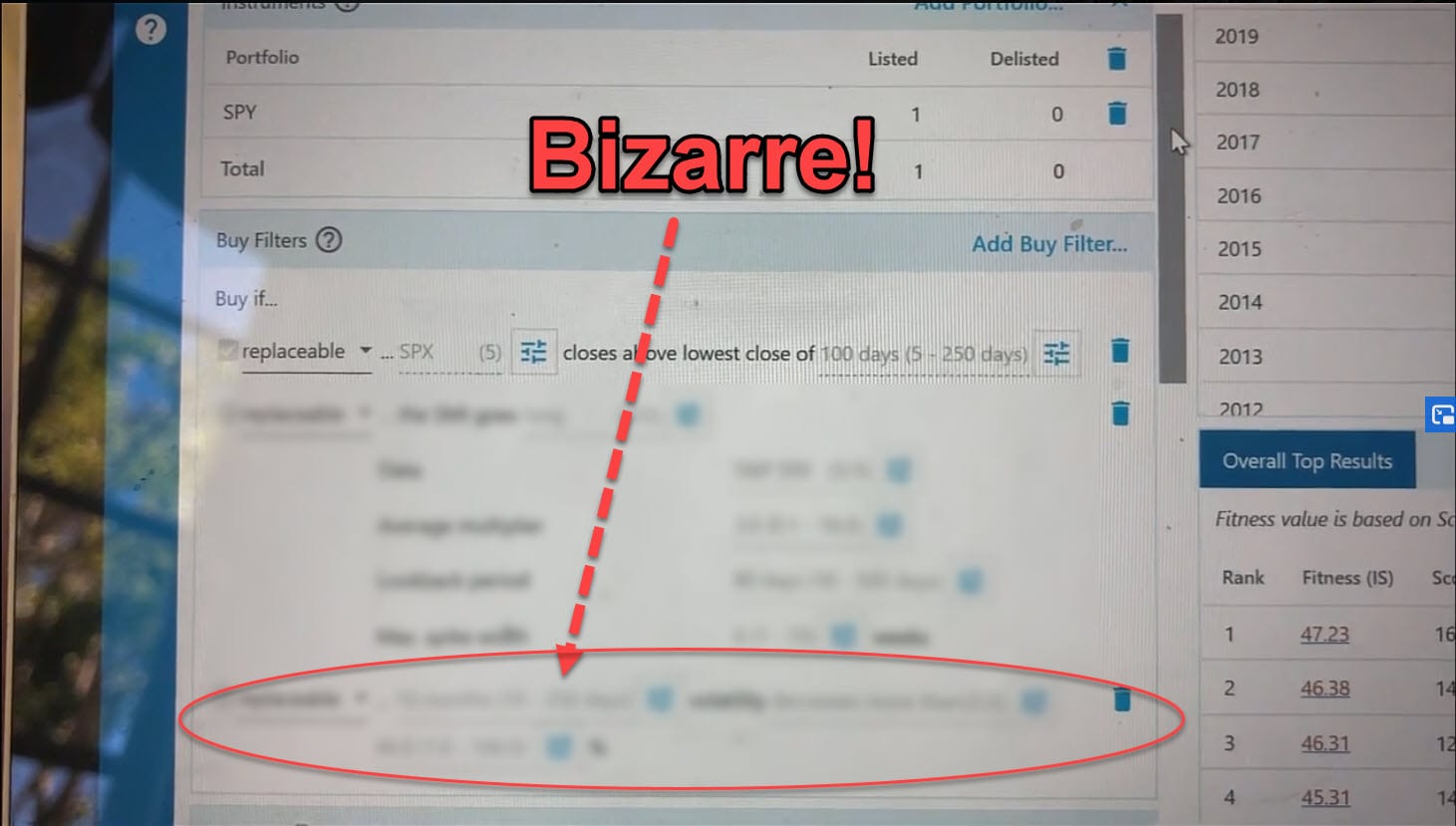

Image: portfolioboss.com

The Weirdor strategy, an acronym for “Weighted Ensemble Interval Distribution One-Rank-Based Risk Optimization,” is rooted in the concept of statistical arbitrage and utilizes complex mathematical models to simultaneously acquire and sell options with strategic intervals and weights.

Harnessing the Power of Arbitrage

At its core, the Weirdor strategy leverages arbitrage opportunities, seeking to exploit price discrepancies between related financial instruments. By purchasing and selling options with different strike prices and expiration dates, traders aim to profit from the differences in their implied volatilities.

The mathematical models employed in Weirdor optimize portfolio risk and return by distributing capital across multiple option contracts. This sophisticated approach enhances diversification and mitigates potential losses, making the strategy suitable for both experienced and novice traders alike.

Understanding the Weirdor Methodology

The Weirdor strategy intricately combines several key components:

- Weighted Ensemble: An ensemble of option portfolios is created, each with varying weights assigned to different contracts.

- Interval Distribution: Options are distributed across a range of strike prices and expiration dates, capturing market inefficiencies.

- One-Rank-Based Risk Optimization: The strategy employs a unique risk optimization technique, ranking options based on their risk-return potential.

Adapting to Evolving Markets

In the dynamic landscape of financial markets, adaptability is crucial. The Weirdor strategy has been constantly refined to keep pace with changing market conditions.

Advanced algorithms now leverage real-time data to adjust option weights and optimize portfolio composition. These algorithms analyze market trends, volatility levels, and historical data to ensure maximum profitability.

Image: tradeproacademy.com

Expert Insights and Tips

For aspiring Weirdor traders, guidance from seasoned professionals can prove invaluable:

- Embrace Technology: Utilize robust trading platforms and analytical tools to automate the strategy and optimize decision-making.

- Manage Risk Cautiously: Implement strict risk management protocols to protect capital and avoid substantial losses.

Moreover, it is essential to seek qualified mentorship and educational resources to grasp the intricacies of the Weirdor strategy and maximize its potential.

Frequently Asked Questions

Q: Is the Weirdor strategy suitable for beginners?

A: While the strategy has a low barrier to entry, a solid understanding of options trading fundamentals and risk management is recommended.

Q: What is the potential profitability of the Weirdor strategy?

A: Returns can vary based on market conditions, but the strategy aims to generate consistent profits over time.

Q: What are the risks associated with the Weirdor strategy?

A: As with any investment, there are inherent risks such as market volatility and liquidity concerns. Adhering to sound risk management practices is crucial.

Weirdor Options Trading Strategy

Image: ploratech.weebly.com

Conclusion: Embracing the Weirdor to Enhance Portfolio Performance

The Weirdor options trading strategy offers a unique opportunity to unearth market inefficiencies and generate consistent profits. Its innovative methodology, underpinned by a dynamic risk optimization approach, empowers traders with a valuable tool to navigate the complexities of financial markets with greater confidence.

Whether you are a seasoned trader or a curious newcomer, delving into the world of Weirdor can unlock new avenues for portfolio growth. Embark on this exciting journey and witness the transformative potential it holds for your investment endeavors.

Are you intrigued by the Weirdor options trading strategy? Leave a comment below and let’s explore its intricacies together!