Navigating the European Options Market

As the allure of options trading captivates investors worldwide, those residing in Europe seek to unravel its complexities within a unique regulatory framework. Options, financial instruments that confer the right but not the obligation to buy (in the case of call options) or sell (put options) an underlying asset, have emerged as a multifaceted tool for risk management and profit generation. This article delves into the world of options trading in Europe, shedding light on its nuances and empowering traders with the insights to navigate this ever-evolving landscape.

Image: www.pinterest.com

Understanding the Regulatory Environment

Trading options in Europe is an intricate endeavor, largely influenced by robust regulations enforced by the European Securities and Markets Authority (ESMA). These regulations aim to safeguard investor interests and promote market integrity. ESMA’s directives, meticulously crafted over several years, govern various aspects of options trading, establishing minimum standards for transparency, investor protection, and market conduct.

Key regulatory mechanisms include investor suitability assessments, which ensure traders possess the requisite knowledge and experience to participate in options trading. Furthermore, ESMA mandates that trading platforms implement rigorous risk management measures, encompassing robust margin requirements and position limits.

Choosing a Reputable Broker

Selecting a dependable broker is paramount for options traders in Europe. Partnering with a respected brokerage firm ensures access to a reliable platform, competitive pricing, and tailored support. When evaluating brokers, factors to consider include:

- Regulatory Compliance: Opt for brokers licensed and regulated by reputable authorities, such as the Financial Conduct Authority (FCA) in the UK or the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in Germany.

- Platform Functionality: Consider the trading platform’s ease of use, functionality, and available tools. Intuitive platforms with advanced charting capabilities and real-time market data can enhance trading efficiency.

- Fees and Commissions: Compare brokerage fees, including commissions, spreads, and margin interest rates, to identify the most cost-effective options.

Understanding European Option Contracts

European options, distinct from their American counterparts, can only be exercised on their designated expiration dates. This fundamental characteristic differentiates them from American options, which grant the flexibility to exercise anytime before expiration. European option contracts typically specify the strike price, the underlying asset, the expiration date, and the number of contracts.

Additionally, European options exhibit unique pricing dynamics governed by the Black-Scholes model. Factors influencing option prices include the underlying asset’s volatility, time to expiration, strike price, and prevailing interest rates.

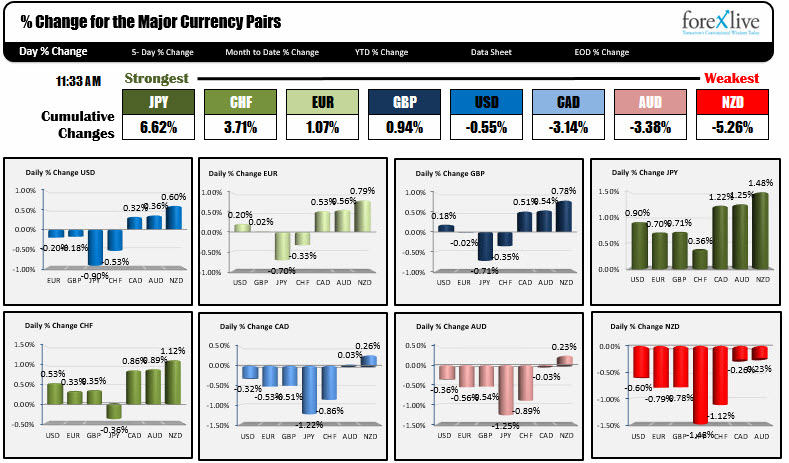

Image: www.forexlive.com

Trading Strategies for European Options

Traders in Europe employ a diverse array of options trading strategies, each catering to specific market conditions and risk tolerance. Common strategies include:

- Covered Call: Selling a call option while owning the underlying asset, generating income from the premium received.

- Put Write: Selling a put option, anticipating an increase in the underlying asset’s price, earning a premium if the price remains above the strike.

- Bull Call Spread: Buying a call option with a lower strike price and simultaneously selling a call option with a higher strike price, profiting from moderate price increases.

- Bear Put Spread: Buying a put option with a lower strike price and selling a put option with a higher strike price, profiting from moderate price decreases.

Trading Options While Living In Europe

Image: suvagadapaw.web.fc2.com

Conclusion

Trading options in Europe offers a plethora of opportunities for savvy investors seeking to capitalize on market movements or manage risk. Navigating the regulatory landscape, understanding contract specifications, and implementing effective trading strategies are essential for European options traders. By embracing these principles and leveraging the guidance provided in this article, traders can confidently venture into this dynamic financial realm.