When it comes to financial markets, options trading holds a significant position as a versatile instrument that enables investors to mitigate risks and optimize returns. In Europe, options trading has been gaining immense popularity due to its growing accessibility and the potential it offers to enhance investment strategies. This article will delve into the intricacies of options trading within the European financial landscape, exploring its rich history, fundamental concepts, and rewarding applications.

Image: www.celent.com

An option contract conveys the right, not the obligation, to buy (in case of a call option) or sell (in case of a put option) an underlying asset at a predetermined price, known as the strike price, before a specified expiration date. This unique feature differentiates options from other financial instruments and empowers investors with the ability to adapt to market dynamics and tailor their positions accordingly. The flexibility offered by options makes them an attractive choice for both sophisticated traders seeking advanced strategies and risk-conscious investors aiming to hedge their portfolios.

A Historical Overview: Tracing the Evolution of Options Trading

The concept of options trading can be traced back to ancient Greece, where it was employed to facilitate grain trading during times of uncertainty. In the 17th century, options emerged in the Netherlands as a way to manage price risks associated with tulip bulb trade. Fast forward to the 20th century, the Chicago Board of Trade (CBOT) played a pivotal role in standardizing options contracts, making them more accessible to a wider range of investors. Today, options trading has evolved significantly, with electronic exchanges and advanced trading platforms enabling seamless execution and sophisticated trading strategies.

Key Concepts Demystified: Unlocking the Fundamentals of Options Trading

Understanding the fundamental concepts of options trading is paramount for successful navigation within this complex financial arena. The strike price, as mentioned earlier, determines the price at which the underlying asset can be bought or sold. The premium is the price paid to acquire an options contract, which represents its intrinsic value plus the time value. Intrinsic value refers to the profit that can be realized by immediately exercising the option, while time value reflects the potential for the underlying asset’s price to fluctuate favorably before expiration.

Options can be tailored to suit specific investment objectives. A call option grants the right to buy the underlying asset, making it suitable for investors anticipating price appreciation. Conversely, a put option provides the right to sell, benefiting those expecting price depreciation. American-style options can be exercised at any time before expiration, while European-style options can only be exercised on the expiration date. Understanding these nuances allows investors to make informed decisions based on their market outlook and risk tolerance.

Options Trading Strategies: A Toolkit for Informed Decision-Making

The versatility of options trading empowers investors with a wide array of strategies to enhance their portfolios. Covered call writing involves selling a call option while owning the underlying asset, aiming to generate additional income through premiums. Protective puts, on the other hand, are utilized to hedge against potential losses in the underlying asset’s value. Straddles and strangles are strategies employed when the direction of the underlying asset’s price movement is uncertain. These strategies involve buying both a call and a put option with different strike prices and expiration dates.

Image: suvagadapaw.web.fc2.com

Navigating the Regulatory Landscape: Ensuring Transparency and Fairness

Options trading in Europe is heavily regulated to ensure market integrity and protect investors’ interests. The European Securities and Markets Authority (ESMA) plays a crucial role in harmonizing regulations across member states and fostering a transparent and orderly trading environment. Key directives such as the Markets in Financial Instruments Directive (MiFID II) and the Market Abuse Regulation (MAR) provide a framework for investor protection, market surveillance, and prevention of insider trading.

In the United Kingdom, options trading falls under the purview of the Financial Conduct Authority (FCA), which enforces regulations to ensure fair and orderly markets. Additionally, the London Stock Exchange Group (LSEG) operates a designated market for options trading, adhering to strict guidelines and best practices to maintain market efficiency and investor confidence.

Exploring European Markets: A Panoramic View of Options Trading Hubs

Europe boasts several prominent financial centers that serve as thriving hubs for options trading. The London Stock Exchange (LSE) is one of the largest and most liquid options markets globally, offering a wide range of options on stocks, indices, and commodities. The Deutsche Boerse, based in Frankfurt, is another major player, providing a comprehensive suite of options products for both domestic and international investors. Euronext, with its presence in Paris, Amsterdam, Brussels, and Lisbon, offers a robust platform for options trading across various asset classes.

Other notable options trading venues in Europe include the Swiss Options and Financial Futures Exchange (SOFFEX), the Italian Stock Exchange (Borsa Italiana), and the Vienna Stock Exchange (Wiener Boerse). Each of these exchanges has its own unique strengths and offerings, catering to the diverse needs of investors and providing access to a broad spectrum of options contracts.

Insights for Investors: Tips for Prudent Options Trading

Successful options trading requires a combination of knowledge, strategy, and risk management. Here are some valuable tips to enhance your trading experience:

- Educate yourself: A thorough understanding of options trading concepts, strategies, and risk factors is essential before venturing into this arena.

- Start conservatively: Begin with small trades until you gain confidence and experience in options trading.

- Manage risk: Employ risk management techniques such as stop-loss orders and position sizing to mitigate potential losses.

- Monitor the market: Stay informed about market trends and news events that may impact the underlying assets you are trading.

- Seek professional advice: If needed, consider consulting with a financial advisor to gain personalized guidance tailored to your investment goals and risk tolerance.

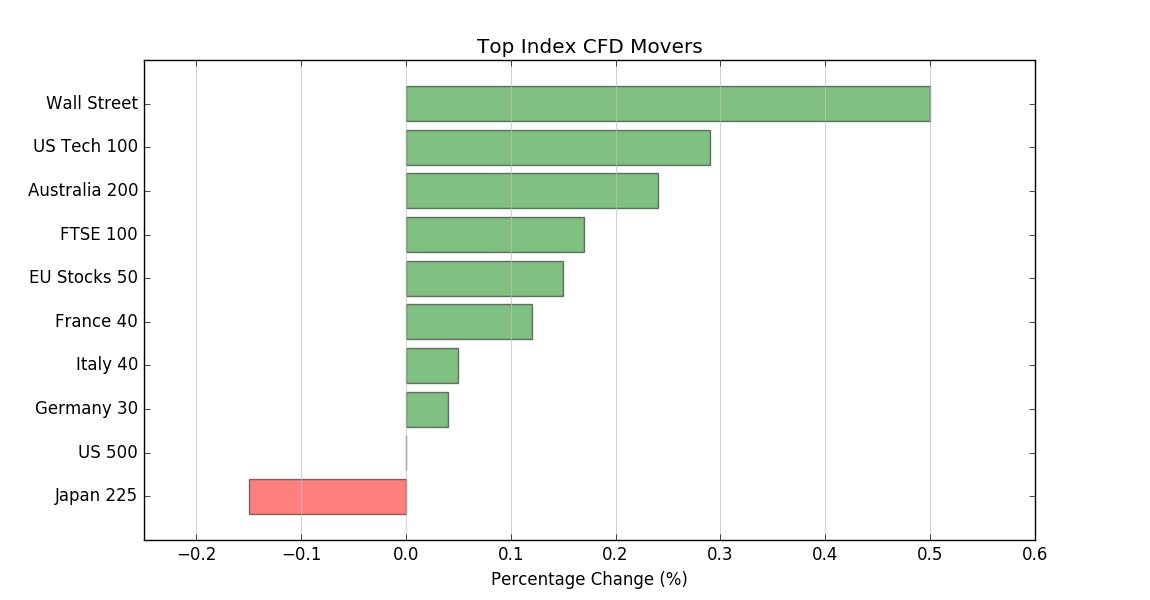

Options Trading In Europe

Image: www.tradingview.com

Conclusion: Unveiling the Potential of Options Trading in Europe

Options trading in Europe presents a multifaceted investment landscape, offering a wealth of opportunities for risk-aware investors. By delving into the intricacies of options contracts, mastering fundamental concepts, and employing well-informed strategies, investors can harness the power of options to enhance their portfolios, generate income, and mitigate risks. The regulatory framework in place ensures transparency and fairness, providing a secure environment for options trading. As the European financial markets continue to evolve, options trading remains a valuable tool for investors seeking to navigate the complexities of the financial landscape and achieve their investment objectives.