Introduction:

In a rapidly evolving financial landscape, savvy investors seek opportunities to amplify their returns and mitigate risks. US options trading has emerged as a potent tool, empowering individuals to harness the potential of the US stock market from the shores of Australia. This comprehensive guide delves into the intricacies of US options trading in Australia, providing a roadmap to navigate the complexities and maximize your gains.

Image: blog.betteraccountingsolutions.com.au

Understanding US Options:

US options are financial contracts that grant buyers the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset, such as a stock or an index, at a predetermined price (known as the strike price) on or before a specified date (known as the expiration date). By leveraging options, traders can enhance their investment strategies by speculating on price movements, hedging against market risks, or generating income from premiums.

Trading US Options in Australia:

The advent of online trading platforms and the presence of reputable brokers in Australia have made US options trading accessible to Australian investors. Several local brokers offer platforms seamlessly integrated with US exchanges, allowing traders to execute trades with ease. It is important to thoroughly research and select a reputable broker that aligns with your trading objectives and risk tolerance.

Key Considerations for Australian Traders:

Navigating the nuances of US options trading in Australia requires a keen understanding of the following aspects:

-

Market Time Zone Differences: Be mindful of the time zone disparities between Australia and the US markets to avoid missing critical trading windows.

-

Currency Fluctuations: Recognize the potential impact of currency exchange rate fluctuations on your trades.

-

Tax Implications: Familiarize yourself with the tax implications applicable to options trading in both the US and Australia to ensure compliance and optimize your returns.

-

Regulation and Legal Framework: Understand the legal and regulatory frameworks governing US options trading in Australia to mitigate risks and ensure ethical practices.

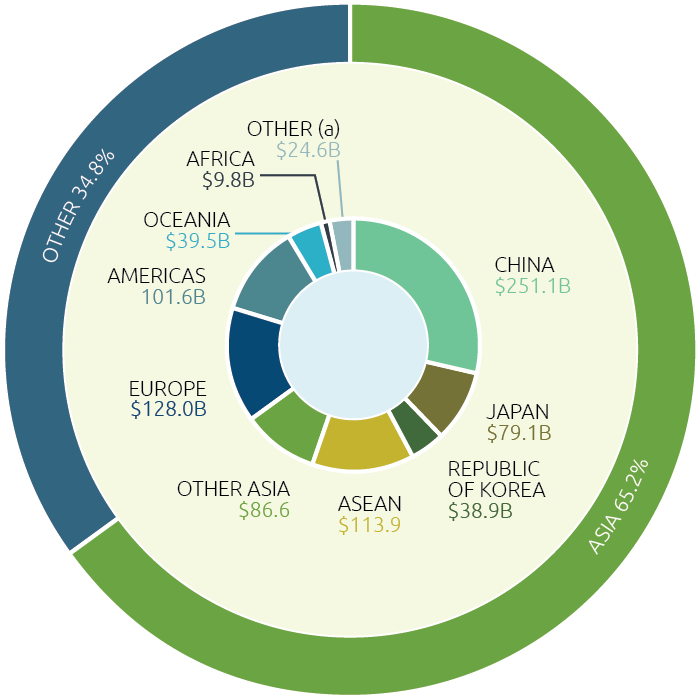

Image: www.dfat.gov.au

Expert Strategies:

Seasoned options traders employ a diverse range of strategies to maximize returns and mitigate risks. Some of the most commonly used strategies include:

-

Bull Call Spreads: This strategy involves buying a higher strike price call option and selling a lower strike price call option with the same expiration date. It is used in bullish markets to benefit from a limited upside potential while capping potential losses.

-

Bear Put Spreads: This strategy entails buying a higher strike price put option and selling a lower strike price put option with the same expiration date. It is employed in bearish markets to capitalize on a limited downside potential while limiting potential losses.

-

Covered Calls: This strategy involves selling (writing) a call option while simultaneously holding the underlying asset. It is suitable for neutral-to-bullish markets and generates income from the premium received.

Trading Us Options In Australia

Image: unbrick.id

Embracing the Power:

US options trading offers a dynamic canvas for savvy investors to amplify returns and navigate market risks. While it presents its unique set of complexities, a thorough understanding of the underlying concepts, careful consideration of key factors, and strategic implementation can empower Australian traders to harness the full potential of US options trading. Embrace the power of this versatile financial instrument and unlock a world of opportunities.