Harnessing Global Market Opportunities

Image: unbrick.id

Options trading is emerging as a potent tool for experienced investors seeking diversified portfolios and enhanced returns. International options trading, in particular, opens the doors to a vast global market teeming with opportunities. By embracing international options trading in Australia, individuals can tap into a seamless gateway that offers access to a wider universe of assets and strategies.

An Overview of International Options Trading

Simply put, options are versatile financial instruments that bestow upon their holders the right, but not the obligation, to either buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific date. When trading options internationally, investors venture beyond the boundaries of their domestic market, gaining exposure to a myriad of assets spanning stocks, indices, commodities, and currencies across multiple exchanges worldwide.

Advantages of International Options Trading

-

Broadened Market Coverage: International options afford access to a comprehensive array of assets and markets, amplifying investment opportunities.

-

Diversification: By incorporating international options into portfolios, investors miti¬gate risks associated with concentration in a single market or asset class.

-

Hedging Strategies: International options enable sophisticated hedging techniques, empowering investors to shield portfolios against market volatility.

Considerations for International Trading in Australia

-

Regulatory Framework: Navigating international options trading in Australia requires compliance with the stringent regulations and guidelines established by the Australian Securities and Investments Commission (ASIC).

-

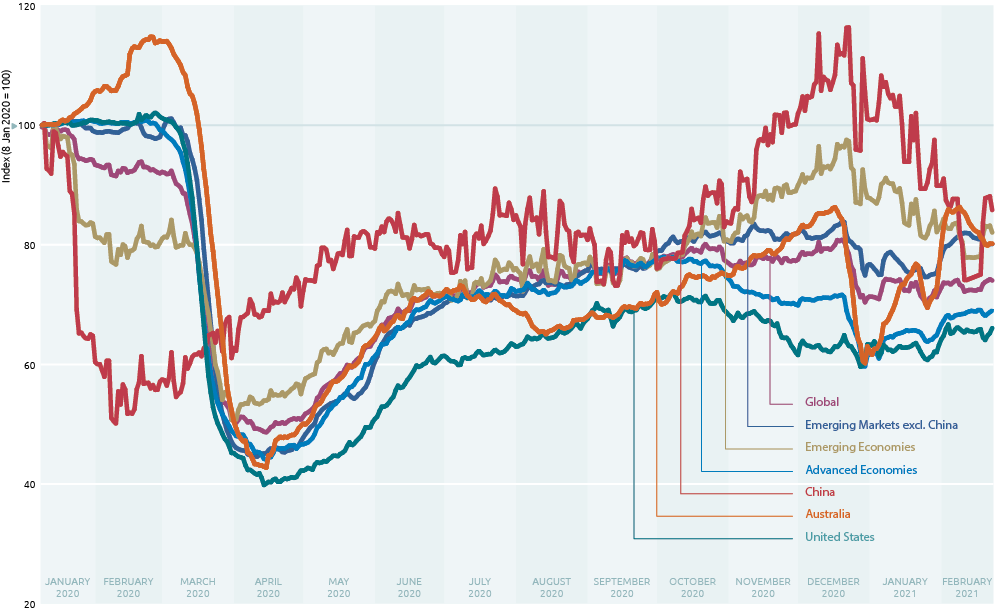

Currency Fluctuations: Embracing international options trading introduces currency exposure, potentially fluctuating portfolio value and warranting careful risk management.

-

Liquidity and Volatility: International options may exhibit varying degrees of liquidity and volatility, emphasizing the importance of conducting thorough research before engaging in trades.

Image: www.dfat.gov.au

Strategies for International Options Trading

-

Pairs Trading: Engaging in simultaneous compra and venda of options on two correlated assets can profit from price discrepancies.

-

Covered Calls: Selling (writing) a call option while owning the underlying asset provides income generation and downside protection.

-

Synthetic Long or Short Stock: Combining options positions can replicate the performance of a stock without direct ownership.

International Options Trading Australia

Image: www.forexfactory.com

Conclusion

International options trading in Australia offers a burgeoning realm of investment opportunities for discerning investors. By comprehending the nuances and utilizing prudent strategies, individuals can harness the potential of this dynamic market to cultivate diversified portfolios and foster financial growth. The availability of comprehensive educational resources and support in Australia facilitates a seamless journey for those embarking on this rewarding endeavor.