In the realm of finance, the world has grown increasingly interconnected. The rapid globalization of markets has paved the way for a new era of investing – international option trading. An international option trading platform empowers investors to transcend geographical boundaries, tapping into a vast universe of opportunities that lie beyond their home country.

Image: www.etnasoft.com

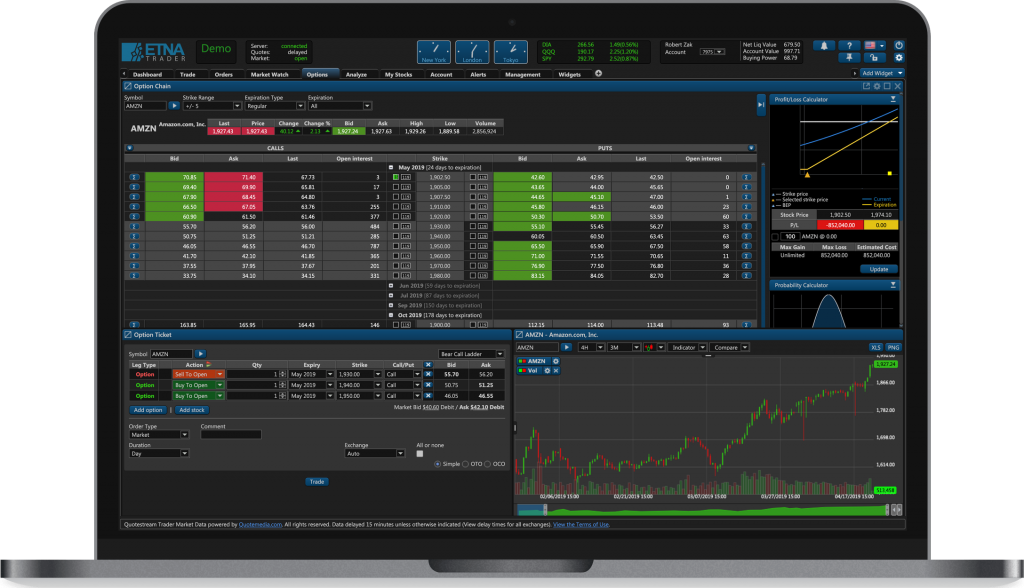

Defined simply, an international option trading platform is an online venue that facilitates the buying and selling of options on stocks, commodities, and indices from various global exchanges. By offering access to these global markets, these platforms provide investors with an unprecedented breadth of investment options, diversification opportunities, and the potential for enhanced returns.

Exploring the Benefits of International Option Trading

-

Diversification: International option trading allows investors to reduce risk by spreading their investments across different markets. By investing in options on foreign stocks, commodities, or indices, investors can mitigate the effects of downturns in any one specific region or sector.

-

Access to Global Markets: International option trading platforms grant investors access to markets that may not be readily available through traditional local brokers. This opens up a world of opportunities and allows investors to capitalize on market trends and events in different countries.

-

Enhanced Return Potential: By tapping into international markets, investors may gain access to higher-return opportunities. Emerging markets, in particular, often offer significant growth potential, but may also come with higher risks.

-

Hedging Strategies: International option trading can also be used for hedging purposes. By buying puts or selling calls on foreign assets, investors can protect their portfolios from adverse price movements in specific countries or sectors.

Navigating an International Option Trading Platform

-

Finding a Reputable Platform: Choosing the right international option trading platform is crucial. Look for platforms with a proven track record, robust security measures, and a user-friendly interface.

-

Understanding International Markets: Before venturing into international option trading, it’s imperative to educate oneself about the specific markets you intend to invest in. Familiarize yourself with the regulations, economic climates, and trading hours of each exchange.

-

Managing Currency Risk: When trading options on foreign assets, currency risk becomes a factor. Consider using currency hedging strategies, such as buying currency forwards or options, to mitigate the impact of adverse currency fluctuations.

-

Exercising Caution: International option trading comes with inherent risks, including political instability, currency fluctuations, and geopolitical events. It’s crucial to exercise caution, invest only what you can afford to lose, and thoroughly understand the risks involved.

-

Seeking Professional Guidance: If you’re new to international option trading or unfamiliar with a specific market, it’s advisable to consult with a financial professional for guidance and support.

Image: www.evergladesjeeps4x4s.org

International Option Trading Platform

Tips for Success in International Option Trading

-

Conduct Thorough Research: Before making any trades, thoroughly research the underlying asset, the market it trades on, and the specific option strategy you plan to employ.

-

Start Small: Begin with small trades and gradually increase your portfolio size as you gain experience and confidence.

-

Use Limit Orders: Limit orders allow you to set a maximum or minimum price for your trades. This helps protect you from adverse price fluctuations and executing trades at unfavorable prices.

-

Monitor Your Trades Regularly: Keep a close eye on the performance of your trades and make adjustments as necessary. Regular monitoring allows you to identify potential profit-taking opportunities or stop losses to minimize potential losses.

-

Stay Informed: Keep yourself updated on global economic and political events, as they can have a significant impact on the performance of international markets.

International option trading platforms have revolutionized the way investors engage with the global markets, offering a world of opportunities and potential rewards. By understanding the benefits and risks involved, investors can harness the power of international option trading to diversify their portfolios, enhance their returns, and achieve their financial goals.