Whether you’re a seasoned trader or just starting to explore the world of options, choosing the right Canadian option trading broker is crucial for your success. With so many options available, it can be overwhelming to navigate the landscape. In this comprehensive guide, I’ll dive deep into the intricate world of Canadian option trading brokers. We’ll delve into their features, benefits, and latest industry trends to equip you with the knowledge and confidence to make an informed decision and unlock greater profits.

Image: www.top8forexbrokers.com

When it comes to option trading in Canada, the regulatory framework is robust and designed to protect investors. The Investment Industry Regulatory Organization of Canada (IIROC) sets strict standards for brokers, ensuring transparency, fair play, and safeguarding of client assets. As you evaluate different brokers, look for IIROC membership as a mark of trustworthiness and compliance with industry best practices.

Features of Canadian Option Trading Brokers:

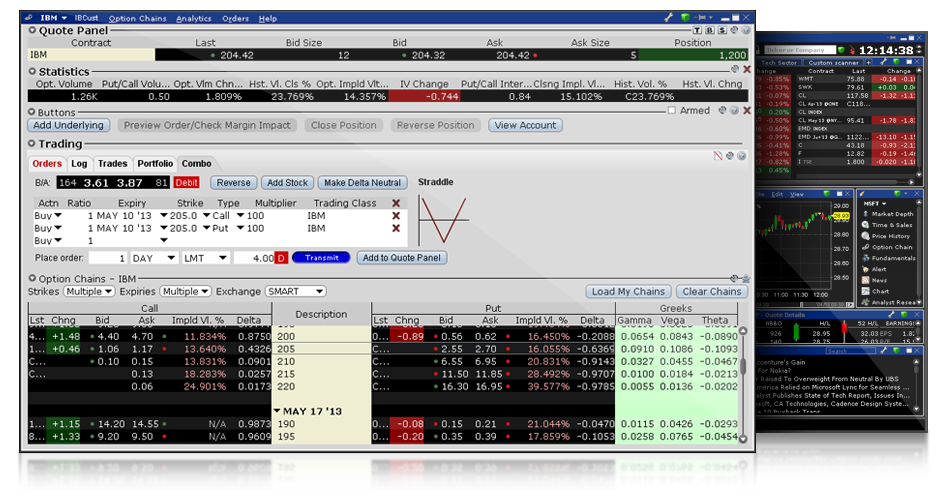

- Trading Platforms: Brokers offer a range of trading platforms, from proprietary software to industry-standard platforms like MetaTrader. The ideal platform should align with your trading style, skill level, and technical preferences.

- Options Offerings: Explore the spectrum of option contracts available through the broker, including stock options, index options, and ETF options. The wider the selection, the greater your opportunities for diversifying your portfolio and managing risk.

- Margin Accounts: Margin trading allows you to leverage borrowed funds to increase your trading power. However, it also magnifies both potential profits and losses, so use this feature cautiously and only if you have experience.

- Real-Time Data: Access to real-time data, including streaming quotes, charts, and news, is essential for making informed trading decisions. Look for brokers that provide high-quality data feeds to stay ahead of market movements.

- Customer Support: Excellent customer support is invaluable when you encounter technical issues or have questions about trading. Responsive and knowledgeable support can make all the difference in navigating market challenges and maximizing your returns.

Understanding Option Trading in Canada

Options are financial instruments that give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. They are a versatile tool that can both enhance returns and manage risk in your investment portfolio.

There are two main types of options: calls and puts. Call options give you the right to buy an asset, while put options give you the right to sell. The price at which you can buy or sell the asset is known as the strike price. You pay a premium to purchase an option, which represents the cost of acquiring the right to trade the underlying asset at the strike price.

Latest Trends in Canadian Option Trading

The Canadian option trading landscape is constantly evolving, driven by technological advancements and regulatory changes. Here are some of the latest trends:

- Increased Popularity of Mobile Trading: Mobile trading apps provide convenience and allow traders to access markets from anywhere. This trend is expected to continue as mobile technology improves and internet connectivity expands.

- Surge in Volatilities: Market volatility has surged in recent times due to geopolitical events and economic uncertainty. This heightened volatility creates opportunities for option traders to profit from price fluctuations.

- Rise of Alternative Options Strategies: Traders are diversifying their portfolios by employing alternative options strategies, such as covered calls, iron condors, and credit spreads, to generate income and manage risk creatively.

Image: fx-list.com

Tips for Choosing the Best Canadian Option Trading Broker:

- Define Your Trading Goals: Identify your risk tolerance, trading style, and financial objectives. This will help you narrow down your options to brokers that align with your needs.

- Research Broker Features: Compare different brokers based on the features discussed earlier, such as trading platforms, options offerings, and customer support. Consider both your current and future trading needs.

- Read Reviews and Testimonials: Seek out independent reviews and testimonials from other traders to gain insights into the broker’s performance, reliability, and user experience.

- Consider Fees and Commissions: Broker fees and commissions can impact your profit margins. Compare different brokers and choose the one that offers competitive rates without compromising service quality.

- Explore Trial or Demo Accounts: If available, take advantage of trial or demo accounts to test drive the broker’s trading platform and services before committing to a real account.

Frequently Asked Questions (FAQs) about Canadian Option Trading Brokers

- Q: Are Canadian option trading brokers regulated?

A: Yes, Canadian option trading brokers are regulated by IIROC (Investment Industry Regulatory Organization of Canada) to ensure fair play, transparency, and client asset protection. - Q: What types of options can I trade in Canada?

A: You can trade various options in Canada, including stock options, index options, and ETF options, providing ample opportunities for portfolio diversification and risk management. - Q: How do I choose the best Canadian option trading broker?

A: Consider your trading goals, compare broker features, read reviews, and explore trial or demo accounts to make an informed decision. - Q: Are there any risks associated with option trading?

A: Option trading involves risks, including the potential for substantial losses. It’s essential to understand option trading strategies, manage risk effectively, and trade within your financial means.

Canadian Option Trading Brokers

Image: s3.amazonaws.com

Conclusion:

Choosing the right Canadian option trading broker is crucial for your trading success. Utilize the tips outlined in this article to evaluate different brokers based on your individual needs and preferences. Remember that option trading involves potential risks, so it’s essential to approach it with a clear understanding of the market and proper risk management strategies. By partnering with a reliable broker, you can unlock the full potential of option trading and enhance your investment returns.

Are you intrigued by the world of Canadian option trading? If you’re seeking further knowledge and guidance, don’t hesitate to reach out for a consultation or explore additional resources on reputable financial websites. Option trading can be a powerful tool, but it’s essential to proceed with caution and informed decision-making. Embrace the opportunity to gain knowledge, sharpen your trading skills, and maximize your returns while navigating the exciting world of Canadian option trading.