Introduction

Image: www.marketsmuse.com

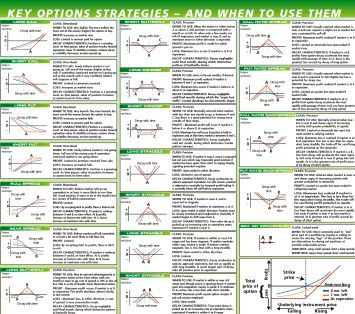

In the tumultuous waters of the financial markets, options trading emerges as a beacon of opportunity for those seeking to mitigate risks, amplify returns, and navigate the complexities of the unknown. Options, like agile ships in a vast ocean, empower traders with the flexibility to capitalize on potential market movements while shielding themselves from downside volatility. This definitive guide delves into the diverse strategies that underpin options trading, equipping you with the knowledge and confidence to make informed decisions in this dynamic arena.

Deciphering the Options Framework

Options, simply put, are financial contracts that confer on the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. This unique duality allows options to be tailored to a multitude of trading objectives, from limiting potential losses to exploiting market volatility. Understanding the fundamental types of options – calls, puts, covered calls, and cash-secured puts – unlocks the gateway to comprehending their strategic applications.

Exploring Comprehensive Strategies

-

Long call strategy: When bullish optimism fills the air, traders seek refuge in a long call strategy. By purchasing the right to buy an underlying asset at a certain price, they position themselves to reap the rewards of an upward price trajectory.

-

Long put strategy: For those anticipating a market downturn, the long put strategy offers a lifeline. This strategy involves acquiring the right to sell an underlying asset at an agreed-upon price, providing protection against depreciating values.

-

Covered call strategy: For investors seeking to generate income while retaining ownership of their underlying assets, the covered call strategy beckons. Here, traders simultaneously sell call options against their existing holdings, allowing them to collect premiums while limiting potential gains.

-

Cash-secured put strategy: Prudent traders seeking to profit from a decline in value without having to purchase the underlying asset may find solace in the cash-secured put strategy. This approach involves selling put options while setting aside cash to fulfill potential obligations.

Harnessing Insights from Industry Experts

“Options trading empowers individuals to tailor their investments to specific market expectations and risk tolerances,” says renowned options expert, Dr. Mark Fisher. “By studying historical data and prevailing trends, traders can make informed decisions, maximizing potential returns while safeguarding their capital.”

Another luminary in the trading sphere, Ms. Susan B. Anthony, emphasizes the importance of strategy diversification. “The financial landscape is an ever-evolving tapestry,” she notes. “By diversifying options strategies, traders can mitigate risks and seize opportunities presented by varying market conditions.”

Empowering Your Trading Journey

Embarking on the path of options trading requires a meticulously designed roadmap. Seek reputable trading platforms, delve into comprehensive educational resources, and engage with experienced mentors to lay a solid foundation for success. Remember, the markets are a crucible of uncertainty, but with the right knowledge and strategies, you have the power to emerge as a seasoned trader, navigating the options market with confidence and wisdom.

Conclusion

Options market trading strategies paint a vivid canvas of potential returns and risk management. By mastering these strategies, traders unlock the ability to navigate the labyrinthine complexities of the financial markets with precision and purpose. Remember, the journey to trading success is a perpetual pursuit of knowledge, adaptation, and resilience. Embrace the challenges, harness the power of options, and witness the transformative possibilities that await you in this captivating realm of financial empowerment.

Image: studycampuslemann.z19.web.core.windows.net

Option Market Trading Strategies

Image: www.pinterest.com