Introduction

Image: visualcapitalistsb.pages.dev

In the realm of financial markets, options trading has emerged as a potent tool for investors seeking to manage risk and harness market opportunities. However, unraveling the intricate factors that influence option pricing can be a formidable task, especially for those navigating the complexities of implied volatility (IV). In this article, we embark on a comprehensive journey to decode IV and its profound impact on option prices.

Embracing the Essence of Implied Volatility

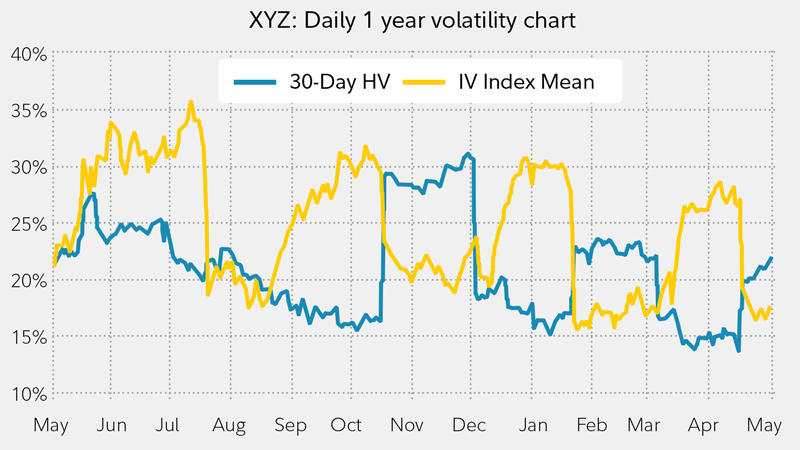

Implied volatility, a crucial metric in option trading, gauges the market’s perception of the future price volatility of an underlying asset. It encapsulates traders’ collective belief about the magnitude of price swings in the upcoming period. A high IV implies that the market anticipates significant price fluctuations, while a low IV suggests a relatively stable path.

The Role of IV in Option Pricing

IV plays a pivotal role in determining the premium of an option, the price paid to acquire the right to buy or sell an underlying asset at a predetermined price and date. As IV increases, so too does the price of an option. This inverse relationship arises because higher IV equates to a wider range of potential price movements for the underlying asset, increasing the likelihood of the option expiring in-the-money (ITM) and thus becoming profitable.

Leveraging IV for Strategic Option Trading

Understanding IV empowers traders to make informed decisions about option strategies. When IV is low, it may be an opportune time to sell options, capitalizing on the lower premiums and reduced risk associated with stable price movements. Conversely, soaring IV presents an opportunity to purchase options, benefiting from the potential for substantial gains if the underlying asset’s price fluctuates significantly.

Expert Insights and Practical Applications

Seasoned market veterans emphasize the importance of considering IV alongside other factors when evaluating option strategies. Dr. John C. Hull, a renowned options trading expert, advises traders to assess the historical volatility of the underlying asset and analyze market news and events that could influence future price movements. By synthesizing this information with IV insights, traders can enhance their decision-making process.

Harnessing the Potential of IV

Trading options with an informed understanding of IV can unlock a wealth of opportunities for both income generation and risk mitigation. By leveraging IV analysis, traders can refine their strategies, optimize premium pricing, and navigate market volatility with greater confidence and precision.

Conclusion

Implied volatility, an enigmatic force in the world of option trading, holds the key to unlocking the mysteries of option pricing. By demystifying IV and grasping its profound influence, traders can equip themselves with the knowledge and skills necessary to thrive in this dynamic and ever-evolving financial landscape. Remember, thorough research, diligent analysis, and a balanced approach are the cornerstones of successful option trading, empowering investors to seize opportunities and navigate market challenges with greater efficacy.

Image: optionalpha.com

Trading Options How Iv Affects Option Price

Image: www.ydeho.com