As I scrolled through my trading platform, a sense of exhilaration washed over me. I had just witnessed an incredible profit on an options trade, leaving me questioning why I hadn’t ventured into this arena sooner. But amidst the euphoria, a nagging question lingered in the back of my mind: how does option trading differ from the more familiar terrain of margin trading?

Image: phemex.com

With renewed curiosity, I embarked on a journey to unravel the nuances of these two high-risk investment strategies. Join me as I explore the world of options and margins, uncovering their similarities and distinctions, and empowering you with expert insights to make informed investment decisions.

Understanding Options Trading

Options trading involves contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified expiration date.

- Key Characteristics: Leverage (potential to amplify profits), limited risk (loss capped at the premium paid), and flexibility (ability to tailor trades to specific objectives).

- Suitability: Seasoned traders with a high risk tolerance and a comprehensive understanding of market dynamics.

Margin Trading vs. Options Trading

Leverage, Risk, and Reward

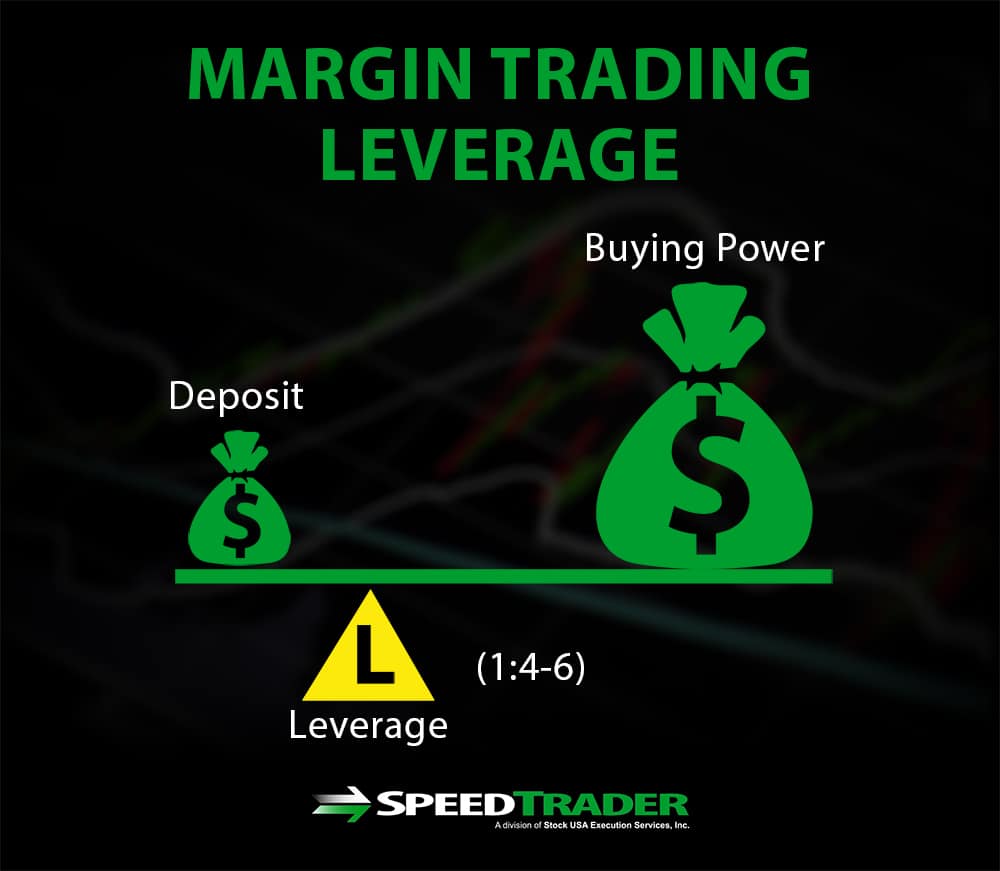

Both options trading and margin trading offer leverage, but they differ in their risk and reward profiles. Margin trading amplifies both potential profits and losses by borrowing money from the broker. Options trading, on the other hand, limits the potential loss to the premium paid, providing a defined risk framework.

Image: speedtrader.com

Control and Flexibility

Options trading grants you the right, but not the obligation, to trade the underlying asset. This flexibility allows you to customize trades to meet your specific needs. In contrast, margin trading gives you direct ownership of the underlying asset, providing greater control but exposing you to potentially unlimited losses.

Complexity

Options trading is generally considered more complex than margin trading. Options contracts involve intricate pricing models and strategies that require a deep understanding of market dynamics. Margin trading, while simpler in concept, still poses significant risks and should be approached with caution.

Expert Tips and Advice

Embrace Education: Before venturing into these high-risk strategies, invest in comprehensive education. Gain a thorough understanding of market dynamics, trading strategies, and risk management principles.

Start Small and Practice: Begin with small trade sizes and practice on paper or simulation platforms to build confidence and refine your strategies before risking real capital.

FAQs

**Which strategy is better for me?**

The choice depends on your financial goals, risk tolerance, and trading experience. Options trading is generally more suitable for advanced traders, while margin trading may be more appropriate for experienced investors with a higher risk appetite.

Can I lose more than my investment with these strategies?

Yes, in margin trading, you can lose more than your initial investment due to the potential for unlimited losses. In options trading, while losses are capped at the premium paid, the underlying asset’s volatility can still lead to significant losses.

How can I mitigate risks?

Implement risk management strategies like setting stop-loss orders, diversifying your portfolio, and maintaining appropriate leverage levels.

Are there any regulations governing these strategies?

Yes, options and margin trading are regulated by financial authorities to protect investors. Ensure you comply with all applicable regulations and consult with licensed and reputable brokers.

Option Vs Margin Trading

https://youtube.com/watch?v=GsQ6tkeqFI8

Conclusion

Option trading and margin trading present compelling yet demanding opportunities for seasoned investors. Whether you seek the potential for magnified profits or prefer a defined risk framework, it’s crucial to thoroughly understand the intricacies of these strategies and implement sound risk management practices. Remember, responsible investment involves continuous education, prudent risk-taking, and a commitment to personal and financial growth.

Are you ready to delve into the exciting but demanding world of options and margin trading? Embrace the thrill of high-stakes investments while navigating the inevitable risks with informed decision-making and expert guidance.