Introduction:

Image: phemex.com

In the realm of investing, where both thrill and trepidation intertwine, margin option trading beckons investors with the tantalizing promise of exponential returns. Yet, this path is not without its potential pitfalls. Amidst the glamour of seemingly effortless gains, it is crucial to understand the nuances of margin trading, navigating the fine line between opportunity and risk.

Defining Margin Option Trading:

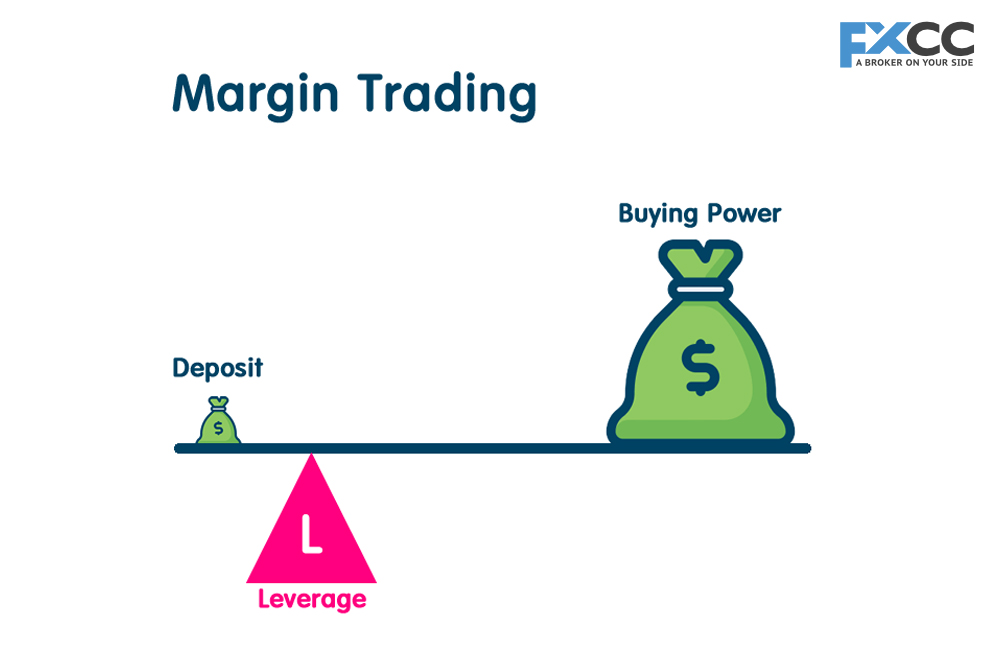

Margin option trading involves borrowing funds from a brokerage firm to amplify your investment capital. By using margin, you can increase your potential profits but also magnify your potential losses. Options, on the other hand, are financial contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a pre-determined price on a specified date.

Fundamentals of Margin Option Trading:

Understanding the underlying concepts is paramount. Margin refers to the borrowed amount, which is expressed as a percentage of the asset’s value. Initial margin and maintenance margin are two important considerations; the former is required to open the position, while the latter is the minimum margin amount that you must maintain to keep the position open.

Option premiums, which are the prices paid for options contracts, fluctuate based on factors such as the underlying asset’s price, time to expiration, and market volatility. Understanding the dynamics of option pricing is essential for effective trading decisions.

The Allure and Perils:

Margin option trading offers the potential for amplified returns, as the borrowed funds effectively leverage your investments. However, the inherent leverage can also magnify losses. The risk of a margin call arises when the value of your investment falls below a certain threshold, requiring you to add funds or liquidate your position potentially at a loss.

Navigating Margin Option Trading Strategies:

Unveiling the nuances of margin option trading strategies empowers investors to harness its potential while mitigating risks. Covered calls, bull call spreads, and bear put spreads are just a few examples of popular strategies. Understanding the mechanics of each strategy is crucial for informed decision-making.

Expert Insights and Practical Guidance:

Seasoned experts in the field share invaluable insights into margin option trading, emphasizing the need for prudent risk management. They advise building a solid trading plan, conducting thorough research, and adhering to strict risk parameters.

Conclusion: A Balancing Act of Opportunity and Risk

Margin option trading offers a compelling path for investors seeking to amplify their financial potential. Yet, it demands a deep understanding of its inherent risks and requires a balanced approach between aggressive trading and prudent risk management. By embracing a comprehensive grasp of the underlying concepts, leveraging expert insights, and implementing carefully crafted strategies, investors can venture into the realm of margin option trading with confidence and the potential to reap its rewards.

Image: www.adigitalblogger.com

Margin Option Trading

Image: haipernews.com