Managed options trading accounts empower individual investors with the potential for significant returns without the complexities of direct options trading. These accounts offer a structured approach to options trading, allowing investors to access the financial markets with a level of expertise that may not be readily available to them.

Image: lezzafrances.blogspot.com

Managed options trading accounts are designed to harness the power of options, financial instruments that provide the right but not the obligation to buy or sell an underlying asset at a specified price on a specific date. This flexibility makes options a versatile tool for risk management, income generation, and speculative trading. However, the complexities of options trading can pose challenges for inexperienced investors.

Managed options trading accounts bridge this knowledge gap by employing professional traders who actively manage the trading strategies within the account. These traders are equipped with a deep understanding of options markets, risk management techniques, and market trends. By entrusting your investments to a managed options trading account, you gain access to the expertise of experienced professionals without the burden of direct options trading.

How Managed Options Trading Accounts Work

Managed options trading accounts operate under a variety of structures, but the core principle remains the same: a professional trader manages the trading activities within the account, executing trades based on predefined strategies and risk tolerances. Here’s a breakdown of the typical process:

1. Account Opening:

To open a managed options trading account, you’ll need to identify a reputable and regulated brokerage firm that offers such services. Conduct thorough research to evaluate the firm’s track record, fees, and investment strategies.

2. Strategy Selection:

Once you’ve selected a brokerage firm, you’ll work with their team to determine the most suitable trading strategy for your financial goals and risk tolerance. Different strategies carry varying levels of risk and potential returns. It’s crucial to understand the strategy thoroughly before committing your funds.

3. Account Funding:

To activate your managed options trading account, you’ll need to deposit funds that will be used for trading purposes. The minimum deposit amount varies depending on the brokerage firm and the selected trading strategy.

4. Ongoing Management:

Once your account is funded, the professional trader assigned to your account will actively manage your investments according to the predefined strategy. They will monitor market conditions, identify trading opportunities, and execute trades on your behalf.

5. Reporting and Communication:

Managed options trading accounts typically provide regular performance reporting, allowing you to track the progress of your investments. The reporting may include detailed summaries of trades executed, account valuations, and market insights. Open communication channels with your account manager are essential for understanding the investment strategy and any necessary adjustments.

Benefits of Managed Options Trading Accounts

Managed options trading accounts offer several key benefits that make them an appealing investment option for many individuals:

1. Access to Expertise:

Lack of experience or time constraints should not prevent you from benefiting from options trading. Managed options trading accounts provide investors access to the expertise of professional traders, who actively monitor markets and make informed decisions on your behalf.

2. Risk Management:

Professional traders employed by managed options trading accounts are well-versed in risk management techniques. They implement strategies to mitigate potential losses and preserve capital, reducing the risks associated with direct options trading.

3. Income Generation:

Well-structured options trading strategies can generate regular income streams through premiums earned from selling options or through successful trades. Managed options trading accounts allow investors to access these income-generating opportunities without the complexities of direct trading.

4. Diversification:

Options trading offers a unique way to diversify investment portfolios. By incorporating options into your asset allocation, you can reduce correlation to traditional investments, potentially enhancing overall returns.

Image: sahammilenial.com

Managed-Options-Trading-Account

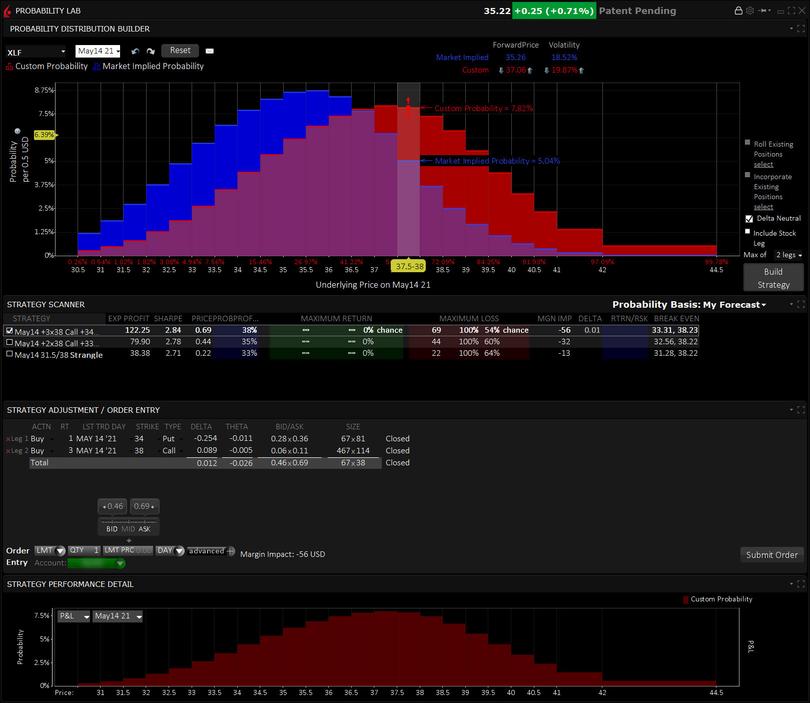

Image: www.interactivebrokers.com

Considerations When Choosing a Managed Options Trading Account

1. Reputation and Track Record:

The repute and track record of the brokerage firm and the professional trader managing your account are crucial. Look for firms with a proven history of success, transparency, and customer satisfaction.

2. Fees and Commissions:

Managed options trading accounts typically charge management fees and commissions based on account size and trading activity. Understand the fee structure comprehensively before investing to avoid unexpected costs.