Introduction

In the realm of financial markets, options trading holds a unique allure, offering investors the potential for exponential returns. However, the complexities of options trading demand a deep understanding of market dynamics and risk management strategies. For those seeking a guided approach to this challenging arena, managed accounts for options trading present an attractive solution.

Image: www.pinterest.com

Managed accounts are essentially investment vehicles wherein a professional money manager handles trading decisions on behalf of clients. These managers, armed with specialized knowledge and market expertise, provide access to tailored options strategies that align with clients’ risk tolerance and financial goals.

Managed Accounts: A Closer Look

Managed accounts for options trading provide several advantages over self-directed trading:

- Professional Expertise: Seasoned money managers leverage their insights to develop and implement sophisticated trading strategies for clients. They stay abreast of market trends, monitor risk levels, and optimize portfolios to meet specific investment objectives.

- Customized Portfolios: Managed accounts offer customized portfolios designed to match individual investment profiles. Whether it’s balancing risk and return or targeting specific market sectors, managers tailor strategies to cater to each client’s needs.

- Risk Mitigation: Options trading involves inherent risks. Experienced money managers employ risk management techniques to mitigate exposure, minimize losses, and protect clients’ assets against market downturns.

- Time Savings: Managed accounts relieve traders of the burden of continuous market monitoring and technical analysis. Managers handle all trading aspects, allowing clients to focus on their core business or personal pursuits.

Navigating the Options Market with Managed Accounts

To participate in managed accounts for options trading, investors typically undergo a rigorous due diligence process:

- Manager Selection: Identifying a reputable and experienced money manager is crucial. Research potential managers, review their track records, and conduct thorough interviews to ensure alignment with your financial goals and risk appetite.

- Account Setup: Once a manager is selected, an account is established with the broker that facilitates the trading activities. The account is typically funded with sufficient capital to support the desired trading strategies.

- Monitoring and Communication: Periodic reviews are essential to ensure the manager’s adherence to the agreed-upon strategies and risk parameters. Regular communication keeps clients informed about market developments and investment performance.

Latest Trends and Developments

The managed accounts for options trading landscape is constantly evolving:

- Artificial Intelligence (AI): AI algorithms are increasingly employed to analyze vast amounts of trading data, identify patterns, and optimize investment decisions in real-time.

- Alternative Data: Managers are harnessing alternative data sources, such as social media sentiment and satellite imagery, to enhance market insights and gain a competitive edge.

- Regulatory Enhancements: Governments and financial regulators are implementing new rules to improve the transparency and oversight of managed accounts, protecting investors and ensuring market integrity.

Image: www.slidebook.io

Expert Advice and Tips for Success

Based on extensive experience in the managed account space, seasoned experts offer the following advice:

- Set Clear Goals: Define your investment objectives, risk tolerance, and time horizon before selecting a manager. Ensure alignment between your expectations and the manager’s investment philosophy.

- Monitor Performance: Regularly review account performance against established benchmarks and market indices. This allows for timely adjustments to strategies if necessary.

- Stay Informed: Educate yourself on options trading strategies and market dynamics. Understanding the complexities of the market empowers you to make informed decisions and hold your manager accountable.

FAQs on Managed Accounts for Options Trading

Q: Are managed accounts suitable for all investors?

A: Managed accounts can benefit investors with varying levels of experience, from those new to options trading to experienced investors seeking professional guidance and risk mitigation.

Q: What are the fees associated with managed accounts?

A: Fees may vary depending on the manager and the specific investment strategy employed. Common fee structures include a percentage of assets under management and performance-based incentives.

Q: How do I find a reputable money manager?

A: Seek referrals from trusted sources, such as financial advisors or fellow investors. Research potential managers, check their credentials, and conduct thorough due diligence before making a decision.

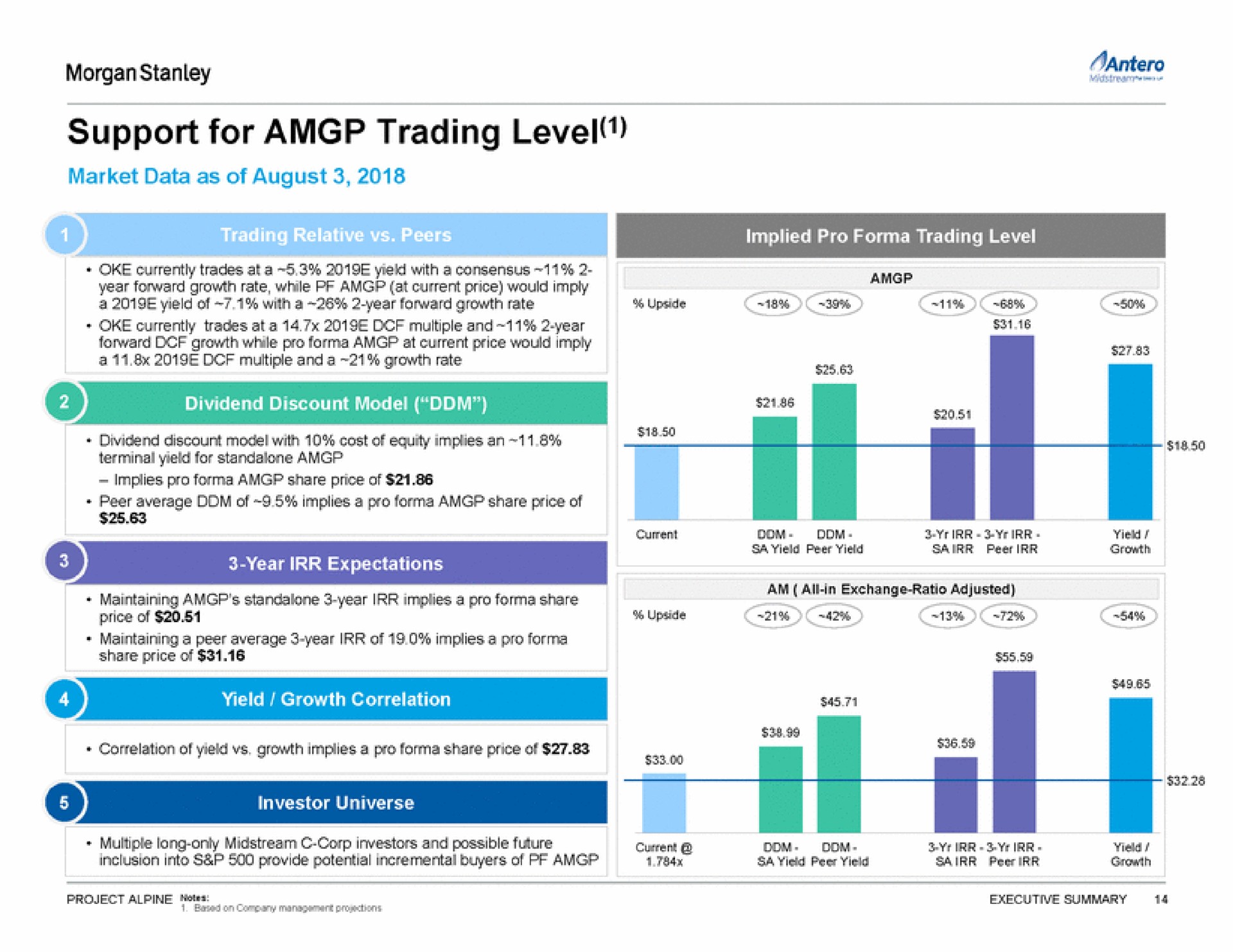

Managed Accounts For Options Trading Morgan Stanley

Image: www.morganstanley.com

Conclusion

Managed accounts for options trading provide a valuable avenue for investors to navigate the intricacies of the options market. By entrusting professional money managers with the execution of trading strategies, investors can benefit from their expertise, customized portfolios, risk mitigation techniques, and time-saving advantages.

Consider whether managed accounts for options trading align with your financial needs and investment goals. Take advantage of professional guidance, stay informed, and make informed decisions to maximize your trading success.