Introduction

Image: play.google.com

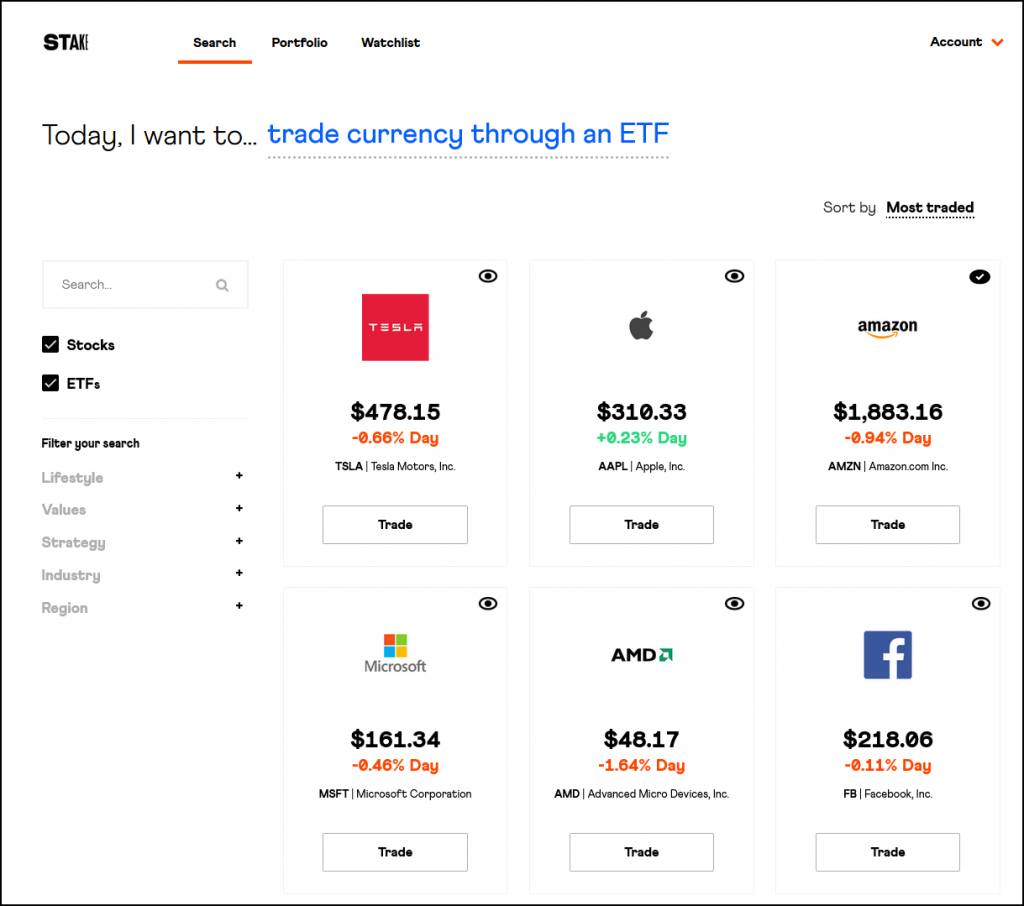

In the realm of financial markets, where opportunities and risks intertwine, stake options trading has emerged as a powerful tool for investors seeking to navigate market volatility and enhance their returns. This comprehensive guide will delve into the intricacies of stake options trading in Australia, empowering you with the knowledge to harness its potential and mitigate its risks. Whether you are a seasoned trader or a novice venturing into this exhilarating field, this article will guide you through the complexities of stake options trading, arming you with the insights and strategies to optimize your trading endeavors.

Understanding Stake Options Trading

Stake options, also known as binary options, are a unique type of derivative contract that offers investors a simplified and potentially lucrative approach to speculating on market movements. Unlike traditional options contracts, which grant the holder the right but not the obligation to buy or sell an underlying asset at a predetermined price, stake options present a binary outcome: either a fixed payout if the predicted market scenario materializes or a complete loss of the invested capital. This straightforward structure makes stake options trading accessible to a wide range of investors, regardless of their experience level.

Benefits and Risks of Stake Options Trading

The allure of stake options trading lies in several compelling advantages:

- Limited Risk Exposure: Investors’ potential losses are capped at the initial capital invested, providing a defined risk profile that can be tailored to individual risk tolerance levels.

- Potential for High Returns: Stake options offer the potential for substantial returns, especially during periods of high market volatility, when asset prices experience rapid fluctuations.

- Simplicity: The binary nature of stake options makes them relatively easy to understand, allowing even novice traders to participate in this market.

However, it is crucial to acknowledge the inherent risks associated with stake options trading:

- All-or-Nothing Outcome: The binary structure of stake options implies that investors can either profit handsomely or lose their entire investment, leaving no room for partial gains or losses.

- Complexity: Despite their apparent simplicity, stake options can be complex instruments, and traders must possess a thorough understanding of market dynamics and risk management techniques to

Image: denofdividends.com

Stake Options Trading Australia

Image: captainfi.com