Introduction

Image: www.cashbackforex.com

Imagine embarking on a thrilling adventure, where the thrill of soaring high and the potential for great rewards intertwine. Options trading, with its alluring promise of substantial gains, beckons countless individuals seeking financial freedom. Yet, navigating this intricate world can be daunting, especially for those venturing into its uncharted territories. One crucial aspect that often perplexes traders is the concept of “lot size.” Understanding this enigmatic term holds the key to unlocking the true potential of options trading. In this comprehensive guide, we will delve into the depths of options trading lot size, empowering you with the knowledge and insights to conquer the trading landscape.

Deciphering Lot Size: The Building Block of Options Trading

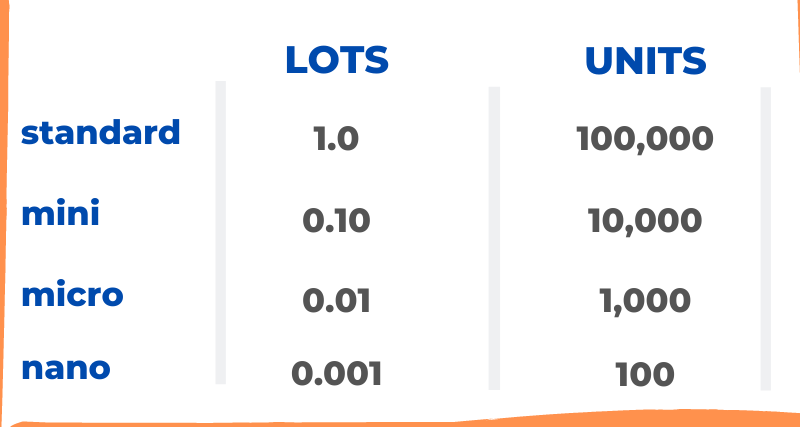

In the realm of options trading, a lot size represents a standardized number of underlying assets associated with each options contract. This predetermined quantity serves as the fundamental unit of trade, ensuring a seamless flow of transactions within the options market. For instance, in the equity options market, the standard lot size typically comprises 100 shares of the underlying stock. This means that when you purchase an options contract, you are effectively acquiring or selling the right to the underlying asset in multiples of 100 shares.

Historical Evolution: The Journey of Lot Sizes

The concept of lot size has its roots in the traditional floor-trading era, where options were traded in physical form. To streamline the trading process and enhance efficiency, standardized lot sizes were introduced. This standardization aimed to reduce confusion and ensure a smooth transfer of contracts between market participants. Over time, the advent of electronic trading platforms further solidified the significance of lot sizes, enabling the swift and efficient execution of trades.

Real-World Applications: The Significance of Lot Sizes

Lot sizes play a pivotal role in shaping the dynamics of options trading. They determine the magnitude of exposure and financial risk associated with each contract. Understanding the lot size of an options contract is paramount for managing risk effectively. It allows traders to calculate the potential profit or loss accurately, ensuring informed decision-making. Moreover, lot sizes influence the liquidity of options contracts. Larger lot sizes tend to attract more market participants, resulting in higher liquidity and tighter bid-ask spreads. Conversely, smaller lot sizes may indicate lower liquidity, potentially leading to wider spreads and increased slippage.

Navigating the Landscape: Expert Insights and Actionable Tips

To navigate the complexities of options trading lot sizes, seasoned traders recommend the following strategies:

- Align Lot Sizes with Trading Strategy: Determine your trading strategy and risk tolerance before selecting an appropriate lot size. Larger lot sizes may be suitable for experienced traders seeking higher potential returns, while smaller lot sizes can align better with conservative trading preferences.

- Consider Market Volatility: The volatility of the underlying asset should also guide lot size selection. In periods of high volatility, it’s advisable to trade smaller lot sizes to mitigate potential losses. Conversely, during

Image: upemopilupuf.web.fc2.com

Options Trading Lot Size

Image: ca.finance.yahoo.com