Imagine standing at the threshold of a vast, uncharted wilderness, ready to embark on an exhilarating adventure. In the world of trading, options present us with such a thrilling frontier, where strategy and boldness intertwine to guide our path toward financial freedom. Exercising options is the key to unlocking the full potential of this enigmatic market, and in this comprehensive guide, we will delve into the intricate details of this crucial aspect.

Image: www.trade-stock-option.com

Understanding Options: The Gateway to Trading Mastery

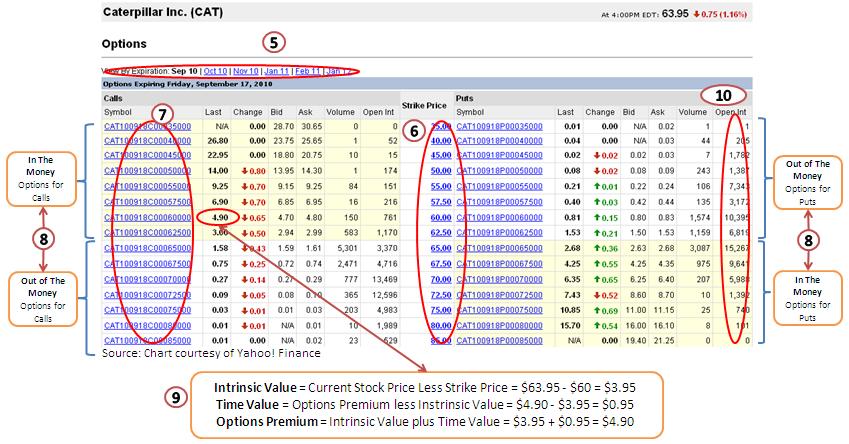

Options are contracts that bestow the holder with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. They offer traders a potent tool to amplify their earnings while mitigating risks. However, it is imperative to grasp the nuances of options trading before venturing into this dynamic realm.

Exercising Options: Taking Control of Your Destiny

Exercising an option entails instructing the broker to execute the purchase or sale of the underlying asset. It is the moment of truth, when the theory and speculation of trading crystallize into tangible results. Understanding the mechanics of exercise is essential for achieving desired outcomes.

Call Option Exercise: Buying at a Discount

A call option grants the holder the right to buy the underlying asset at a specified price, known as the strike price. Exercising a call option becomes a profitable endeavor when the market price of the underlying asset exceeds the strike price. By exercising the option, the trader effectively acquires the asset at a favorable price, securing a potential profit.

Image: www.wallstreetmojo.com

Put Option Exercise: Selling at a Premium

Conversely, a put option provides the holder with the right to sell the underlying asset at a predetermined price. Exercising a put option becomes lucrative when the market price of the underlying asset falls below the strike price. By exercising the option, the trader sells the asset at a price higher than the prevailing market price, realizing a gain.

Timing and Strategy: Navigating the Market’s Rhythms

The timing of option exercise is paramount to maximizing profitability. Exercising too early may result in missed opportunities, while waiting too long could lead to the expiration of the option without value. A judicious evaluation of market conditions, technical analysis, and personal goals is crucial for determining the optimal time to exercise.

Furthermore, developing a sound trading strategy is essential for consistent success. This involves identifying trading opportunities that align with your risk tolerance and investment horizon. Whether you adopt a scalping, swing trading, or long-term investment approach, a well-defined strategy will guide your decision-making.

Realizing Gains and Managing Risks: The Path to Financial Empowerment

Exercising options can yield substantial gains, but it is equally important to manage risks effectively. Understanding the potential for losses and implementing prudent risk management techniques is essential for preserving capital and safeguarding your trading journey.

Tax Implications: Navigating the Fiscal Landscape

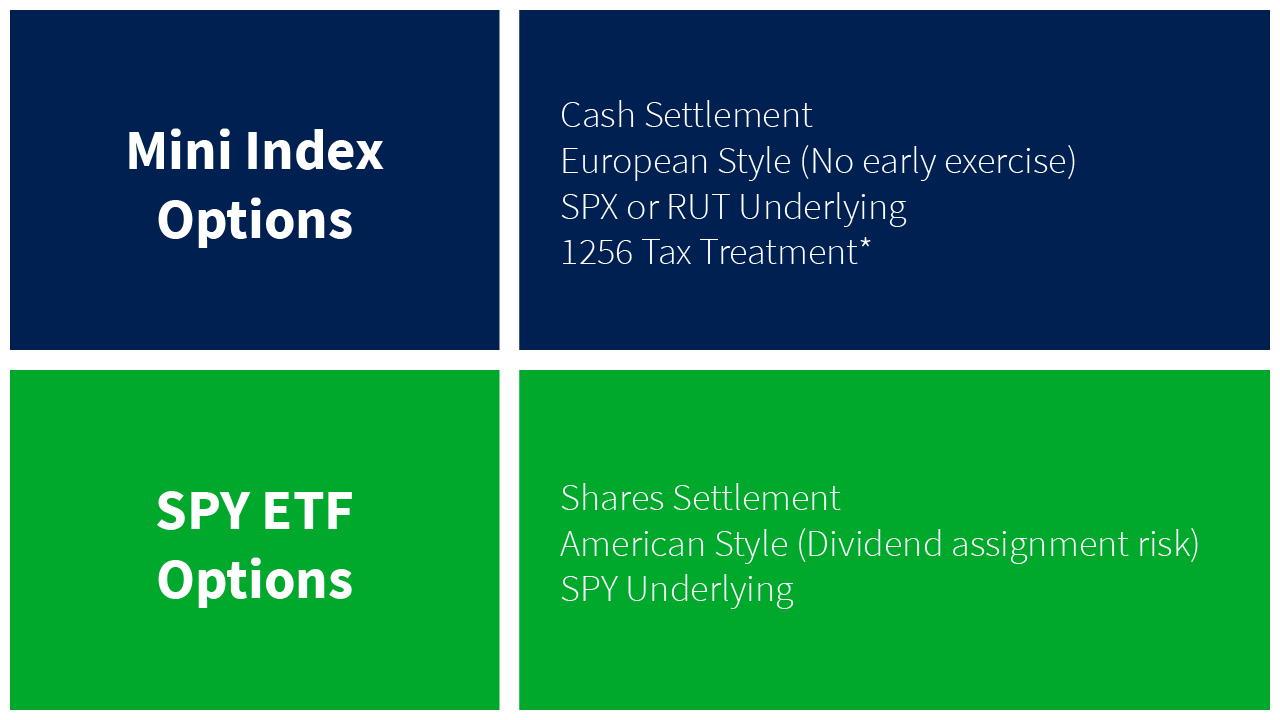

It is crucial to be aware of the tax implications associated with exercising options. Consult with a qualified tax professional to optimize your tax strategies and minimize potential liabilities. Thorough knowledge of the tax code will empower you to make informed decisions and maximize your after-tax returns.

Advanced Techniques: Enhancing Your Trading Prowess

As you gain experience and confidence in options trading, you may explore advanced techniques such as spreads, straddles, and strangles. These strategies involve combining multiple options to create tailored risk and reward profiles. While advanced techniques offer the potential for greater rewards, they also carry increased complexity and risk.

How To Exercise Options In Trading

Image: www.cboe.com

Conclusion: Unleashing Your Trading Potential

Exercising options is a powerful tool that can propel your trading endeavors to new heights. By understanding the mechanics, timing, and strategies involved, you can effectively control your destiny in the market. Remember to approach options trading with prudent risk management and a well-defined strategy. With dedication and a constant pursuit of knowledge, you can harness the full potential of options to achieve financial success and personal empowerment. The world of trading awaits your arrival, and the path to financial freedom lies at your fingertips. Embrace the challenge, exercise your options wisely, and seize the opportunities that this dynamic market has to offer.