Introduction: Unearthing the Enigmatic World of Options Trading

The realm of equity options trading, where sophisticated investors navigate a labyrinth of intricate strategies, holds immense allure for aspiring wealth builders. In this article, we embark on a comprehensive exploration of options trading principles, strategies, and the rewards awaiting those who master this financial art form. Options, a type of financial instrument, empower traders to capitalize on market movements without tying up significant capital. By studying the intricate strategies employed in equity options trading, investors can enhance their financial acumen and harness the power of advanced financial tools.

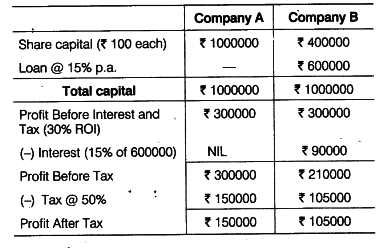

Image: ask.learncbse.in

Understanding Options: A Gateway to Informed Investment Decisions

An option, in financial parlance, is a contract that grants the buyer the right, but not the obligation, to purchase (in the case of a call option) or sell (in the case of a put option) an underlying asset, such as a stock or index, at a predetermined price (strike price) on or before a specific date (expiration date). These financial instruments derive their value from the underlying asset and can be used for speculation, hedging, and portfolio optimization.

Unveiling the Arcane Techniques of Options Trading

Options trading encompasses a myriad of strategies, each tailored to specific market conditions and risk appetites. Covered call writing, for instance, involves selling call options against stocks already owned in the portfolio, generating additional income through option premiums while retaining the potential upside of the underlying asset. Straddles, on the other hand, involve simultaneous purchase of both call and put options with the same strike price but different expiration dates, benefiting from significant market volatility. Iron condors, a more advanced strategy, entail selling an out-of-the-money call option and buying a further out-of-the-money call option with a higher strike price while also selling an out-of-the-money put option and buying a further out-of-the-money put option with a lower strike price. This complex strategy seeks to capitalize on moderate market movements and capture time decay.

Navigating Market Uncertainties with Strategic Options Trading

Options trading provides investors with a versatile toolset to navigate the uncertainties inherent in financial markets. Hedging, a defensive strategy, involves using options to offset the risk associated with an existing investment. For instance, investors can purchase put options on stocks they own to protect against potential price declines. Speculation, an aggressive strategy, seeks to profit from anticipated market movements. Investors can employ call options to wager on rising prices or put options to speculate on falling prices. Income generation, a hybrid strategy, involves using options to generate income through option premiums, as in covered call writing.

Image: articles-junction.blogspot.com

Mastering the Art of Options Trading: A Symphony of Skill and Diligence

Successful options trading demands a symphony of skill and diligence. In-depth research forms the cornerstone, as traders must possess a thorough understanding of the underlying assets, market conditions, and historical trends. Risk management is paramount, with traders employing techniques such as position sizing, stop-loss orders, and margin management to mitigate potential losses. Emotional discipline, the ability to control impulsive trades and adhere to a well-defined strategy, is vital to long-term success.

Equity Options Trading Strategies

Image: admiralmarkets.com

Conclusion: Unveiling the Path to Financial Empowerment

Options trading, with its diverse strategies and applications, empowers investors to unlock the full potential of financial markets. By embracing a disciplined approach, honing their skills through diligent study, and adhering to sound risk management principles, traders can navigate the complexities of options trading and reap the rewards of informed investment decisions. May this article serve as a beacon of knowledge, guiding you towards financial empowerment and the realization of your investment aspirations.