Beginners and seasoned traders alike constantly seek out resources to enhance their knowledge and skills within the dynamic field of options trading. Fortunately, an extensive pdf guide compiling 50 futures and options trading strategies has emerged as a valuable resource for aspiring traders. This comprehensive guide delves into various proven strategies, providing indispensable insights for navigating the complex world of options trading.

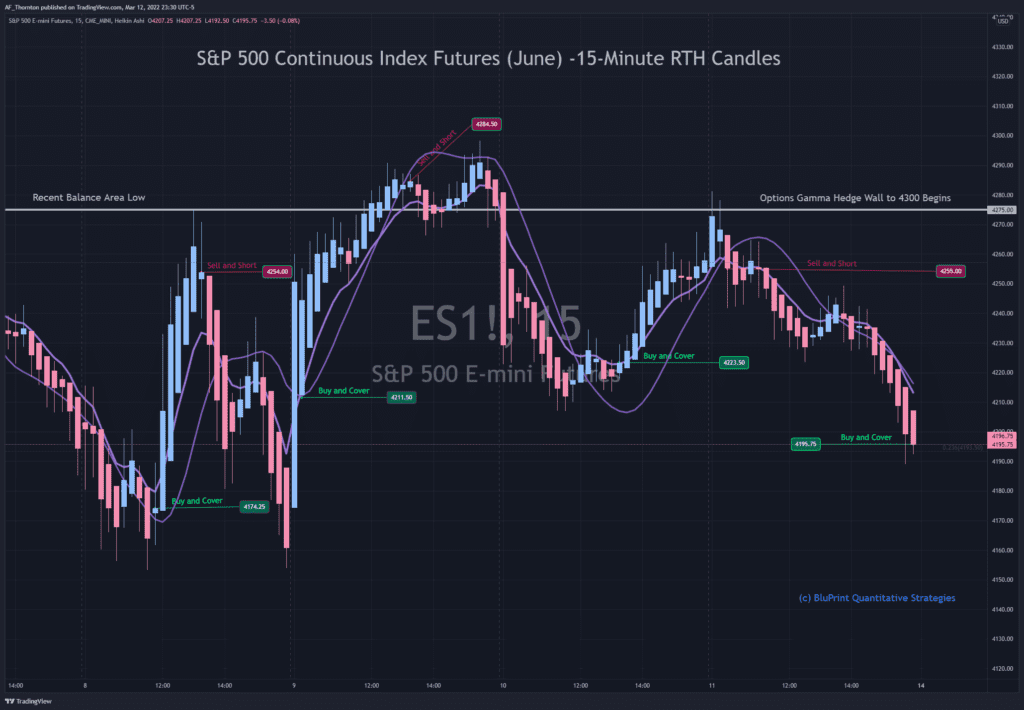

Image: www.bluprinttrading.com

Delving into the intricate world of options trading, the guide unravels the basic concepts and principles that lay its foundation. It elucidates the different types of options contracts, including calls, puts, and their underlying mechanics. With a firm grasp of these fundamentals, traders can progress toward exploring the diverse strategies outlined in the guide.

The 50 futures and options trading strategies showcased within the guide span various risk-reward profiles to accommodate different trading styles and preferences. Each strategy is meticulously described, encompassing its underlying principles, implementation guidelines, and potential profit potential. For instance, the guide introduces the popular Iron Condor strategy, which involves simultaneous execution of short puts and calls at defined strike prices to capture time decay while potentially profiting from a narrower price range.

In addition to providing an exhaustive list of trading strategies, the guide emphasizes the importance of risk management. It underscores the criticality of understanding the potential risks associated with each strategy and employing appropriate risk mitigation measures. By incorporating these risk management techniques into their trading routines, traders can enhance their overall trading discipline and decision-making processes.

The guide also dedicates sections to portfolio diversification, exploring strategies to minimize risk and enhance returns through diversification techniques. Traders are introduced to the concept of delta-neutral spreads, which strive to create portfolios with zero or minimal directional bias – reducing portfolio volatility and exposure to market fluctuations.

Furthermore, the guide addresses the psychological aspects of options trading, recognizing the significance of emotional control and discipline. It highlights potential cognitive biases that may hinder trading endeavors and offers strategies to mitigate their impact. By cultivating emotional resilience and maintaining a level-headed approach, traders can make informed decisions and avoid costly mistakes.

The guide concludes by reiterating the importance of continued education and practice in options trading. It encourages traders to continually refine their knowledge and skills through ongoing research and market analysis. By embracing a mindset of continuous learning, traders can stay abreast of evolving market conditions and adapt their strategies accordingly, which is paramount in the dynamic world of options trading.

50 Futures and Options Trading Strategies: A Comprehensive Guide to Boost Your Returns

Navigating the intricate world of futures and options trading requires a solid foundation and a comprehensive understanding of various trading strategies. Fortunately, a definitive pdf guide encompassing 50 futures and options trading strategies has emerged as an invaluable resource for aspiring and seasoned traders alike. This guide not only unveils the essential concepts of futures and options trading but also empowers traders with a comprehensive arsenal of strategies to maximize their profitability.

The guide commences by establishing a solid foundation in the basics of futures and options contracts, providing clear explanations of their underlying principles and mechanics. This clarity empowers traders to confidently navigate the different types of futures and options contracts available, including futures, options on futures, and options on stocks. With a firm grasp of these fundamentals, traders can progress towards exploring the diverse strategies outlined in the guide.

The 50 futures and options trading strategies presented within the guide encompass a wide spectrum of risk-reward profiles, catering to different trading styles and preferences. Each strategy is meticulously described, incorporating its underlying principles, implementation guidelines, and potential profit potential. For instance, the guide delves into the popular Iron Condor strategy, which involves the simultaneous execution of short puts and calls at defined strike prices, aiming to capture time decay while profiting from a narrower price range.

However, the guide goes beyond merely listing trading strategies; it emphasizes the criticality of risk management. It underscores the need for traders to meticulously assess the potential risks associated with each strategy and implement appropriate risk mitigation measures. By incorporating these risk management techniques into their trading routines, traders can enhance their overall trading discipline and decision-making processes, laying the foundation for sustainable profitability.

The guide also dedicates sections to portfolio diversification, exploring strategies to minimize risk and enhance returns through diversification techniques. Traders are introduced to the concept of delta-neutral spreads, which seek to create portfolios with zero or minimal directional bias, thereby reducing portfolio volatility and exposure to market fluctuations.

Recognizing the psychological aspects of futures and options trading, the guide delves into the significance of emotional control and discipline. It highlights potential cognitive biases that may impede trading endeavors and offers strategies to mitigate their impact. By cultivating emotional resilience and maintaining a level-headed approach, traders can make informed decisions and avoid costly mistakes, maximizing their chances of success in the often-volatile world of futures and options trading.

The guide concludes by emphasizing the importance of continued education and practice in futures and options trading. It encourages traders to continually refine their knowledge and skills through ongoing research and market analysis. By embracing a mindset of continuous learning, traders can stay abreast of evolving market conditions and adapt their strategies accordingly, which is paramount in the dynamic world of futures and options trading.

![READ [PDF] Futures Trading Strategies: Enter and | eleanorharveyのブログ](https://stat.ameba.jp/user_images/20220824/01/eleanorharvey/18/50/j/o0793112315164835737.jpg)

Image: ameblo.jp

50 Futures And Options Trading Strategies Pdf

https://youtube.com/watch?v=WsTAgI2pyiM