Investing in the stock market can be a great way to grow your wealth. However, it can also be a risky business. Option trading is a more advanced investment strategy that can help you to reduce your risk and potentially increase your returns. In this article, we will provide you with a comprehensive overview of CommSec option trading, including how it works, the different types of options, and the risks involved.

Image: www.reddit.com

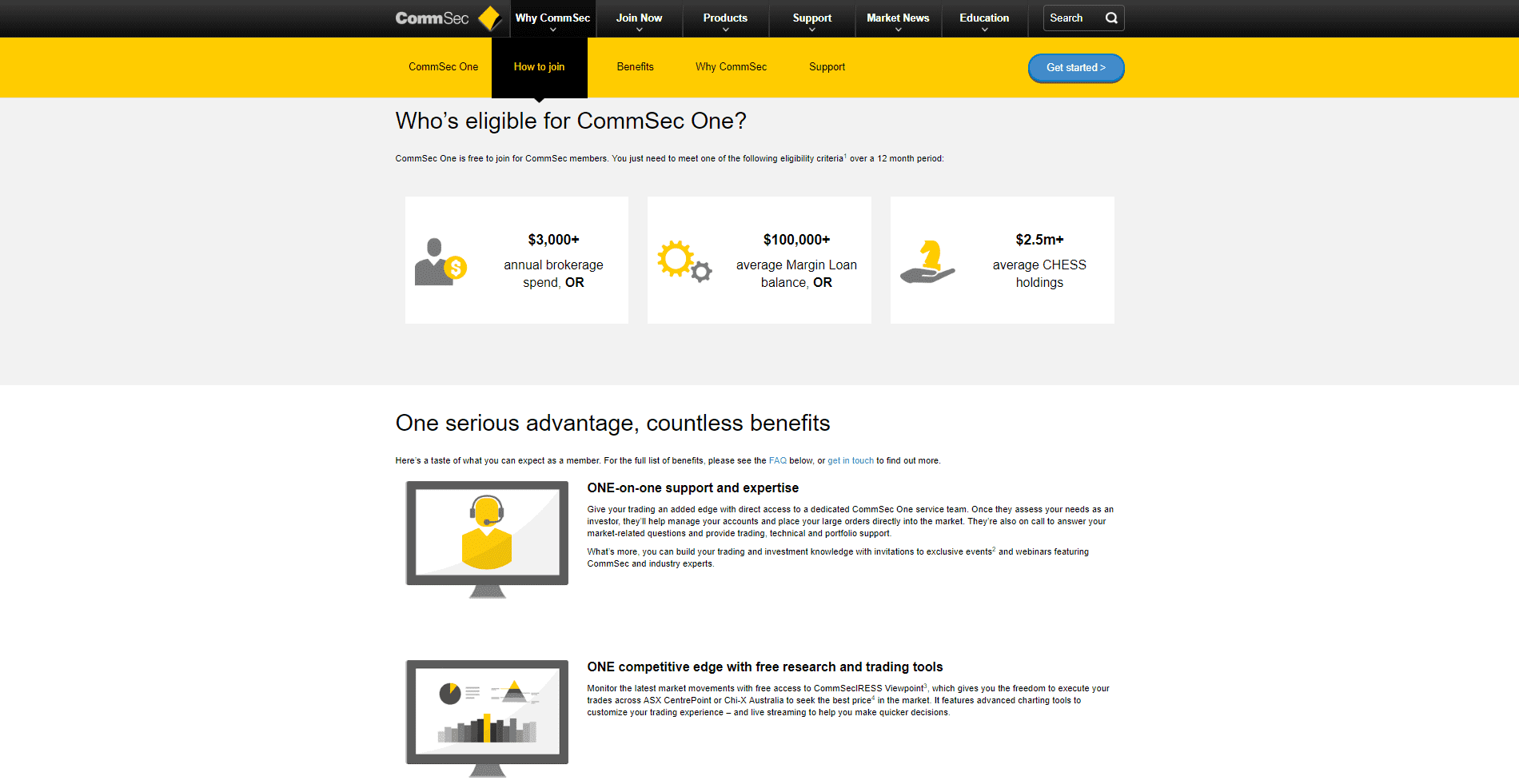

What is CommSec Option Trading?

CommSec is a leading online broker in Australia. It offers a range of investment products, including options. Options are a type of derivative contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date. This can be a useful tool for hedging your investments or speculating on the future price of an asset.

The Different Types of Options

There are two main types of options: calls and puts. **Call options** give you the right to buy an underlying asset at a specified price on or before a specified date. **Put options** give you the right to sell an underlying asset at a specified price on or before a specified date.

In addition to these two basic types of options, there are also a number of other types of options available, such as spreads, straddles, and strangles. These more complex options can be used to create more sophisticated investment strategies.

The Risks of Option Trading

Option trading can be a risky business. The value of options can fluctuate rapidly, and you could lose all of your investment. It is important to understand the risks involved before you start trading options.

Some of the risks of option trading include:

- The risk of losing your investment. The value of options can fluctuate rapidly, and you could lose all of your investment.

- The risk of not being able to exercise your option. If the price of the underlying asset does not move in the direction you expected, you may not be able to exercise your option.

- The risk of being assigned. If you sell a call or put option that is in the money, you could be assigned and forced to buy or sell the underlying asset at the strike price.

Image: www.commsec.com.au

Tips for Option Trading

If you are considering option trading, it is important to do your research and understand the risks involved. Here are a few tips to help you get started:

- Start with a paper trading account. This will allow you to practice trading options without risking any real money.

- Select the right options for your investment goals. Not all options are created equal. Make sure you select the options that are right for your risk tolerance and investment objectives.

- Manage your risk. Option trading can be a risky business. It is important to manage your risk by only trading with money you can afford to lose.

FAQ on CommSec Option Trading

Here are some frequently asked questions about CommSec option trading:

- What is the minimum investment required to trade options on CommSec? There is no minimum investment required to trade options on CommSec.

- What are the fees involved in option trading on CommSec? CommSec charges a brokerage fee of $19.95 per trade.

- Can I trade options on my mobile phone? Yes, you can trade options on your mobile phone using the CommSec app.

- What are the risks involved in option trading on CommSec? The risks involved in option trading on CommSec are the same as the risks involved in option trading on any other platform.

Commsec Option Trading

Image: www.dailyforex.com

Conclusion

Option trading can be a complex but potentially rewarding investment strategy. If you are interested in learning more about CommSec option trading, we encourage you to do your research and talk to a financial advisor.

Are you interested in learning more about CommSec option trading?