In the dynamic world of investing, options trading presents a unique and potentially lucrative opportunity to harness fluctuations in asset prices. Understanding the complexities of commsec options trading levels is crucial for both seasoned and aspiring traders to navigate this landscape effectively. This in-depth guide delves into the fundamentals of commsec options trading levels, empowering you with the knowledge and insights to make informed decisions and maximize your returns.

Image: sites.psu.edu

Demystifying Options Trading Levels

Options trading, in essence, involves entering into contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a predetermined date. Options are classified into two primary types:

- Call Options: Provide the buyer with the right to purchase the underlying asset at the strike price.

- Put Options: Grant the buyer the right to sell the underlying asset at the strike price.

commsec, a leading Australian financial services provider, offers a robust platform for options trading, providing traders with access to a wide range of underlying assets and various expiration dates. Understanding the different levels within the commsec options trading framework is essential for strategic decision-making.

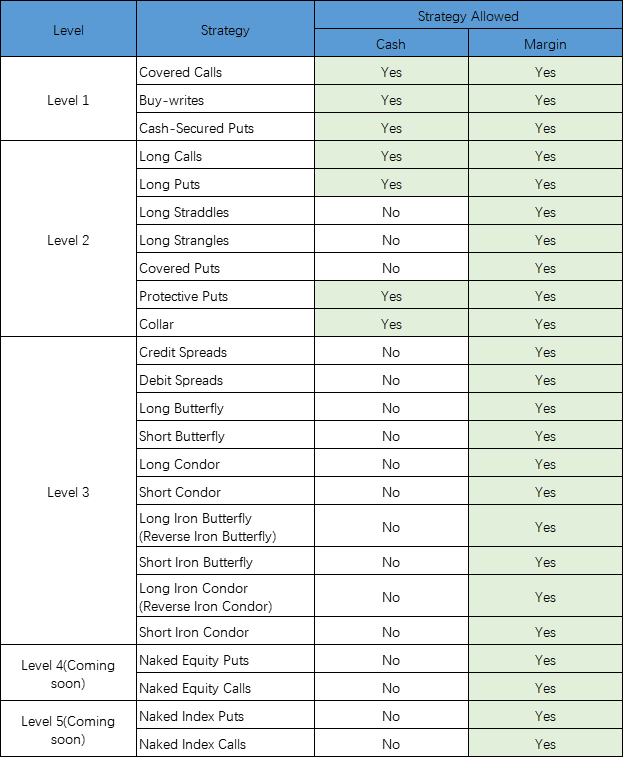

Exploring commsec Options Trading Level Types

commsec categorizes options trading levels based on the trader’s level of experience and sophistication. These levels determine the features and functionalities available to traders and the types of options contracts they can access.

Level 1: Introductory Options

- Suitable for traders new to options trading.

- Limited to vanilla options (single-legged contracts) and options on shares.

- Designated for educational purposes and restricted trading volumes.

Image: tradingbrokers.com

Level 2: Standard Options

- Recommended for traders with basic options experience.

- Offers access to a broader range of options strategies, including multi-legged contracts.

- Trading volumes are subject to higher limits than Level 1.

Level 3: Advanced Options

- Reserved for experienced and sophisticated traders.

- Grants access to advanced trading strategies and complex options types.

- Encompasses extended trading hours and increased trading volumes.

The appropriate level for each trader depends on their knowledge, experience, and risk tolerance. Traders should carefully consider their trading goals and capabilities before selecting their commsec options trading level.

Unlocking the Power of commsec Options Trading

Equipped with a clear understanding of commsec options trading levels, traders can harness the full potential of this platform to enhance their investment strategies. Key considerations include:

Leveraging Options Strategies

Options offer a versatile array of strategies that can be tailored to different market conditions and investment objectives. From hedging positions to speculating on price movements, options provide traders with greater flexibility and potential for returns.

Selecting the Right Strike Price

The strike price of an option plays a pivotal role in determining its value and profitability. Factors to consider when choosing the strike price include the current market price of the underlying asset, volatility, and the trader’s risk appetite.

Understanding Option Premiums

Option premiums represent the price paid to acquire an options contract. Premiums are influenced by various factors, including the strike price, time until expiration, and market volatility. Traders should carefully evaluate the premium cost relative to the potential return on investment.

Mastering the Art of Options Trading

To fully master the nuances of commsec options trading, traders should continuously refine their knowledge and skills through a combination of resources:

- Education: Take advantage of online courses, webinars, and seminars offered by commsec and other financial institutions.

- Research: Stay abreast of market news, economic data, and industry trends that impact options pricing and strategies.

- Practice: Utilize simulation or paper trading platforms to test trading strategies and hone execution skills.

Commsec Options Trading Levels

Image: shortthestrike.com

Conclusion

Navigating commsec options trading levels requires a comprehensive understanding of the different levels, option types, and trading strategies available. By embracing these concepts, traders can unlock the full potential of this platform and make informed investment decisions aimed at maximizing their returns. While options trading conlleys inherent risks, a thorough understanding of commsec options trading levels can empower traders to navigate these complexities with confidence and elevate their investment success to new heights.