**

Image: www.youtube.com

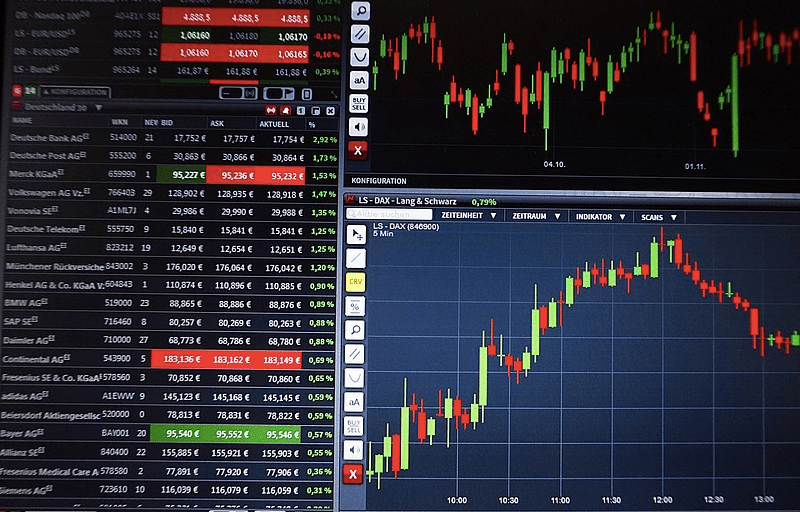

In the fast-paced world of financial markets, one day options trading stands out as a high-stakes game of risk and reward. Unlike traditional options contracts that endure for weeks or months, one day options, also known as daily options, provide traders with a limited 24-hour window to strike gold or face a definitive loss. The thrill and terror of this time-sensitive endeavor captivate seasoned traders and novice speculators alike, but understanding the ins and outs of this trading strategy is crucial before taking the plunge.

Understanding the Allure of One Day Options

One day options offer a tantalizing proposition: the chance to reap substantial profits within a single trading day. Their short duration allows traders to execute quick trades, potentially capturing fleeting market movements and capitalizing on short-term fluctuations in stock prices. Moreover, the all-or-nothing nature of these options eliminates the risk of undefined losses, reducing financial exposure compared to longer-term options strategies.

Mechanics of One Day Trading

Traders must first comprehend the fundamental principles governing one day options. These contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before the expiration time, which occurs at the end of the trading day. However, unlike traditional options, one day options cannot be exercised early, adding an element of urgency to the trading process.

Trading Strategies for Success

Navigating the treacherous waters of one day options trading requires a well-defined strategy. Successful traders typically adopt one of two primary approaches:

-

Directional Trading: This strategy involves speculating on the future price direction of the underlying asset. Traders who anticipate a price increase may buy call options, while those expecting a decline may opt for put options.

-

Volatility Trading: Here, the focus shifts from predicting price movements to capitalizing on fluctuations in volatility. When market volatility is high, option prices tend to increase, providing opportunities for profit. By selling call or put options, traders can benefit from elevated volatility without speculating on the underlying asset’s direction.

Managing Risk with Precision

Embarking on the pursuit of one day options trading warrants a stringent risk management strategy. Key tactics include:

-

Setting Stop-Loss Orders: Predetermine a tolerable loss threshold and place stop-loss orders accordingly to protect against excessive losses.

-

Managing Position Size: Limit the size of individual trades relative to overall trading capital to minimize exposure to potential losses.

-

Diversification: Spread risk by trading multiple one day options contracts on different underlying assets, mitigating the impact of any single trade.

Conclusion

One day options trading unveils a world of boundless possibilities for those seeking quick and substantial gains. Its high-risk, high-reward nature demands a deep understanding of market dynamics, a well-defined trading strategy, and meticulous risk management. By embracing prudent practices and mastering the intricacies of this exhilarating trading avenue, traders can harness the potential of one day options to achieve their financial aspirations.

Image: www.daytrading.com

One Day Options Trading

https://youtube.com/watch?v=yTRrwFRzuu8