Introduction:

In the fast-paced world of finance, time is money. That’s where options automated trading systems come in. Technology has revolutionized the trading landscape, making it possible to execute complex trades with precision and speed. In this article, we will delve into the captivating world of options automated trading, exploring its history, applications, trends, and strategies. By the end of our exploration, you’ll have a deep understanding of how these systems can empower your trading journey.

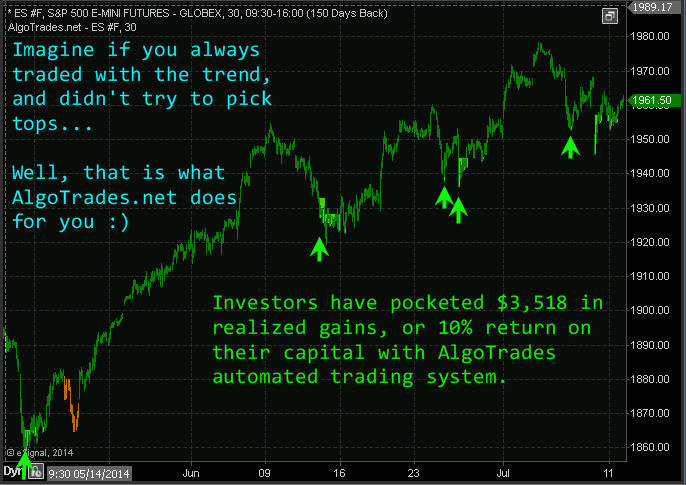

Image: www.algotrades.net

Dive into the Realm of Options Automated Trading:

Options automated trading systems are sophisticated software programs designed to automate the analysis, execution, and management of options trades. While traditional trading involves manual decisions based on human judgment, automated systems leverage advanced algorithms and real-time market data to make swift and data-driven decisions. They scan markets for lucrative opportunities, identify potential risks, and execute trades with lightning-fast response times, allowing traders to capture fleeting market inefficiencies.

Tracing the Evolution of Automation in Trading:

The origins of automated trading can be traced back to the 1960s when the first computerized trading systems emerged. However, it wasn’t until the late 20th century that options automated trading systems gained traction, driven by the advent of sophisticated computer models and high-speed internet connectivity. Over the years, advancements in technology have pushed the boundaries of automated trading, empowering traders with a suite of robust tools.

Practical Applications of Automated Trading:

Options automated trading systems find applications in various investment strategies, including:

- Trend following: These systems analyze market momentum and trade options in the direction of prevailing trends.

- Pairs trading: They exploit price discrepancies between correlated assets by buying one and simultaneously selling the other.

- Mean reversion trading: They identify assets that have deviated significantly from their mean price and trade options to profit from their expected return towards the mean.

- Scalping: They execute multiple short-term trades to capture small price movements and accumulate profits over time.

Image: tosindicators.com

Latest Trends Shaping the Landscape:

The landscape of options automated trading systems is constantly evolving, driven by technological advancements. Some of the latest trends include:

- Machine learning and AI: Advanced algorithms leverage machine learning and artificial intelligence (AI) for more accurate market analysis and predictive capabilities.

- Cloud computing: Cloud-based platforms provide scalable and cost-efficient environments for running automated trading systems.

- Low-code platforms: User-friendly platforms enable non-programmers to develop and deploy their own automated trading strategies.

Harnessing the Power of Expert Insights:

To maximize the potential of options automated trading systems, it’s essential to learn from experienced traders. Here are some expert tips:

- Start with a trusted provider: Choose a reputable platform that offers reliable technology, flexible customization options, and dedicated support.

- Test before investing: Allocate a small portion of your portfolio for testing your automated trading strategies before scaling up operations.

- Monitor your performance: Regularly track the performance of your automated trading system and make necessary adjustments based on market conditions.

Empowering Your Trading Journey:

Well-designed and executed automated trading strategies can empower your trading journey in several ways:

- Time savings: Automation frees up your time, allowing you to focus on strategic decisions and market analysis.

- Precision and speed: Automated trading systems execute trades with high accuracy and lightning-fast response times, seizing fleeting trading opportunities.

- Risk management: Sophisticated algorithms help manage risk by setting clear parameters for trade entry and exit points.

- Emotional detachment: Automation removes the influence of emotions from the decision-making process, fostering discipline and preventing irrational trades.

Options Automated Trading System

Conclusion: Embark on a Journey of Empowerment:

Embracing options automated trading systems can open a world of possibilities for traders. By leveraging the power of technology and expert insights, you can enhance your trading efficiency, optimize risk-reward dynamics, and ultimately empower your financial journey. Remember, automation is not a substitute for knowledge and market understanding; it’s a valuable tool that can complement your trading skills and elevate your trading potential. As you embark on this journey, stay curious, embrace innovation, and continuously refine your strategies to unlock the full potential of options automated trading systems.