Nifty Strategies Option Trading: Unveiling the Power of Derivatives

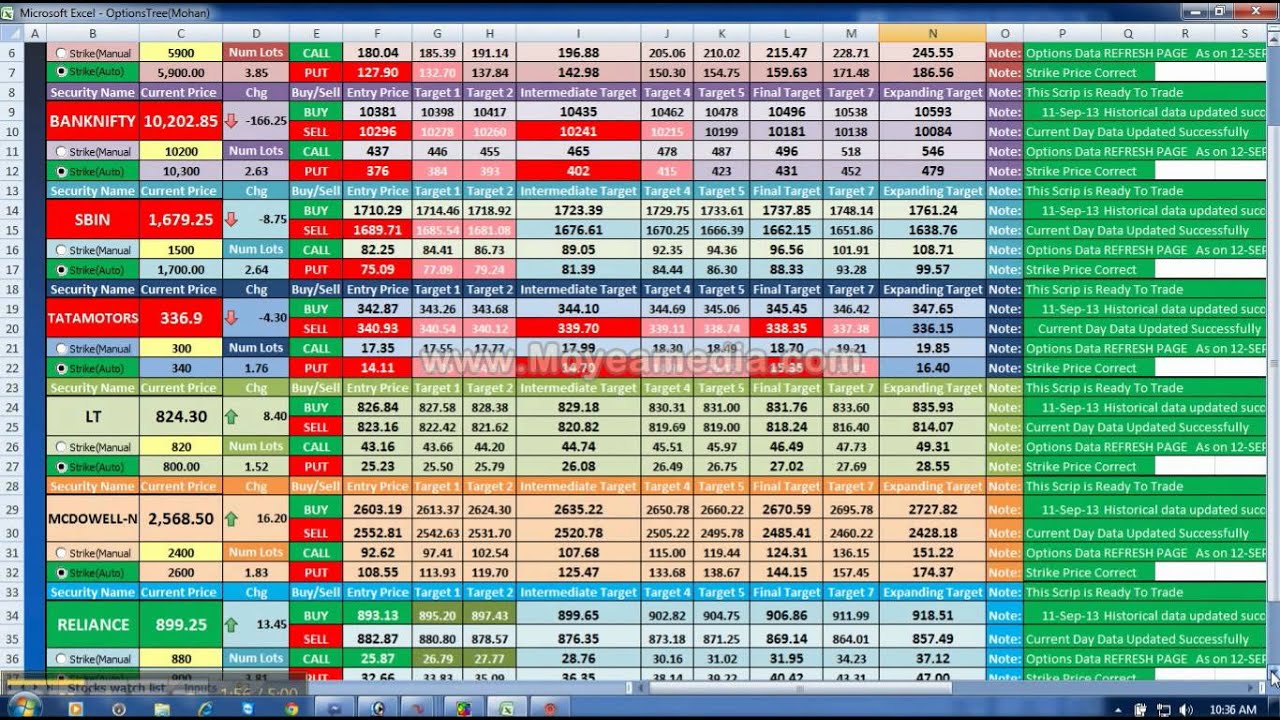

Image: aqasesuyohaw.web.fc2.com

In the vibrant and dynamic world of stock markets, option trading has emerged as a potent weapon for savvy investors seeking to amplify their gains and hedge against potential losses. Among the array of options available, Nifty strategies have garnered significant attention due to their versatility, transparency, and suitability for a wide range of investors.

Nifty Options: A Gateway to the Derivatives Arena

Nifty options are standardized derivatives contracts that derive their value from the underlying Nifty 50 index, a benchmark of the performance of the top 50 companies listed on the National Stock Exchange of India (NSE). These contracts provide investors with the flexibility to capitalize on the price movements of the underlying index, regardless of the direction the market takes.

Core Principles of Nifty Options Trading

At the heart of Nifty options trading lies the concept of time: each contract has a defined expiry date on which it settles. The option’s value is influenced by several key factors, including:

- Type of Option: Buyers have the option to buy or sell the underlying index (call or put option, respectively), while sellers (writers) have the obligation to fulfill the contract.

- Strike Price: This represents the index level at which the buyer or seller has the right to exercise the option.

- Expiration: The duration of the contract determines its premium, with closer expiration dates commanding higher premiums.

Embracing Nifty Strategies: A Path to Prudent Trading

Seasoned traders employ a variety of Nifty strategies to optimize their options activity. Some of the most common include:

-

Bull Call Spread: This strategy combines the purchase of a call option at a lower strike price with the sale of a call option at a higher strike price. It allows investors to profit from a moderate rise in the index value while limiting potential losses.

-

Bear Put Spread: Similar to the bull call spread, this strategy involves purchasing a put option at a higher strike price and selling a put option at a lower strike price. It provides gains from a decline in the index value, with limited risk.

-

Straddle: This strategy involves buying both a call option and a put option with the same strike price and expiration. It profits from significant price fluctuations in either direction, regardless of the trend.

-

Strangle: Similar to a straddle, this strategy combines the purchase of a slightly out-of-the-money call option and a slightly out-of-the-money put option. It targets moderate price movements while offering a wider profit spread compared to a straddle.

Unleashing the Potential of Nifty Strategies

Nifty strategies offer numerous advantages, making them an attractive choice for market participants. These benefits include:

- Flexibility: Traders can tailor their strategies to their specific risk tolerance and market outlook.

- Hedging: Options can act as insurance policies, allowing investors to protect their portfolios from adverse market movements.

- Limited Risk: Compared to direct equity investing, options limit the financial exposure to defined levels.

- Leverage: By investing a relatively small premium, traders can gain potential returns that could exceed the initial investment.

Empowering Investors with Know-how

To successfully navigate the world of Nifty options trading, it is crucial for investors to arm themselves with knowledge and understanding. Here are some tips for enhancing your skills:

- Seek Expert Guidance: Consult with seasoned traders or financial advisors who specialize in options trading.

- Educate Yourself: Engage in online courses, webinars, or workshops to deepen your comprehension.

- Practice Regularly: Use paper trading platforms or demo accounts to test your strategies and refine your skills.

- Manage Risk: Exercise caution and never invest more than you are willing to lose.

By embracing Nifty strategies option trading with a well-informed approach, you can unlock the doors to potential gains and assert greater control over your investment journey. Remember, the key lies in diligent research, prudent execution, and a disciplined approach to risk management.

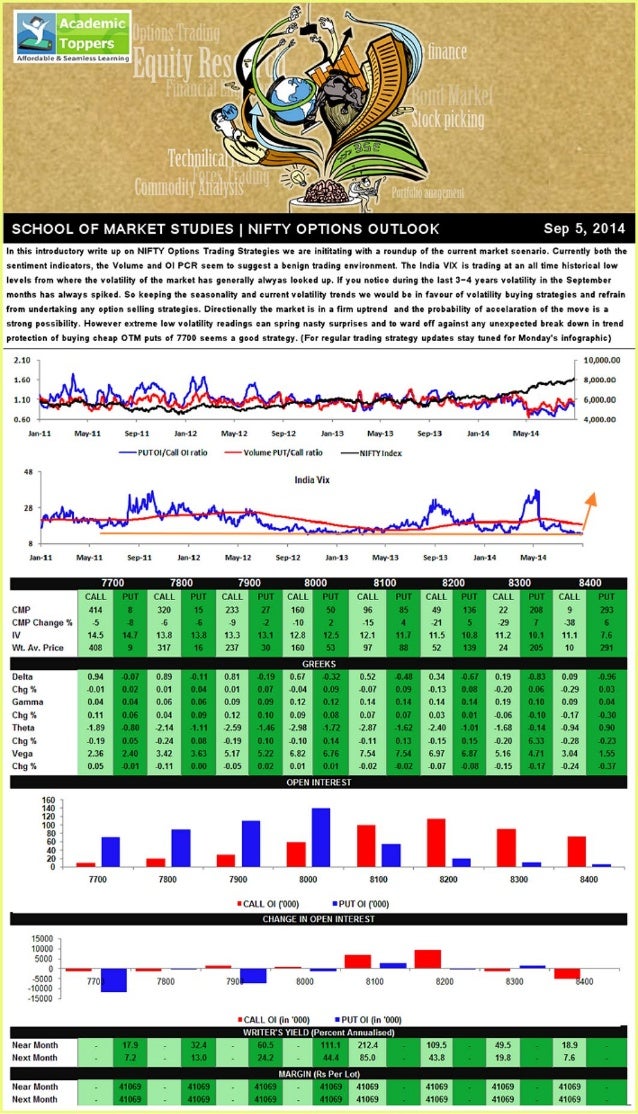

Image: www.slideshare.net

Nifty Strategies Option Trading