Imagine a financial realm where opportunities dance just out of reach, slipping through the cracks of conventional trading strategies. This realm is the enigmatic world of illiquid option trading, where the dance of supply and demand takes on a unique and challenging rhythm. If you’re an adventurous trader with a keen eye for hidden value, prepare to delve into the intricate depths of this fascinating market niche.

Image: www.tradingsim.com

Unveiling the Enigma of Illiquid Options

Illiquid options are financial instruments that represent the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Unlike their highly liquid counterparts, illiquid options trade less frequently, casting a veil of mystery over their true worth. Understanding this unique characteristic is paramount to unlocking the potential profits that lie within.

Navigating the Elusive: Strategies for Illiquid Option Trading

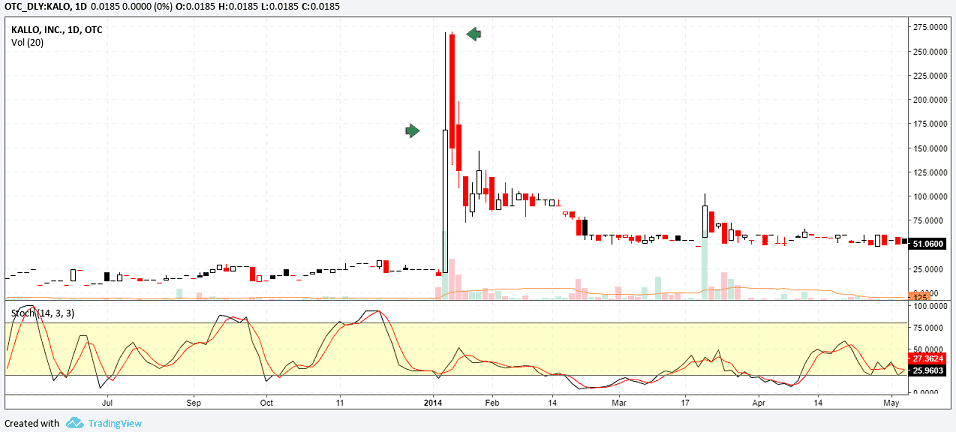

In the murky waters of illiquidity, conventional trading tactics falter, giving way to novel strategies. One such approach is to identify stocks with low trading volume and high implied volatility. This combination creates a fertile ground for potential option premiums that can be exploited.

Another strategy is to seek out options with wide bid-ask spreads. These represent gaps between the price at which buyers are willing to purchase and sellers are willing to offer, creating opportunities for adept traders to capitalize on the inefficiencies of the market.

Embracing the Paradox: Embracing the Paradox: Risks and Rewards of Illiquid Option Trading

While illiquid options hold the tantalizing promise of hidden profits, they also bear an inherent level of risk. The lack of liquidity means that it can be challenging to enter or exit positions quickly, exposing traders to potential price fluctuations.

Yet, amidst the risks, seasoned traders find solace in the rewards. The potential to uncover undervalued options and profit from market inefficiencies can be a potent lure for those willing to venture into the uncharted waters of illiquidity.

Image: vietnambiz.vn

Expert Insights: Unlocking the Secrets of Illiquid Option Trading

To illuminate the path forward, we sought guidance from renowned experts in the field. One such luminary, Dr. Mark Sebastian, cautions, “In illiquid option trading, patience is not just a virtue; it’s a necessity.” He emphasizes the importance of recognizing that the market’s pace may be slower than anticipated and advises traders to exercise patience when pursuing their goals.

Another esteemed expert, Ms. Kathy Lien, advises, “Understanding market sentiment and trading psychology is crucial in illiquid option trading.” She underscores the need to develop a deep understanding of how emotions and expectations can influence market movements, enabling traders to make informed decisions.

Illiquid Option Trading

Image: iqbrokers.co

The Call to Adventure: Embarking on Your Illiquid Option Trading Odyssey

Illiquid option trading is a captivating realm, where the promise of profit dances alongside the specter of risk. It is a domain reserved for audacious traders with a thirst for adventure and a keen eye for opportunity.

If the allure of uncovering hidden market inefficiencies resonates within you, equip yourself with the knowledge and strategies outlined in this article. Embark on your own illiquid option trading odyssey, where the thrill of the chase and the potential for triumph await those who dare to venture beyond the boundaries of conventional trading.