Imagine you’re a coffee lover who knows a local cafe is planning to expand. You’re confident their expansion will drive up the cafe’s value, but you don’t have the funds to invest directly.

Image: www.youtube.com

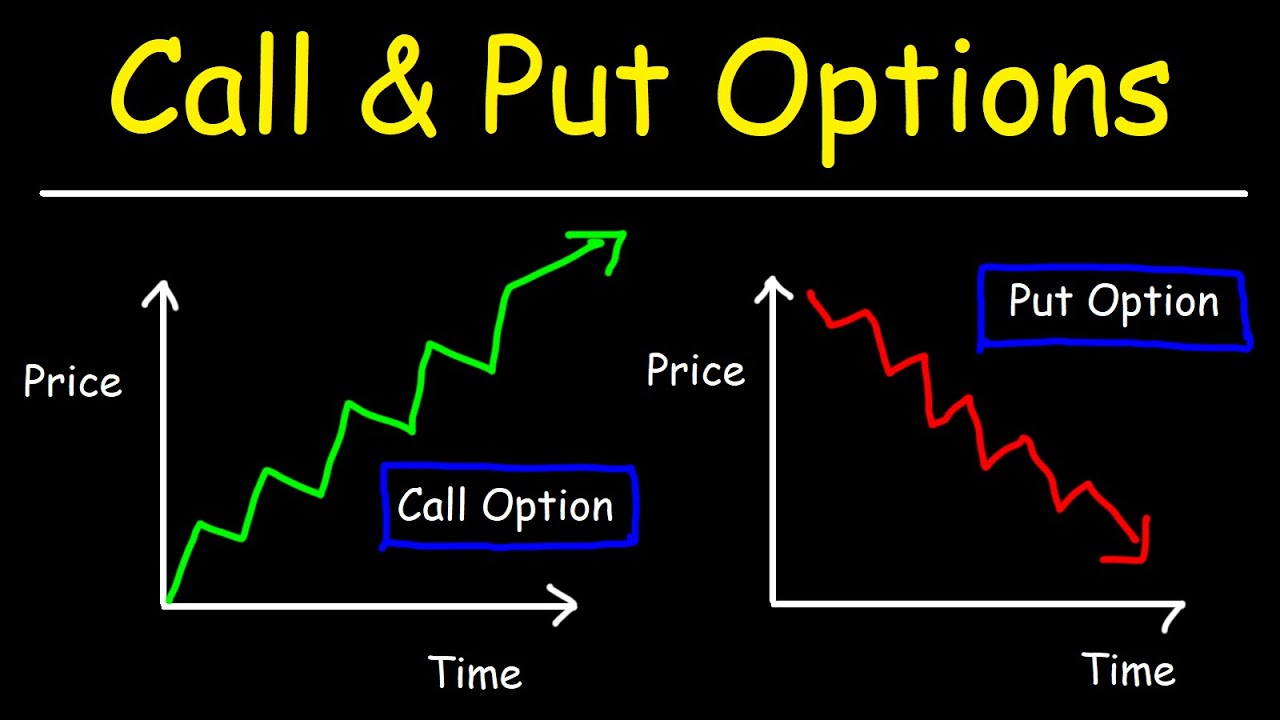

That’s where options trading comes in. An option is a contract that gives you the right, but not the obligation, to buy or sell an asset at a specific price on a specific date.

Understanding Call and Put Options

In our coffee cafe example, you could buy a call option, which gives you the right to buy the cafe’s stock at a certain price (the exercise price) by a certain date (the expiration date).

If the cafe’s stock price rises above the exercise price by the expiration date, you can exercise your option and buy the stock at the exercise price. You can then sell the stock at the higher market price for a profit.

Conversely, you could buy a put option, which grants you the right to sell the cafe’s stock at the exercise price by the expiration date. If the stock price falls below the exercise price, you can exercise your option and sell the stock at the exercise price, profiting from the price decline.

Tips for Success

Here are some tips for successful options trading:

- Choose liquid options: Higher-volume options offer greater liquidity and lower spreads (the difference between the bid and ask prices).

- Understand the risks: Options trading carries significant risks, and you could lose your entire investment. Carefully consider your financial situation and risk tolerance before trading.

- Use technical and fundamental analysis: Conduct thorough research on your chosen asset, considering both technical charts and news and market sentiment.

A Simple Option Trading Example

Let’s say you buy a call option on the cafe’s stock with an exercise price of $10 and an expiration date two months from now. The current market price of the stock is $9.

If the stock price rises to $12 by the expiration date, you can exercise your option and buy the stock at $10. You can then sell the stock for $12, yielding a profit of $2 per share.

Image: www.bank2home.com

FAQs

Q: What are the main benefits of options trading?

A: The potential for leverage, income generation, and hedging.

Q: When should I not trade options?

A: If you don’t understand the risks, have limited capital, or are in a volatile market.

Simple Options Trading Example

Image: messots.blogspot.com

Conclusion

Options trading can be a valuable tool for investors seeking leverage, income, or hedging. However, it’s crucial to approach options trading with a clear understanding of the risks involved. By following these tips and conducting thorough research, you can increase your chances of successful options trading.

Are you interested in learning more about options trading?