Image: options.cafe

In the realm of financial investments, options trading presents an intriguing blend of opportunities and intricacies. Masterfully navigating this terrain requires a deep understanding of a specialized lexicon, known as the Greek alphabet. Each Greek letter signifies a metric that gauges the sensitivity of an option contract to underlying factors. By deciphering these metrics, traders can make informed decisions, optimize risk management, and enhance their returns in the options market.

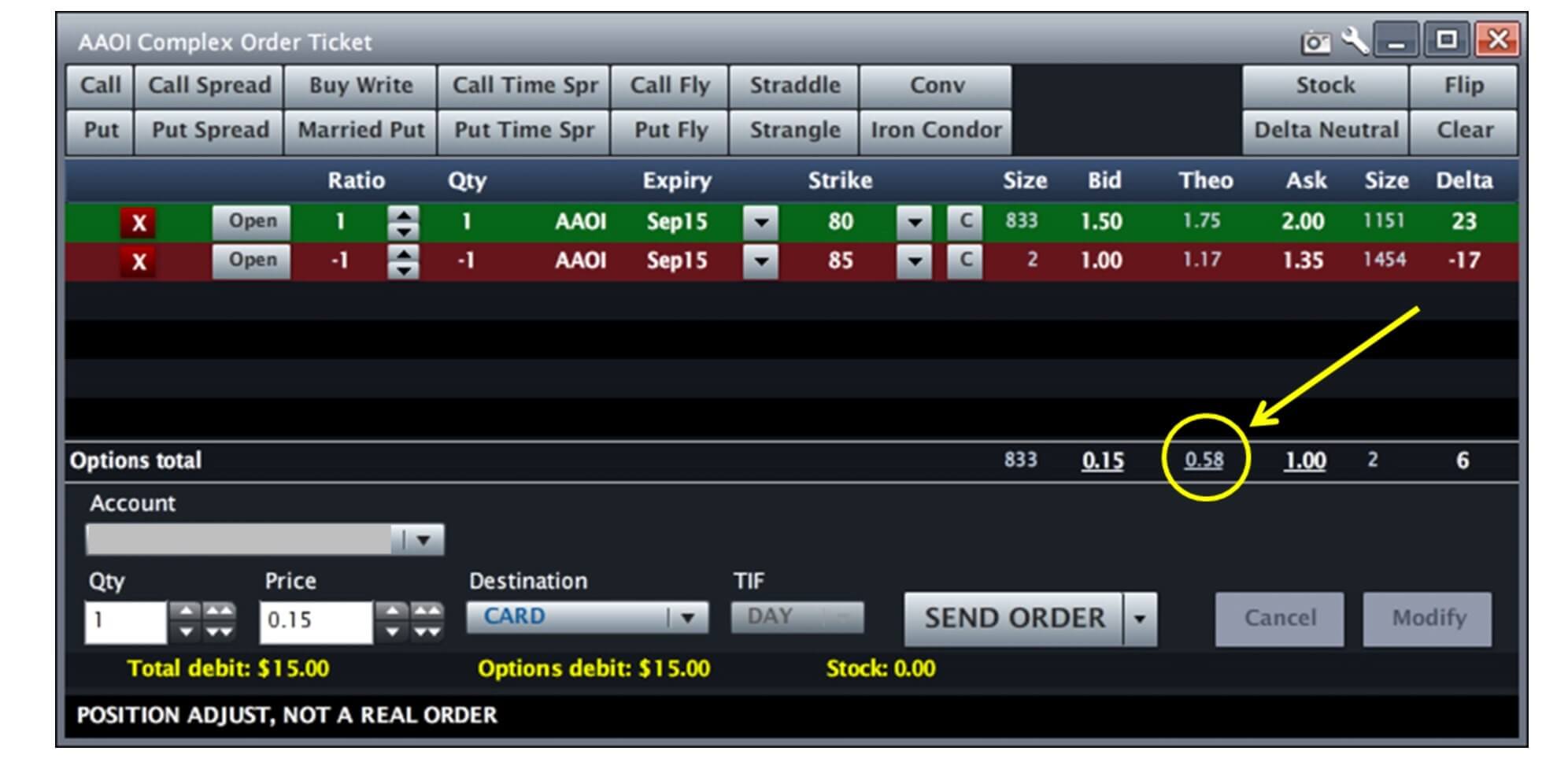

Delta: Measuring Price Sensitivity

The cornerstone of the Greek alphabet, Delta, quantifies the relationship between the underlying asset’s price and the option’s price. A positive Delta indicates that the option’s price will increase (decrease) as the underlying asset’s price rises (falls). For instance, a Delta of 0.5 suggests that for every $1 increase in the underlying asset’s price, the option’s price will jump by $0.50.

Gamma: Capturing Delta’s Sensitivity

Gamma, the second Greek letter, measures the rate of change in Delta. A positive Gamma signifies that Delta will grow as the underlying asset’s price fluctuates. This implies that options with higher Gamma offer traders increased leverage as the price moves in the anticipated direction. However, higher Gamma also amplifies potential losses if the price moves against the trader.

Theta: The Temporal Factor

Theta assesses the impact of time decay on an option’s price. As an option approaches its expiration date, its value diminishes, with the pace of decay determined by Theta. Options with longer expiration dates tend to have lower Theta, while those nearing their end harbor higher Theta. Understanding Theta helps traders optimize their entry and exit strategies.

Vega: Volatility’s Impact

Vega measures the sensitivity of an option’s price to changes in implied volatility. Volatility, a measure of the market’s perceived uncertainty about the future price path of an asset, can significantly influence option prices. Options with higher Vega are more susceptible to price fluctuations driven by volatility changes.

Additional Greeks: Refining Analysis

Beyond these core Greeks, several other metrics provide valuable insights for traders. Rho gauges an option’s price sensitivity to changes in interest rates, while Kappa measures the second-order response of Delta to changes in volatility. Understandings these metrics collectively empowers traders with a comprehensive understanding of option valuations.

Harnessing Greek Magic: Expert Insights

“The Greeks are not merely abstract concepts but invaluable tools in the hands of astute options traders,” asserts Dr. Mark Harrison, a renowned derivatives expert. “By deciphering these metrics, traders can precisely determine the impact of various factors on their options positions, enabling them to make informed adjustments and optimize their trading strategies.”

Actionable Tips for Trading Success

-

Analyze Delta: Determine the direction and magnitude of an option’s price movement based on the underlying asset’s price fluctuations.

-

Manage Gamma: Monitor and adjust your portfolio as Delta changes, mitigating potential risks while capitalizing on opportunities.

-

Consider Theta: Understand how time decay affects option prices, guiding your entry and exit points to maximize profitability.

-

Gauge Vega: Assess the impact of volatility on your option positions, adjusting your strategies accordingly to mitigate risks.

-

Consult Expert Guidance: Tap into the wisdom of experienced traders and financial professionals to refine your understanding and improve your decision-making.

By embracing the power of the Greek alphabet, options traders elevate their market acumen, unlocking the potential for substantial returns while managing risks with precision. May the Greeks guide your path to trading success!

Image: www.simplertrading.com

Trading Options Greek Pdf