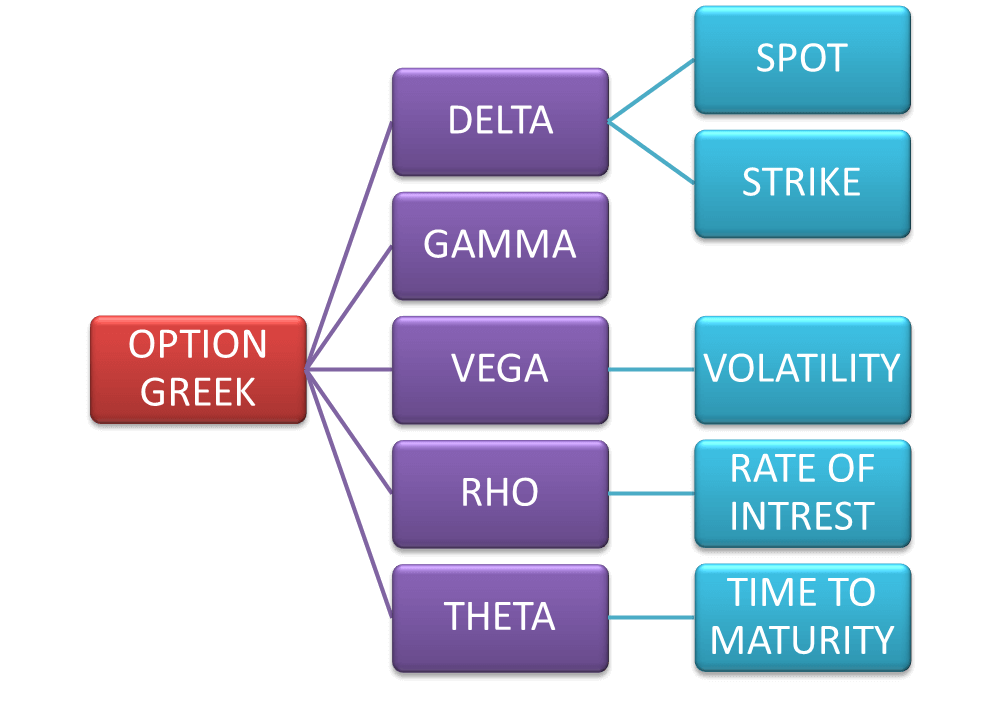

Getting to know Option Trading Greek Letters

The world of options trading can be a complex one, but there’s one set of tools that can help you navigate it with confidence: the Greek letters. These letters represent important values, also known as metrics, that quantify the risk and potential profit of an option contract. By understanding these Greek letters, you’ll be better equipped to make informed decisions and maximize your trading strategies.

Image: tradingfuel.com

The Greek Alphabet of Option Trading

Let’s start with a brief introduction to the most important Greek letters used in option trading:

- Delta (Δ): Measures the sensitivity of an option’s price to changes in the underlying asset’s price.

- Gamma (Γ): Quantifies how Delta changes in relation to changes in the underlying asset’s price.

- Theta (Θ): Represents the rate of decay in an option’s value as time passes.

- Vega (ν): Measures the sensitivity of an option’s price to changes in implied volatility.

- Rho (ρ): Indicates how an option’s price changes in relation to changes in the risk-free interest rate.

Unleashing the Power of Greek Letters

Now that you have a basic understanding of the Greek letters, let’s delve into how they can impact your option trading strategies:

Delta is a crucial element for understanding the risk and potential profit of an option contract. A positive Delta indicates that the option’s price will move in the same direction as the underlying asset’s price. Gamma, on the other hand, measures how Delta changes in relation to price changes. A higher Gamma means that Delta will become larger as the underlying asset’s price moves.

Theta is particularly important for traders who hold options for an extended period. It represents the rate at which an option’s value decays over time. Options lose value as they approach their expiration date, and Theta quantifies this decay. Conversely, Vega measures the sensitivity of an option’s price to changes in implied volatility. Higher implied volatility can lead to increased option prices, while lower implied volatility can result in decreased option prices.

Rho is a less commonly used Greek letter, but it can be significant in certain market conditions. It indicates how an option’s price changes in relation to changes in the risk-free interest rate. When interest rates rise, the value of call options tends to increase, while the value of put options generally decreases.

Tips and Expert Advice: Embracing the Greek Letters

Leveraging the Greek letters effectively in your option trading strategies requires a deep understanding of these metrics. Here are a few tips and pieces of expert advice to help you master their application:

- Embrace the Power of Delta: Consider Delta as a gauge of an option’s responsiveness to underlying price movements. Use this knowledge to identify options with the desired sensitivity to price changes.

- Timing is Key: Time decay, as measured by Theta, can significantly impact your trading results. Understand how Theta affects specific options and time your trades accordingly.

Image: www.binaryoptions.co.uk

FAQ: Demystifying the Option Trading Alphabet

Q: What is the significance of Gamma in option trading?

A: Gamma measures how Delta changes in response to underlying asset price changes. A high Gamma indicates that Delta will become more pronounced as the underlying asset’s price fluctuates.

Q: How can Vega impact my option trades?

A: Vega quantifies the sensitivity of an option’s price to changes in implied volatility. It is crucial for traders who trade options in volatile markets or when volatility is expected to change significantly.

Option Trading Greek Letter

Image: in.pinterest.com

Conclusion: Mastering the Greek Lexicon

The Greek letters are indispensable tools for navigating the complexities of option trading. By mastering the Greek lexicon, you’ll gain a deeper understanding of option contract behavior, empowering you to make informed decisions and enhance your trading strategies. So, embrace the Greek letters and unlock the full potential of your option trading journey.

Are you ready to elevate your option trading game with the power of Greek letters? Dive into this comprehensive guide today!