In the enigmatic realm of financial markets, traders navigate a labyrinthine world of options and their intricate Greek letters. Understanding the language of the Greeks is akin to unlocking a treasure trove of insights, enabling traders to make informed decisions and navigate market turbulence with precision.

Image: www.myespresso.com

The Alpha and Omega of Option Greeks

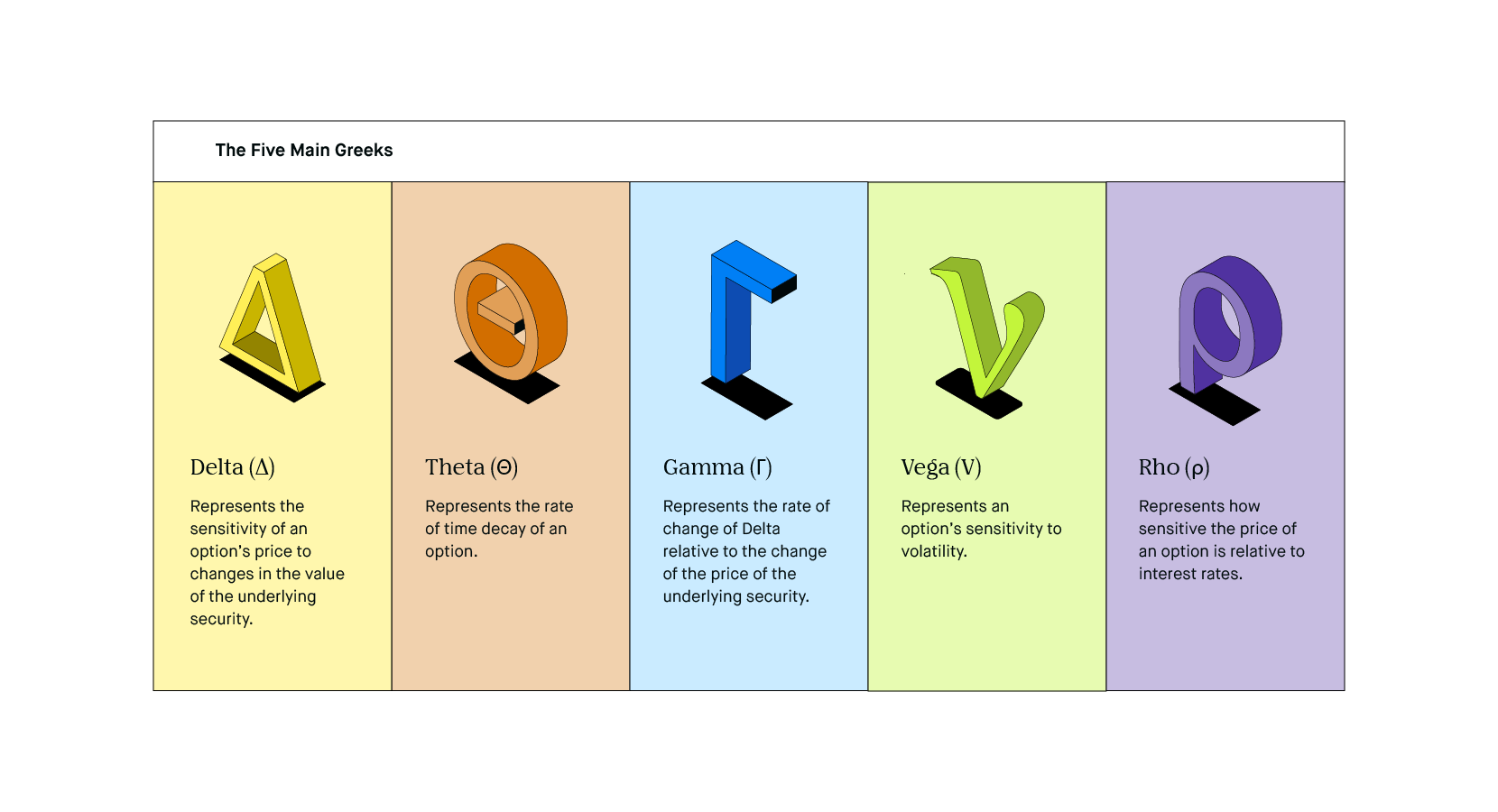

Greek letters are not mere symbols; they represent mathematical parameters that quantify the inherent risk and potential rewards of options. They measure various aspects of an option’s behavior, including its sensitivity to changes in variables such as the underlying asset price, volatility, and time.

The most commonly encountered Greeks are Delta, Gamma, Vega, and Theta. Each Greek represents a specific type of market risk, and understanding their interplay can empower traders to make intelligent hedging decisions.

Delta: The Robust Indicator of Price Sensitivity

Delta measures the rate at which an option’s value changes in relation to the underlying asset price. It indicates the number of shares or units of the underlying that would be delivered or received upon its exercise. A Delta of 0.5, for instance, suggests that for every $1 change in the underlying asset’s price, the option’s value will change by $0.5.

Gamma: The Quickening Force of Price Acceleration

Gamma reflects the sensitivity of Delta to changes in the underlying asset price. It measures the rate at which Delta itself changes as the underlying asset’s price fluctuates. A high Gamma indicates that Delta is prone to rapid shifts, signaling that the option’s value is highly responsive to price movements.

Vega: The Enigma of Volatility’s Sway

Vega captures the relationship between an option’s value and the implied volatility of the underlying asset. It measures the change in the option’s value for a given change in implied volatility. A high Vega suggests that the option is highly vulnerable to volatility swings, making it both a potential boon and a potential bane.

Theta: The Ticking Time Bomb of Option Decay

Theta represents the relentless decay in an option’s value as time passes. It measures the dollar value lost by an option for each passing day. Theta is particularly important for short-term options, as it can erode their value significantly over time.

Expert Insights: Harnessing the Power of the Greeks

Sarah Jones, renowned option trading expert, underscores the importance of incorporating the Greeks into one’s trading strategy. “By understanding the Greeks, you gain the ability to forecast how your options will behave under various market conditions,” she explains. “This knowledge empowers you to mitigate risk and capitalize on opportunities more effectively.”

Actionable Tips for Navigating the Greek Labyrinth

-

Learn the Greek Alphabet: Familiarize yourself with the basics of the Greek letters and their specific functions.

-

Understand Greek Relationships: Study the interdependencies and correlations among the Greeks to gain a holistic view of option dynamics.

-

Use Greek Calculators: Leverage online tools and calculators to effortlessly calculate Greek values for specific options.

-

Apply Greeks to Real-World Strategies: Integrate your knowledge of the Greeks into your trading plans to manage risk, optimize returns, and outsmart the market.

In conclusion, reading the Greeks is a skill that every aspiring option trader must master. By deciphering the language of the Greeks, traders unlock a world of opportunities and gain the competitive edge they need to navigate the turbulent waters of financial markets. Embrace the Greeks, and harness their power to unlock the hidden treasures of option trading success.

Image: blog.lyra.finance

How To Read The Greeks Option Trading

Image: www.vrogue.co