In the ever-evolving world of financial markets, the advent of extended hours trading options has revolutionized the trading landscape. Extended hours trading, also known as “pre-market” or “after-hours” trading, empowers traders with the ability to execute trades beyond the confines of regular market hours. This extended access unlocks a realm of opportunities and strategic advantages that were once unavailable.

Image: www.daytradetheworld.com

What is Extended Hours Trading?

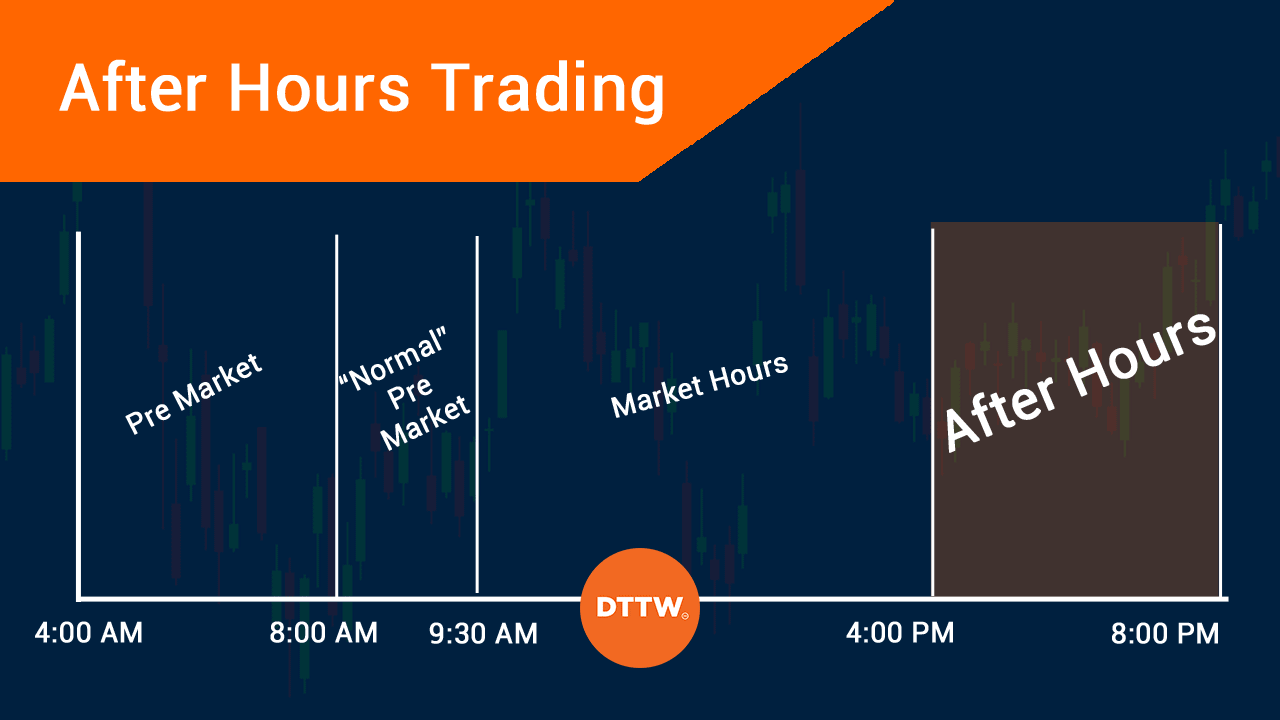

Extended hours trading is a facility offered by certain trading platforms that allows traders to place orders before the official market open and after the market close. This extended window of trading typically spans from 4:00 AM to 9:30 AM Eastern Time (ET) for pre-market trading and from 4:00 PM to 8:00 PM ET for after-hours trading. It is important to note that not all stocks are available for extended hours trading, and the options available may vary depending on the platform used.

Benefits of Extended Hours Trading

The allure of extended hours trading lies in its multifaceted benefits for traders:

- Increased Liquidity: Extended hours trading offers increased liquidity, especially for highly traded stocks with large capitalization. This enhanced liquidity allows for more seamless order execution, reducing the risk of substantial price slippage during market open or close.

- Earlier Market Access: Pre-market trading provides an opportunity to place trades ahead of the market’s official open. This early access enables traders to capitalize on news and events that occur outside of regular trading hours.

- Extended Flexibility: After-hours trading extends the trading day for those with busy schedules or time zone constraints. It allows traders to adjust positions or enter new trades after the market close, without having to wait until the following morning.

- Trading Volatility: Extended hours trading is characterized by increased volatility, due to lower trading volumes and wider bid-ask spreads. This volatility presents both opportunities and risks, providing potential for substantial gains but also increased market uncertainty.

- News and Events: Extended hours trading allows traders to respond swiftly to news announcements and economic data releases that occur outside of regular trading hours. This prompt response can lead to informed trading decisions and potentially profitable outcomes.

Risks of Extended Hours Trading

While extended hours trading offers numerous benefits, it is crucial to acknowledge its inherent risks:

- Liquidity Concerns: Liquidity can be lower during extended hours trading compared to regular market hours, especially for less actively traded stocks. This reduced liquidity may impact order execution and potentially lead to larger price swings.

- Wide Spreads: Bid-ask spreads tend to be wider during extended hours trading, increasing transaction costs for traders. This can affect profitability, particularly for smaller trades.

- Volatility: Extended hours trading is marked by increased volatility, which can lead to significant price fluctuations. Traders should exercise caution and carefully manage their risk exposure in this environment.

- Limited Market Data: Market data, such as news and analyst reports, may be more limited during extended hours trading. This can make it challenging for traders to fully assess market conditions and make informed decisions.

Image: www.quora.com

Strategies for Extended Hours Trading

To navigate the unique challenges and opportunities of extended hours trading, traders should adopt appropriate strategies:

- Choose Liquid Stocks: Prioritize trading stocks with high trading volumes and wide bid-ask spreads during extended hours to ensure liquidity.

- Manage Risk: Implement effective risk management strategies, such as stop-loss orders, to mitigate losses in the face of increased volatility.

- Beware of False Breakouts: False breakouts are more common in extended hours trading due to lower liquidity. Be cautious when executing trades based on breakouts, as they may not be sustained during regular market hours.

- Use Limit Orders: Limit orders can help traders control their execution price and prevent unfavorable fills during extended hours trading.

Extended Hours Trading Options

Image: www.eoption.com

Conclusion

Extended hours trading options offer a multifaceted opportunity for traders to expand their trading strategies and enhance their trading experience. By understanding the benefits and risks associated with this extended trading window, traders can leverage the increased liquidity, flexibility, and responsiveness that it offers. However, it is crucial to exercise caution, implement appropriate risk management strategies, and adopt suitable trading strategies to maximize the potential of extended hours trading while mitigating potential risks.