In the enigmatic world of options trading, Theta reigns supreme as the enigmatic force that wields the power of time over the value of these captivating financial instruments. Theta represents the inexorable decline in the value of an option as the inexorable march of time draws near its expiration date. This intriguing concept serves as a double-edged sword, posing both opportunities and risks for traders who dare to venture into its enigmatic realm.

Image: www.pinterest.com

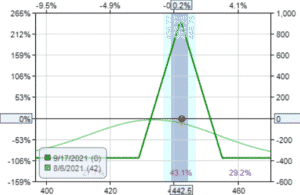

Theta plays a crucial role in options trading due to its impact on the extrinsic value of options. Extrinsic value constitutes the difference between an option’s current market price and its intrinsic value, the latter of which is determined by the difference between the underlying asset’s price and the option’s strike price. As time dwindles away, extrinsic value gradually erodes, causing the option’s overall value to diminish.

Understanding Theta’s Influence

To grasp the nuances of Theta’s influence, it’s essential to delve into its intricate workings. Theta exerts a more pronounced effect on out-of-the-money (OTM) options, which refer to options whose strike price is significantly above or below the underlying asset’s current price. These options possess a larger extrinsic value component, rendering them more susceptible to the relentless passage of time. Conversely, in-the-money (ITM) options, whose strike price is closer to the underlying asset’s price, experience a less dramatic decline in extrinsic value as time progresses.

Theta’s impact also varies based on the option’s time to expiration. Options with shorter timeframes exhibit a more rapid rate of decay compared to those with longer time horizons. This increased rate of decay stems from the dwindling value of the remaining time premium inherent in short-term options.

Exploring Theta’s Implications

Theta’s pervasive influence manifests itself through its implications for option traders. For options sellers, Theta offers a potential edge. Writing OTM options with shorter durations allows traders to harness the power of time decay to their advantage. As the option’s extrinsic value dwindles, the trader’s profit potential increases, provided the underlying asset’s price remains relatively stable.

On the other hand, options buyers must contend with the unrelenting force of Theta. Purchasing OTM options with short timeframes exposes traders to the risk of accelerated extrinsic value erosion. This decay can swiftly erode the potential value of the option, potentially resulting in significant losses. Understanding Theta’s implications and the associated risks is critical for options buyers.

Theta’s Role in Options Strategies

Theta’s multifaceted nature makes it an indispensable element in various options strategies. Seasoned traders often employ strategies that exploit the predictable behavior of Theta to enhance their trading outcomes. One prevalent strategy involves pairing the sale of OTM short-term options with the simultaneous purchase of longer-term options. This approach capitalizes on Theta’s influence, as the short-term option’s value swiftly erodes while the long-term option’s value remains relatively stable.

Theta also influences the profitability of certain option trades over extended periods. Theta decay exerts a negative impact on the potential returns of long-term options trading strategies, such as buy-and-hold or covered calls. Alternatively, short-term options trading strategies, such as scalping or day trading, may benefit from Theta’s rapid decay, allowing for potentially higher returns within shorter timeframes.

Image: optionstradingiq.com

Theta Options Trading

Conclusion

In the intricate realm of options trading, Theta emerges as a pivotal force that shapes the destiny of these financial instruments. By comprehending the profound influence of Theta on option value and its implications for trading strategies, traders can unlock the doors to informed decision-making. Embracing Theta’s power and employing it judiciously can empower traders to navigate the ever-changing landscape of options markets and pursue their financial goals with greater precision and confidence.