Imagine yourself as an options trader, navigating the ever-shifting landscape of the market. With each passing moment, you grapple with a multitude of forces that influence the value of your investments. Amidst this whirlwind of volatility, one elusive yet potent force deserves your attention: theta decay.

Image: redot.com

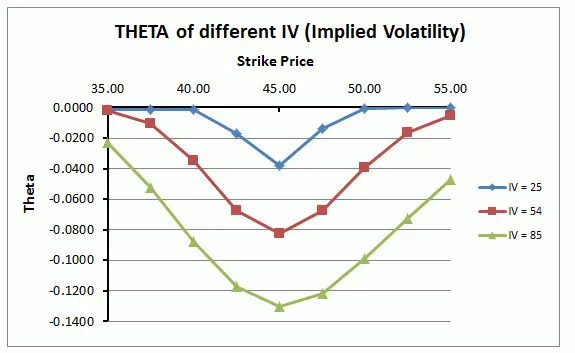

Theta, often overlooked or underestimated, represents the inexorable decline in the value of an option as time elapses. Unlike delta, which measures the sensitivity of an option’s price to changes in underlying security, theta captures the impact of time on its value.

Time’s Relentless March: The Essence of Theta Decay

Every option has a lifespan, an expiration date beyond which it becomes worthless. As the clock ticks down towards this fateful moment, the value of the option steadily diminishes. This is theta decay in action.

The rate of theta decay accelerates as the option approaches expiration. This is because the probability of the option profiting diminishes with each passing day. As the option becomes increasingly unlikely to be exercised profitably, its value correspondingly dwindles.

Time as a Sword and a Shield: The Impact of Time on Call and Put Options

Theta decay affects call and put options differently. Call options, which give the holder the right but not the obligation to buy an underlying security at a specified price, lose value faster than put options. This is because the passage of time reduces the probability that the underlying security will rise above the strike price, making the call option less valuable.

Conversely, put options, which give the holder the right but not the obligation to sell an underlying security at a specified price, typically experience slower theta decay. This is because the passage of time increases the probability that the underlying security will fall below the strike price, making the put option more valuable.

Navigating the Tides of Theta Decay: Strategies for Option Traders

Understanding theta decay is crucial for option traders who seek to maximize their returns and minimize their losses. Several strategies can help you mitigate the effects of theta decay:

- Choose options with longer expirations: Longer-dated options experience less theta decay than shorter-dated options, giving you more time to profit from potential price movements in the underlying security.

- Trade in-the-money options: In-the-money options have intrinsic value, even if the underlying security’s price does not move significantly. This can help offset some of the theta decay you would otherwise experience.

- Use option strategies that limit theta decay: Certain option strategies, such as covered calls and protective puts, can reduce your exposure to theta decay by creating a balanced portfolio.

By incorporating these strategies into your trading plan, you can minimize the impact of theta decay and enhance your chances of profitability in the options market.

Image: www.ouestny.com

Expert Insights on Tackling Theta Decay

Seek counsel from experienced option traders and industry experts to glean invaluable insights on managing theta decay effectively:

“Theta decay is a double-edged sword. It can both erode your profits and create opportunities for astute traders. Understanding theta decay is essential for success in options trading.”

“Don’t underestimate the power of theta decay, especially in short-dated options. Choose longer-term options and consider strategies that help mitigate its effects.”

FAQs on Theta in Options Trading

- What is theta decay?

Theta decay is the decline in an option’s value as time passes.

- How does theta decay affect call and put options?

Theta decay typically affects call options more quickly than put options.

- How can I minimize theta decay?

You can minimize theta decay by choosing longer-dated options, trading in-the-money options, and using option strategies that limit theta decay.

- Is theta decay a threat or an opportunity in options trading?

Theta decay can be both a threat and an opportunity. It can erode profits, but it can also create opportunities for traders who understand how to manage it.

What Does Theta Mean In Options Trading

Image: blog.stratzy.in

Conclusion

Theta, the often-elusive force in options trading, plays a crucial role in determining an option’s value. By understanding the nature and impact of theta decay, you can become a more informed and successful options trader. Remember, the clock is always ticking, and theta decay is a force that you must be prepared to manage.

Are you interested in learning more about theta decay and its effects on options trading? Join the discussion in our forums and social media communities, where you can connect with other traders, ask questions, and share your insights.