Picture yourself as a new investor embarking on the exciting journey of options trading. With dreams of conquering the financial markets, you cautiously navigate the labyrinth of options, their complexities, and their potential rewards. Little do you know that a subtle yet formidable force lurks in the shadows, silently chipping away at your portfolio’s value: theta decay.

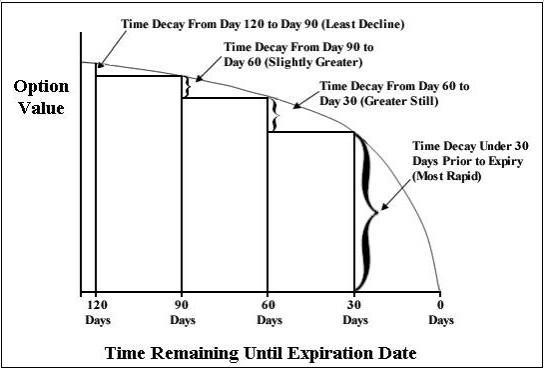

Image: thediversifiedtrader.com

Defining Theta Decay: The Bane of Time

Theta decay, simply put, is the relentless erosion of an option’s value as time passes. It is an intrinsic property of all options contracts, mirroring the inexorable march of time. As the expiration date of an option approaches, its time value, which constitutes a significant portion of its premium, dwindles away like a fragile ice sculpture in the summer sun.

This decay is particularly pronounced in short-term options, those with expiration dates less than a month away. For every day that passes, these options lose a portion of their value, making them more susceptible to the perils of theta decay.

Implications of Theta Decay for Options Traders

Theta decay poses a formidable challenge for options traders, especially those employing strategies that rely heavily on time premium. Options buyers, who purchase the right but not the obligation to buy or sell an underlying asset at a specified price, bear the brunt of theta decay.

As time ticks away, the value of the options they hold diminishes, chipping away at their potential profits. Time becomes their adversary, threatening to turn their hopes into losses.

Understanding the Impact of Theta Decay

Comprehending the dynamics of theta decay is crucial for all options traders. It is a factor that must be carefully considered when crafting trading strategies. Long-term options, with their longer time horizons, experience less theta decay compared to their short-term counterparts. This makes them a more suitable choice for strategies that aim to profit from long-term market trends.

Conversely, short-term options are more vulnerable to theta decay. Traders who employ short-term options, such as day traders or scalpers, must factor in the rapid erosion of value and adjust their strategies accordingly.

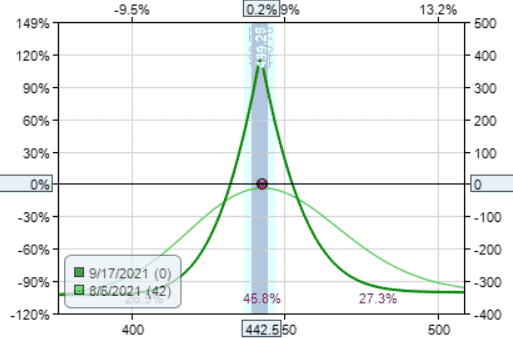

Image: optionstradingiq.com

Strategies to Mitigate Theta Decay

While theta decay is an unavoidable force in the world of options trading, there are strategies that traders can employ to mitigate its impact:

-

Sell options instead of buying them: Options sellers collect premiums from options buyers, effectively pocketing theta decay rather than suffering its consequences.

-

Choose options with longer expirations: Long-term options experience less theta decay, providing more leeway for traders to navigate market fluctuations.

-

Trade options with higher volatility: Options with higher volatility exhibit slower theta decay rates. This is because volatility is a measure of an underlying asset’s price movement, and higher volatility implies greater potential for the option to gain value.

-

Monitor theta decay closely: Traders should monitor theta decay rates for their options positions regularly. By tracking the time value erosion, they can make informed decisions about when to adjust or close their positions to minimize losses.

Option Trading 1 Theta Decay

Image: niftyoptiontrading.blogspot.com

Conclusion: Embracing the Dance with Theta

Theta decay is an ever-present reality in the world of options trading, a silent force that demands respect and careful consideration. By understanding theta decay’s dynamics, traders can develop sophisticated strategies that mitigate its impact and harness its potential to their advantage. It is in the delicate dance with theta decay that true options traders emerge, adept at navigating the ebbs and flows of time’s relentless passage.