In the dynamic world of financial markets, options trading offers a myriad of opportunities for investors seeking to maximize returns. Among the various options strategies, “all-or-none” options stand out as a unique and impactful approach that can significantly enhance portfolio performance. This comprehensive guide will delve into the intricate details of all-or-none options, exploring their mechanics, benefits, and potential risks to empower traders with the knowledge needed to make informed trading decisions.

Image: www.interactivebrokers.com

Unveiling All-or-None Options: A Strategic Gambit

All-or-none options, often referred to as “AON” options, are a specific type of option contract that carries a unique characteristic: the underlying shares are either delivered in full upon expiration (if the option is exercised) or not delivered at all. This “all-or-nothing” nature sets AONs apart from traditional options, where the underlying shares can be delivered partially. AONs essentially represent an “all-in” proposition, requiring investors to accurately predict the future performance of the underlying asset to maximize their returns.

The absence of partial share delivery in AONs makes them an ideal tool for investors seeking to leverage large price movements in the underlying asset. If exercised, AONs can yield substantial profits when coupled with favorable market conditions. However, this same characteristic also amplifies the potential losses, as investors either capture significant gains or lose their entire investment. AONs, therefore, demand meticulous analysis and a comprehensive understanding of market volatility to navigate their risk-reward dynamics effectively.

Crafting an All-or-None Strategy: A Calculated Approach

To successfully incorporate all-or-none options into a trading strategy, investors must possess a methodical approach that incorporates both fundamental and technical analysis. Fundamental analysis involves a comprehensive evaluation of the underlying company, its industry, and key economic indicators to determine its intrinsic value. Technical analysis, on the other hand, focuses on historical price patterns and market trends to identify potential entry and exit points for trades.

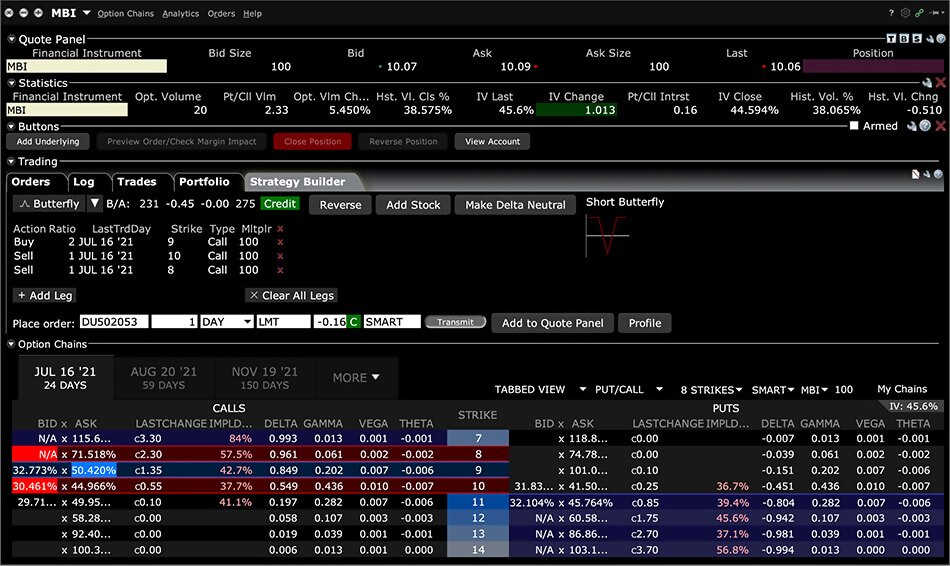

When constructing an AON strategy, identifying the appropriate strike price is paramount. The strike price represents the price at which the underlying shares can be bought (in the case of call options) or sold (in the case of put options) upon exercise. Selecting a strike price that aligns with the predicted future direction of the underlying asset is crucial. Implied volatility also plays a significant role in AON trading, as it influences the premium paid for the option.

Benefits and Considerations: Unlocking the Potential and Managing the Risks

All-or-none options offer several advantages to investors willing to embrace their unique characteristics. Their ability to magnify profits when the underlying asset experiences large price swings can lead to substantial gains. Additionally, AONs often trade at a lower premium compared to traditional options, making them a cost-effective choice for investors with limited capital.

However, the inherent risk associated with AONs cannot be overlooked. The potential for total loss looms over every AON trade, making it imperative to have a deep understanding of the risks involved. Proper risk management strategies should be implemented, such as setting appropriate position sizes and employing protective strategies, to mitigate potential losses and preserve capital.

Image: ofertalaboral.uct.cl

Practical Applications: Harnessing the Power of AONs

All-or-none options can be strategically utilized in various market scenarios to enhance portfolio performance. One common approach involves using AONs as a speculative play on anticipated large price movements. Investors can employ call AONs to capitalize on bullish market sentiment, expecting the underlying asset to appreciate significantly. Conversely, put AONs can be employed in bearish markets, seeking to profit from declines in the underlying asset’s price.

Another practical application of AONs lies in hedging strategies. Investors holding a long position in the underlying asset can purchase a protective put AON to limit potential losses if the asset price falls below a predetermined level. Similarly, investors with a short position in the underlying asset can use a protective call AON to minimize losses if the asset price rises beyond a certain point.

Options Trading All Or None

Image: www.pinterest.com

Conclusion: Mastering the Art of All-or-None Options

In the realm of options trading, all-or-none options offer a unique and potentially rewarding proposition to investors seeking to amplify returns. By understanding the mechanics, benefits, and risks associated with AONs, traders can effectively incorporate them into their trading strategies. However, it is imperative to remember that AONs are not suited for every market condition or risk tolerance. Traders must exercise caution and possess a comprehensive understanding of the markets before venturing into AON trading. With proper planning, analysis, and risk management, all-or-none options can become a valuable tool in an investor’s arsenal, unlocking the potential for significant gains while navigating the complexities of financial markets.