In the realm of financial markets, two titans emerge, each promising a gateway to wealth and prosperity: stock options and forex trading. While both share the allure of high-stakes gameplay, their nature and complexities are worlds apart—a fact that prudent investors cannot afford to overlook. Let us embark on a captivating journey to uncover the hidden depths of these financial juggernauts, weighing their risks and rewards, and equipping you with the wisdom to make informed decisions.

Image: gbxmarkets.com

Stock Options: Empowering Investors with Predictive Prowess

Stock options, derivatives that grant the right to buy or sell an underlying stock at a predetermined price within a specific timeframe, bestow upon investors a unique blend of opportunity and risk. They offer a tantalizing chance to capitalize on anticipated stock market fluctuations, empowering traders to make highly leveraged bets on the direction of future prices. By purchasing a call option, investors wager on a stock’s rise, while a put option provides a hedge against its potential decline.

Forex Trading: Navigating the Fluid Tides of Currency Markets

In stark contrast to stock options, forex trading delves into the dynamic realm of currency exchange. This global marketplace, where currencies ebb and flow around the clock, presents traders with myriad opportunities to profit from minute price fluctuations. The allure of forex trading lies in its liquidity, accessibility, and potential for high returns, making it a magnet for both experienced traders and those seeking a quick buck. However, the risks inherent in this fast-paced arena are equally undeniable.

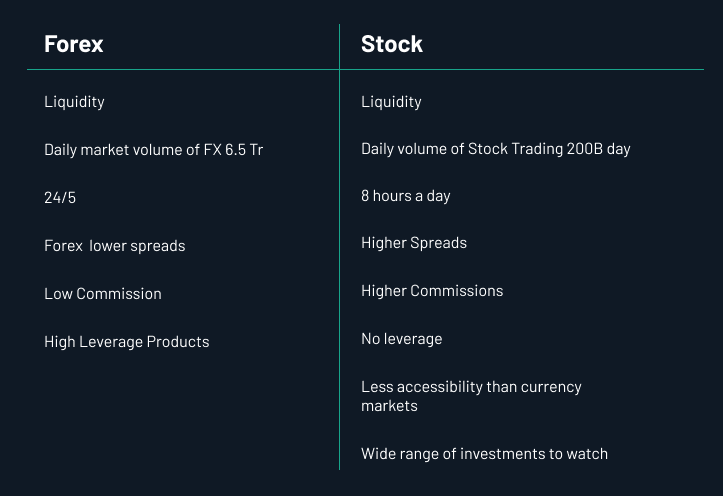

Decoding the DNA of Stock Options vs. Forex Trading

To discerning investors, the crux of the debate between stock options and forex trading boils down to their intrinsic nature. Stock options are fundamentally equity-based, drawing their value from the performance of a specific company’s stock. Forex trading, on the other hand, operates in the realm of currencies, where geopolitical events, economic indicators, and global market sentiment reign supreme.

Image: businessfirstfamily.com

Stock Options: A Calculated Gambit

Opting for stock options is akin to placing a strategic bet on a company’s trajectory. Astute investors meticulously analyze financial statements, industry trends, and management strategies to gauge a stock’s potential for growth or decline. While stock options offer the enticing possibility of substantial profits, they are not without perils—incorrectly predicting market movements can result in substantial losses.

Forex Trading: A Dance with the World’s Markets

Forex trading, by comparison, resembles a dance with the world’s interwoven economies. Traders navigate a complex landscape of currency pairs, each influenced by a myriad of factors such as interest rate differentials, political stability, and global economic events. Success in forex trading requires a deep understanding of macroeconomic dynamics and an uncanny ability to anticipate market shifts.

Choosing Your Path: Embracing Informed Decisions

The choice between stock options and forex trading is not a simple one. Both present unique opportunities, but each demands a distinct set of skills and risk tolerance. Stock options empower investors to leverage their insights into company-specific performance, while forex trading offers adventurous traders the chance to profit from global economic dynamics.

Stock Options: A Balanced Approach

Seasoned investors often incorporate stock options into their portfolio as a prudent means of augmenting potential returns or hedging risks. Careful analysis, coupled with measured trading, can mitigate downside potential and enhance overall investment outcomes.

Forex Trading: Embracing the High-Stakes Arena

Forex trading beckons to those with a robust understanding of global markets and a honed ability to navigate currency fluctuations. While it holds the promise of hefty profits, it also carries the risk of significant losses if not approached with due diligence and risk management strategies.

Stock Options Vs Forex Trading

Conclusion: Financial Empowerment through Informed Choice

In the kaleidoscope of financial markets, stock options and forex trading stand as two compelling paths to financial empowerment. However, the path you choose must align with your investment goals, risk tolerance, and market acumen. By meticulously dissecting the intricacies of each, you can make an informed decision that sets you on the path to financial success. Remember, prudence and continuous education are your unwavering allies in the pursuit of market triumphs.