Stepping into the fast-paced world of options trading, the Eurostoxx options trading calendar emerges as an indispensable tool for navigating the intricate landscape of this dynamic market. By delving into the intricacies of this calendar and understanding its underlying principles, traders can empower themselves with the knowledge and foresight to make informed decisions.

Image: maureqmalanie.pages.dev

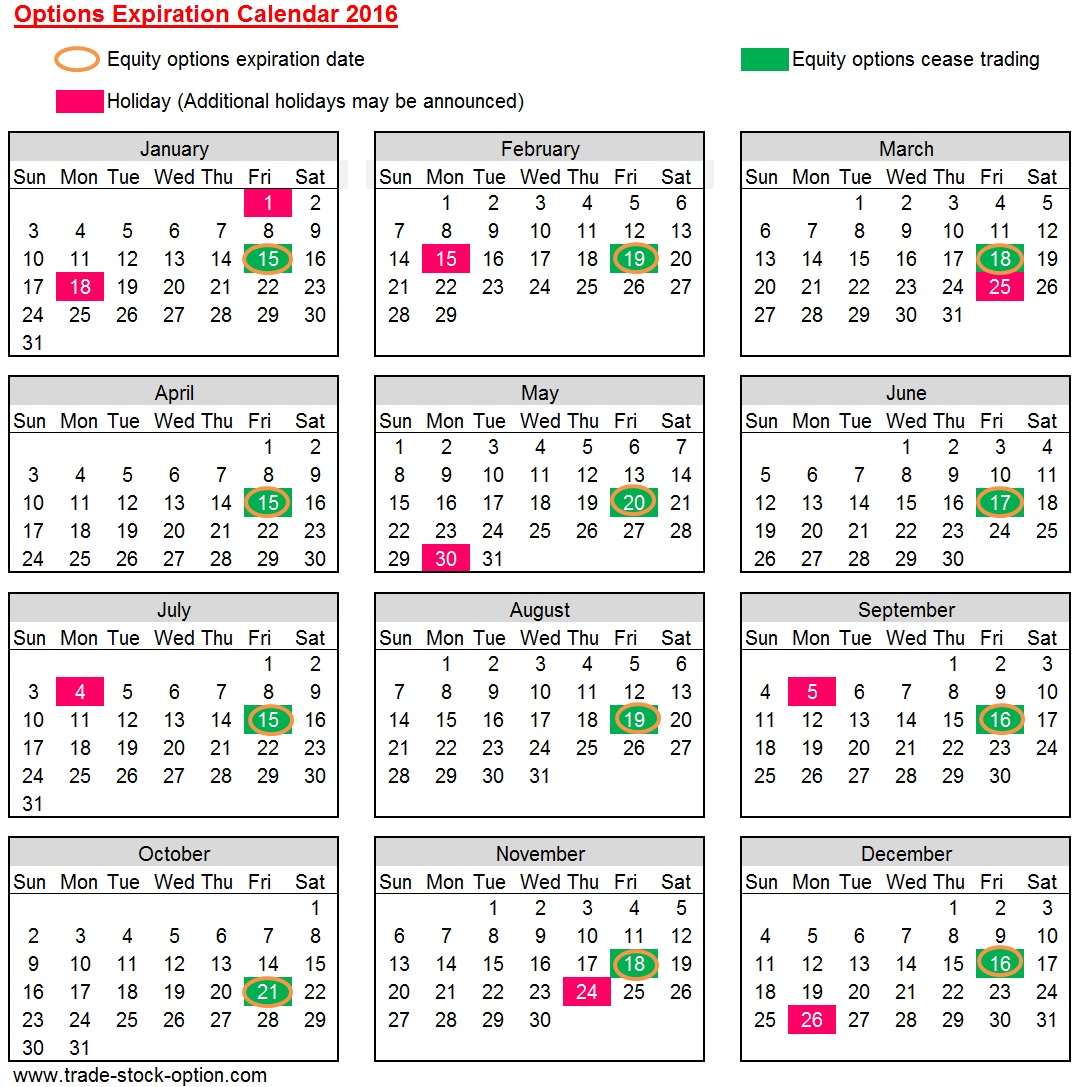

The Eurostoxx options trading calendar provides a meticulously organized schedule outlining the expiration dates for Eurostoxx options contracts. These contracts offer traders the flexibility to trade on the price movements of the Eurostoxx 50 index, a benchmark indicator of the performance of the largest 50 companies in the eurozone. By tracking the expiration dates, traders can strategically plan their entry and exit points, ensuring they align with the anticipated price movements of the underlying index.

Decoding the Eurostoxx Options Trading Calendar

Comprehension of the Eurostoxx options trading calendar is paramount for effective trading. Each month, a series of options contracts expiring on the third Friday of the month are introduced. These contracts are categorized as either monthly or quarterly expirations. Monthly expirations occur in January, February, March, April, May, June, July, October, and November, while quarterly expirations fall in March, June, September, and December.

Traders can leverage this calendar to identify upcoming expiration dates, enabling them to assess potential trading opportunities and strategize accordingly. By pinpointing the anticipated price movements of the Eurostoxx 50 index, traders can determine the optimal time to buy or sell options contracts, maximizing their potential for profit.

Trading Strategies Informed by the Eurostoxx Options Trading Calendar

Armed with the insights gleaned from the Eurostoxx options trading calendar, traders can formulate tailored trading strategies. For instance, a trader anticipating a bullish trend in the Eurostoxx 50 index could consider purchasing a call option contract expiring on a subsequent monthly or quarterly date. Conversely, a bearish outlook may prompt the purchase of a put option contract with a similar expiration.

Monitoring the calendar allows traders to stay updated on upcoming expirations, ensuring they can adjust their strategies promptly if market conditions shift unexpectedly. By aligning their trades with the expiration schedule, traders can enhance their chances of successful outcomes.

Tips and Expert Advice for Eurostoxx Options Trading

Enrich your Eurostoxx options trading endeavors with these valuable insights from seasoned experts:

- Thorough Research: Conduct comprehensive research to understand the underlying dynamics of the Eurostoxx 50 index, including its historical price movements, economic factors, and industry trends.

- Risk Management: Implement robust risk management strategies to safeguard your trading capital. Determine appropriate position sizes and establish stop-loss orders to mitigate potential losses.

- Market Analysis: Regularly analyze market conditions, using technical indicators and fundamental analysis to assess the potential price trajectory of the Eurostoxx 50 index.

- Volatility Assessment: Understand the concept of volatility and its impact on options pricing. High volatility often leads to wider option premiums, potentially increasing profit margins but also amplifying risks.

By incorporating these expert recommendations into your trading approach, you can increase your chances of success in the Eurostoxx options market.

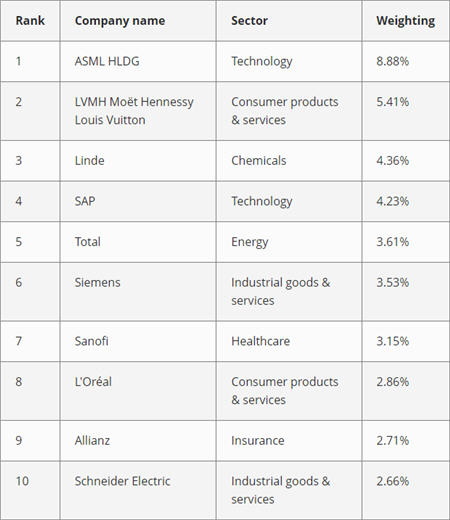

Image: www.best-trading-platforms.com

Frequently Asked Questions (FAQs)

To further clarify key aspects of the Eurostoxx options trading calendar, here is a collection of commonly asked questions and concise answers:

- Q: How often is the Eurostoxx options trading calendar updated?

A: The calendar is updated monthly to reflect the upcoming expiration dates. - Q: Which exchanges offer Eurostoxx options trading?

A: Eurostoxx options are traded on various exchanges, including Eurex, CBOE Europe, and the London Stock Exchange. - Q: What are the trading hours for Eurostoxx options?

A: Trading hours typically align with the underlying Eurostoxx 50 index, varying depending on the exchange. - Q: How can I track the performance of Eurostoxx options?

A: Traders can monitor the performance of Eurostoxx options through financial news outlets, trading platforms, and brokers.

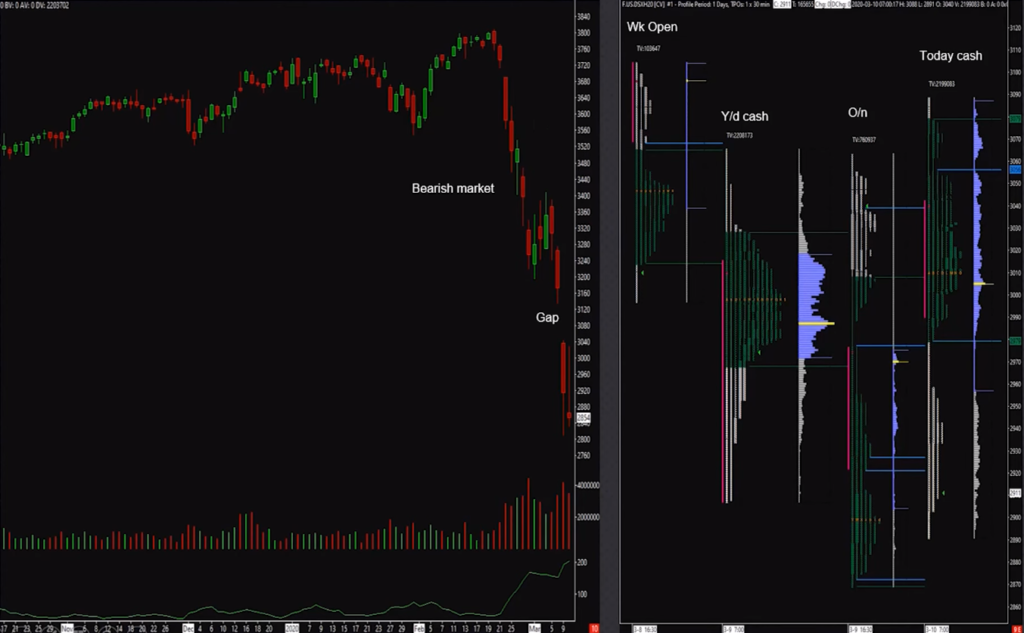

Eurostoxx Options Trading Calendar

Image: axiafutures.com

Conclusion

Mastering the Eurostoxx options trading calendar empowers traders with the knowledge and foresight to navigate the complexities of this dynamic market. By comprehending the expiration schedule, traders can align their strategies with anticipated price movements, increasing their potential for successful trades. As always, thorough research, prudent risk management, and expert guidance are key ingredients for achieving optimal results in the world of options trading.

Are you intrigued by the intricacies of Eurostoxx options trading? Share your thoughts and experiences in the comments section below.