Unveiling the Secrets of EuroStoxx Options Trading Hours

Image: axiafutures.com

Introduction:

Imagine yourself standing at the crossroads of financial opportunity, eager to tap into the vibrant world of options trading. As you navigate this complex landscape, one crucial aspect that you must master is the intricate dance of trading hours. EuroStoxx options, in particular, adhere to a specific schedule that can make or break your investment strategies. This article will serve as your ultimate guide to unraveling the mysteries of EuroStoxx options trading hours, empowering you to capture every valuable moment in the market.

Understanding EuroStoxx Options Trading Hours:

EuroStoxx options trading hours align with the operational times of the underlying EuroStoxx 50 index. Here’s a closer examination:

- Opening Hours: Trading commences at 8:00 AM Central European Time (CET) Monday through Friday.

- Closing Hours: The trading day concludes sharply at 4:30 PM CET.

- Weekend Break: As with all financial markets, EuroStoxx options trading takes a break on weekends, resuming on Monday morning.

- Public Holidays: Keep an eye out for public holidays in major European countries, as these can cause trading hours to shift or be suspended altogether.

Significance of Trading Hours:

Grasping EuroStoxx options trading hours is paramount for several reasons:

- Maximize Trading Opportunities: By aligning your trading activities with the designated hours, you maximize your chances of catching the most opportune moments in the market.

- Risk Management: Understanding trading hours allows you to plan your trades effectively, reducing exposure to price fluctuations outside of these defined times.

- Prevent Losses: Trading outside of established hours can lead to delayed or even failed executions, potentially incurring substantial losses.

The Impact of Euro Stoxx 50 Index Performance:

EuroStoxx options trading hours are closely intertwined with the performance of the Euro Stoxx 50 index. Market volatility and significant news events can influence the index’s fluctuations, resulting in increased trading activity or sudden shifts in market sentiment. Therefore, monitoring the index’s performance becomes essential for savvy traders.

Expert Insights and Actionable Tips:

To elevate your EuroStoxx options trading strategy, consider these expert insights:

- Trade During Core Hours: Maximize your chances of successful trades by focusing on the period from 9:00 AM to 11:00 AM CET and 1:00 PM to 3:00 PM CET, when liquidity is generally highest.

- Monitor Global Events: Stay abreast of global economic news and events that could impact the Euro Stoxx 50 index. This knowledge will help you anticipate potential market movements and adapt your trading strategies accordingly.

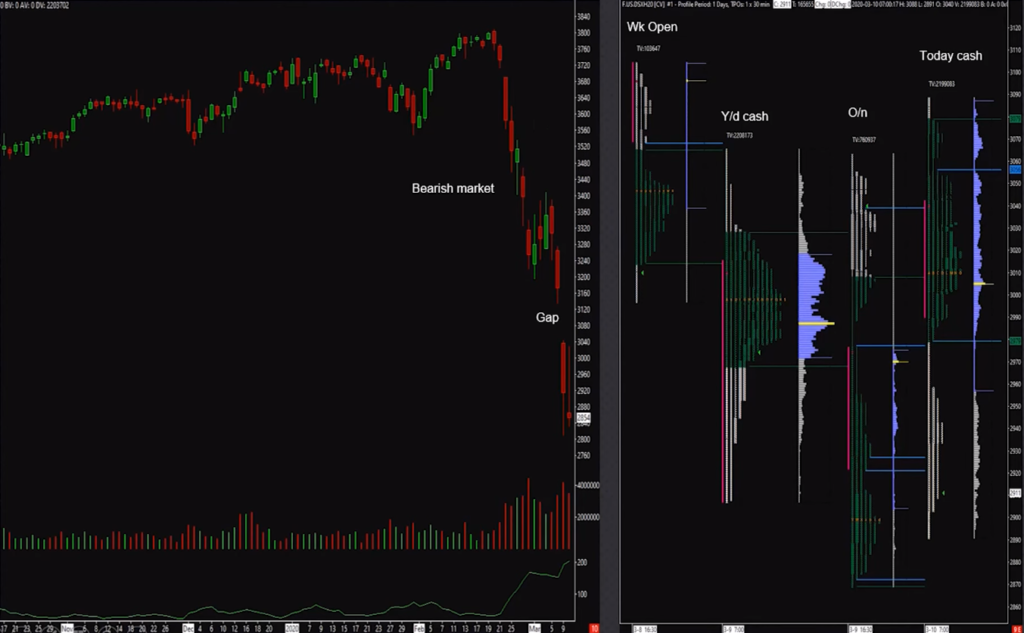

- Use Market Analysis Tools: Leverage technical analysis tools such as candlestick charts and moving averages to identify trends and patterns in the Euro Stoxx 50 index. This insight can inform your trading decisions and improve your chances of profitability.

Conclusion:

Mastering EuroStoxx options trading hours is an indispensable skill for unlocking the full potential of this dynamic financial instrument. By adhering to the designated trading schedule, comprehending the impact of the Euro Stoxx 50 index, and implementing the expert insights provided, you can confidently navigate the market and seize lucrative trading opportunities. Remember, timing is everything in the fast-paced world of options trading, and EuroStoxx options trading hours serve as the compass guiding you toward financial success.

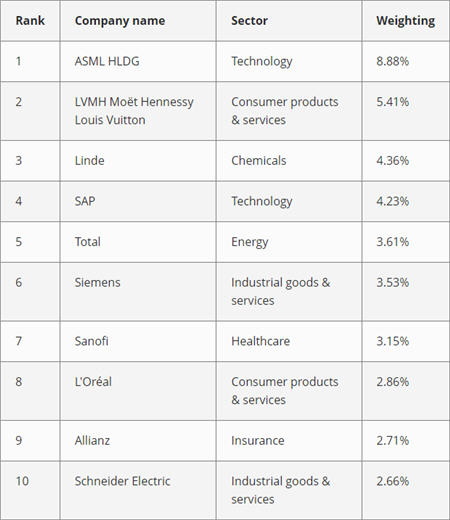

Image: www.best-trading-platforms.com

Eurostoxx Options Trading Hours

Image: www.forexlive.com