When it comes to trading equity derivatives in Europe, understanding the Euro Stoxx options trading hours is crucial. These hours determine when you can place orders, manage positions, and execute trades in the Euro Stoxx 50 index options. Whether you’re a seasoned professional or a novice investor, having a firm grasp of the trading schedule will help you make informed decisions and optimize your trading strategy.

Image: libraryoftrader.net

What are Euro Stoxx 50 Options?

Euro Stoxx 50 options are standardized contracts that give the holder the right, but not the obligation, to buy (call option) or sell (put option) the Euro Stoxx 50 index at a predetermined price (strike price) on or before a specified date (expiration date). Trading in these options provides investors with various opportunities for speculation, hedging, and income generation.

Euro Stoxx Options Trading Hours: An Overview

Euro Stoxx options trading hours follow the Central European Time (CET) zone, which is one hour ahead of Greenwich Mean Time (GMT). The regular trading session for these options begins at 9:00 AM CET and ends at 5:30 PM CET on weekdays. However, it’s important to note that the trading schedule may vary during certain market holidays or special circumstances.

Pre-trading and post-trading sessions are also available for Euro Stoxx options. The pre-trading session commences at 8:00 AM CET, allowing investors to place orders before the opening bell. The post-trading session, known as the Extended Trading Hours (ETH), runs from 5:30 PM CET to 7:00 PM CET, enabling traders to adjust their positions after the regular trading hours.

Understanding the Intercontinental Exchange (ICE) Market

Euro Stoxx 50 options are primarily traded on the Intercontinental Exchange (ICE), specifically at ICE Futures Europe. The ICE market provides a centralized platform for trading various financial instruments, including equity derivatives. The ICE opens on weekdays at 8:00 AM CET and closes at 6:00 PM CET, ensuring an overlap with the Euro Stoxx options trading hours.

Image: www.forex.com

Implications of Trading Hours for Investors

The Euro Stoxx options trading hours have several implications for investors:

- Order Execution: Orders placed during regular trading hours are typically executed immediately or within a short period. However, orders placed outside these hours, such as during pre-trading or post-trading sessions, may experience delays or reduced liquidity.

- Market Volatility: Market volatility can fluctuate significantly during different trading sessions. For example, the pre-trading and post-trading sessions often experience lower volatility due to reduced trading activity.

- Risk Management: Traders must closely monitor market conditions throughout the trading hours. News and events released during regular trading hours have the potential to impact prices, while overnight events can affect markets during the pre-trading session.

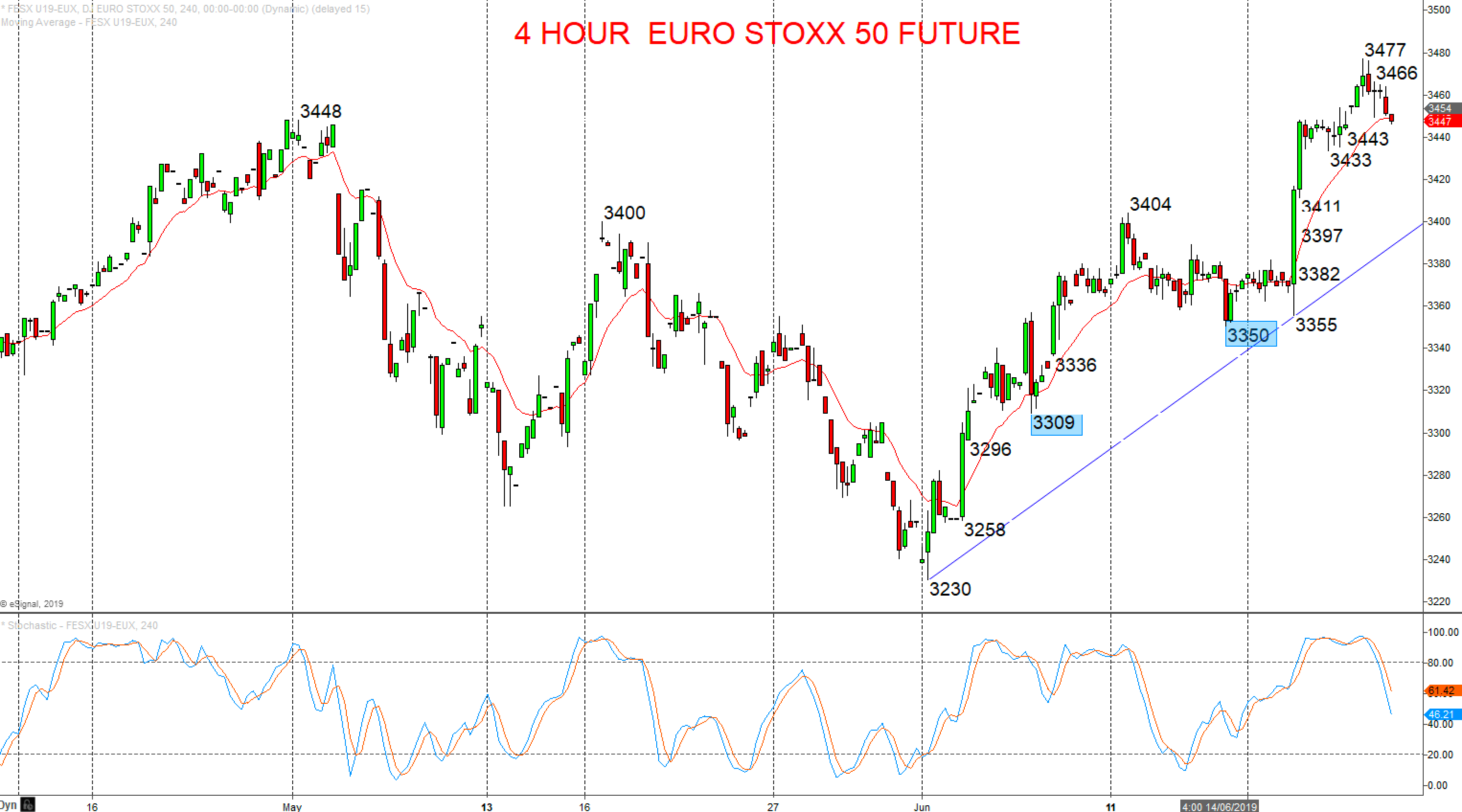

Euro Stoxx Options Trading Hours

Image: www.fxstreet.com

Conclusion

Comprehending Euro Stoxx options trading hours is paramount for effective trading. By aligning your trading strategy with these hours, you can optimize order execution, anticipate market volatility, and effectively manage your risk exposure. Whether you’re aiming for short-term gains or long-term wealth accumulation, staying abreast of the Euro Stoxx options trading schedule and the associated implications will greatly enhance your chances of success in Europe’s equity derivatives market.