Introduction:

Image: tradersunion.com

In the labyrinthine world of financial markets, options hold the allure of both potential profit and calculated risk. Among these enigmatic financial instruments, options guidelong call stands out as a strategic tool for savvy investors. In this article, we delve into the intricate details of options guidelong call, equipping you with the knowledge and insights to navigate the online option trading landscape.

Understanding Options Guidelong Call:

An options guidelong call is a contract that grants the buyer (or holder) the exclusive right, but not the obligation, to purchase an underlying asset at a predetermined price (the strike price) on a specified date (the expiration date). In exchange for this privilege, the buyer pays a premium to the seller (or writer) of the contract.

Components of an Options Guidelong Call:

- Underlying Asset: The security, such as a stock, index, or commodity, that the option contract pertains to.

- Strike Price: The fixed price at which the buyer can purchase (exercise) the option contract.

- Expiration Date: The date on which the option contract becomes void if not exercised.

- Premium: The upfront cost paid by the buyer to purchase the option contract.

How Options Guidelong Call Works:

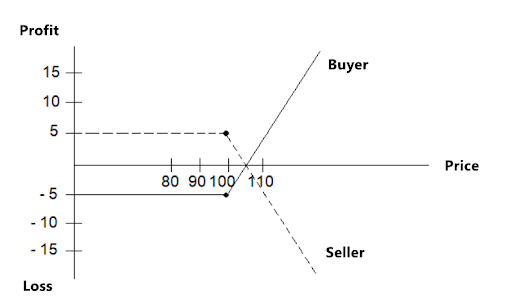

An options guidelong call gives the buyer a bullish stance. They anticipate that the price of the underlying asset will rise above the strike price by the expiration date. If their prediction proves correct, they can exercise their right to purchase the asset at the lower strike price, potentially profiting from the difference in value.

Factors Affecting Options Guidelong Call Value:

The value of an options guidelong call is influenced by several factors, including:

- Underlying Asset Price: As the price of the underlying asset fluctuates, the value of the option contract will change accordingly.

- Time to Expiration: As the expiration date nears, the value of the option contract rapidly decays until it becomes worthless.

- Implied Volatility: This measure reflects market expectations of future price volatility of the underlying asset.

- Interest Rates: Interest rates play a role in determining the carrying costs of the underlying asset, affecting option values.

Benefits and Risks of Options Guidelong Call:

Benefits:

- Potential Profit: The lure of options guidelong call lies in the opportunity to potentially profit from a favorable price movement in the underlying asset.

- Control: The buyer has the flexibility to exercise the option or not, based on their market judgment.

Risks:

- Premium Lost: If the underlying asset price does not rise above the strike price by the expiration date, the buyer loses the entire premium paid.

- Unlimited Risk: The seller of an options guidelong call is exposed to unlimited potential losses if the underlying asset price significantly exceeds the strike price.

Trading Options Guidelong Call Online:

Navigating the online option trading space can be intimidating, but with the right platform and education, you can gain access to diverse options guidelong call contracts.

Choosing an Online Broker:

Selecting a reputable online broker that offers options trading is crucial. Consider factors such as佣金, clearing fees, and trading platform user-friendliness.

Understanding Options Trading Platform:

Options trading platforms provide real-time data, charting tools, and execution capabilities. Familiarize yourself with the platform’s features and seek assistance from an experienced trader or broker if needed.

Expert Insights and Actionable Tips:

- Respect the Risks: Options trading carries inherent risks. Always understand and manage your risk tolerance.

- Set Realistic Expectations: Do not expect immediate riches. Patience and a disciplined approach are key to success.

- Continuous Education: Stay abreast of market trends and developments by reading books, attending webinars, and seeking professional guidance.

Conclusion:

Options guidelong call is a valuable инструмент for online option traders who seek to capitalize on market opportunities. By understanding the intricacies of this contract, traders can make informed decisions, mitigate risks, and optimize their trading strategies. Remember, education, experience, and a responsible mindset are essential for successful options trading. Embrace the learning process, minimize risk, and unlock the potential profits that the world of options has to offer.

Image: gapup.club

Options Guidelong Call Explained Online Option Trading Guide

Image: www.investing.com