In the realm of financial markets, investors have access to a vast landscape of opportunities. Among them, cash trading and option trading stand as distinct avenues, each offering unique advantages and considerations. Embark on this educational journey to unravel the intricacies of these two trading approaches.

Image: industrialtrading.co.za

Cash Trading: The Direct Route to Market

Cash trading, also known as spot trading, entails the immediate purchase or sale of a security at the prevailing market price. In this straightforward transaction, investors acquire ownership of the underlying asset and bear the associated risks and rewards directly. Cash trading is a highly liquid market, with ample opportunities for execution and settlement within a short time frame. It is suitable for those seeking direct exposure to market movements and the potential for quick returns.

Option Trading: Unlocking Potential with Flexibility

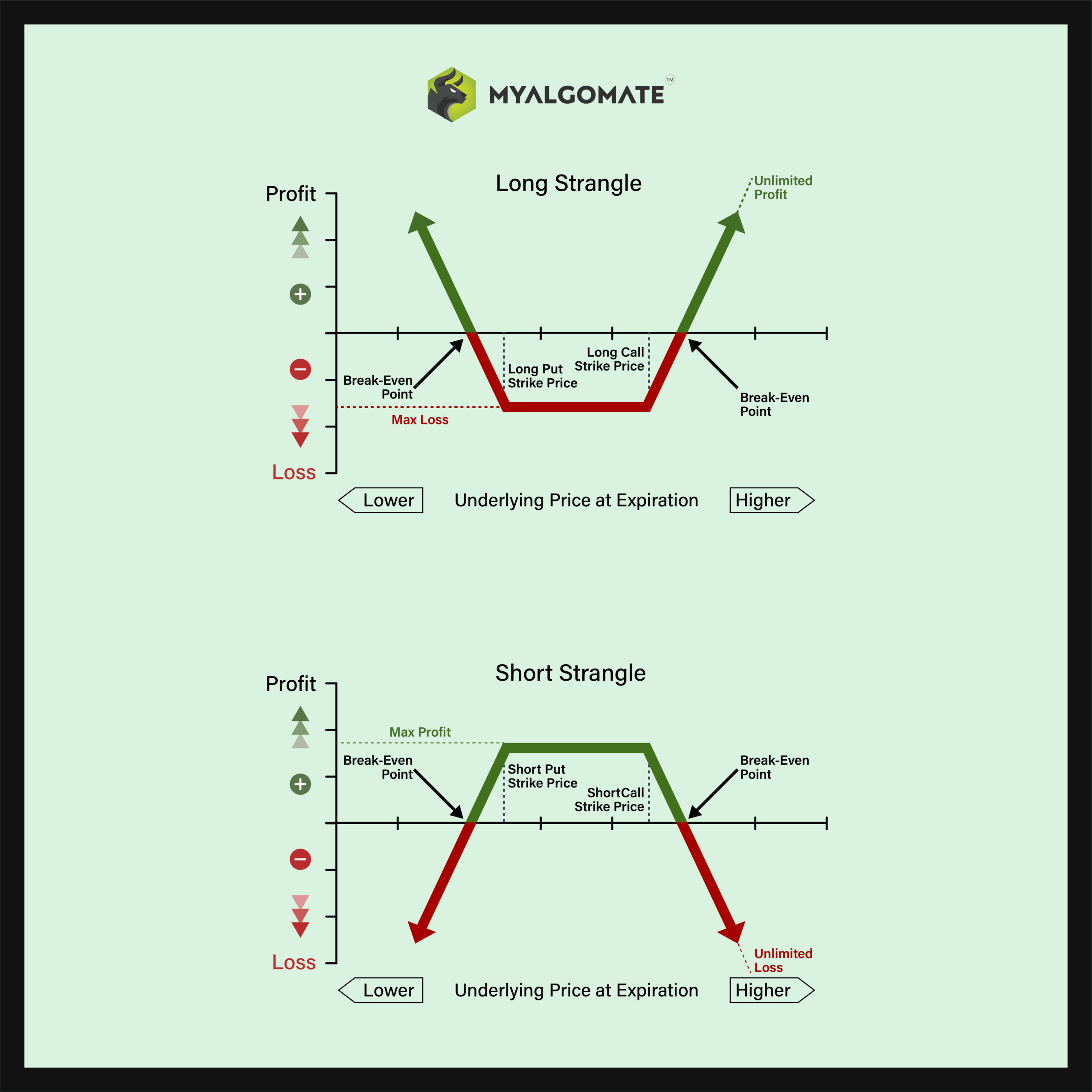

Option trading presents a more nuanced approach, offering investors the option to buy or sell an underlying asset at a specific price on or before a specified date. Unlike cash trading, the option contract does not mandate ownership, but rather grants the holder the right to exercise this optionality at their discretion. Option trading offers both offensive and defensive strategies, enabling investors to hedge against risk, speculate on market movements, or generate income through premium.

Key Differences: Unveiling the Distinctions

To further illustrate the contrasting nature of these trading styles, let’s delve into their key differences:

Ownership: Cash trading confers direct ownership of the underlying asset, while option trading provides the right to purchase or sell, but not absolute ownership.

Flexibility: Option trading grants investors the flexibility to choose whether or not to exercise their options, while cash trading requires immediate fulfillment.

Risk and Reward: Cash trades carry immediate market risk, as investors directly assume the fluctuations of the underlying asset. Option premiums limit risk, as investors only forfeit the price paid for the contract.

Time Horizon: Cash trades are typically executed within a short time frame, while option contracts have predetermined expiration dates, allowing for both short-term and long-term strategies.

Example 1: An investor purchases 100 shares of Apple stock for $150 per share via cash trading. They now own these shares and bear the full impact of market price movements.

Example 2: An investor purchases an option contract giving them the right to buy 100 shares of Microsoft stock at $250 per share within the next two months. They pay a premium of $5 per share for this contract. The investor can choose to exercise this option only if the market price exceeds $255, profiting from the difference.

Image: www.myalgomate.com

Expert Insights: Wisdom from the Market

“Cash trading provides the purest form of market exposure, while option trading offers investors a powerful tool to manage risk and unlock potential opportunities,” says Dr. Emily Carter, a renowned financial strategist.

“Understanding the nuances of each trading style is crucial for investors to make informed decisions and harness the potential of the markets,” advises Professor John Smith, a leading authority on options trading.

Difference Between Cash Trading And Option Trading

Image: telegra.ph

Conclusion: Empowering Investors with Informed Choices

Cash trading and option trading represent distinct paths in the financial landscape, each catering to unique investor objectives and strategies. By understanding the fundamental differences between these trading styles, investors can navigate the markets with greater confidence and make informed choices that align with their risk tolerance and financial goals.