Cash and option trading are fundamental pillars of the financial landscape, enabling investors to navigate market dynamics and pursue diverse investment strategies. Cash trading involves the exchange of currencies or securities at their current market price, while option trading offers flexibility and the potential for elevated returns through the use of options contracts. Understanding these concepts is crucial for anyone seeking to delve into the world of financial markets.

Image: derivfx.com

Cash Trading: The Foundation of Stock Trading

Cash trading, also known as spot trading, is the most straightforward form of trading in which buyers and sellers exchange securities or currencies at the prevailing market price. It is the most common method of buying and selling stocks, bonds, and currencies. Cash trading is executed on stock exchanges, where orders are matched and executed instantaneously. The price of the security at the time of execution determines the transaction value. Cash trading is ideal for executing immediate trades and gaining exposure to underlying assets.

Option Trading: Beyond Buy-and-Hold

Option trading introduces a nuanced dimension to financial markets. Options contracts provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. This flexibility allows investors to tailor strategies based on market outlook and risk tolerance. Option trading opens up opportunities for income generation through premium collection and strategic hedging against market fluctuations. Understanding option pricing models and risk management techniques is paramount for successful option trading.

Exploring Option Types and Strategies

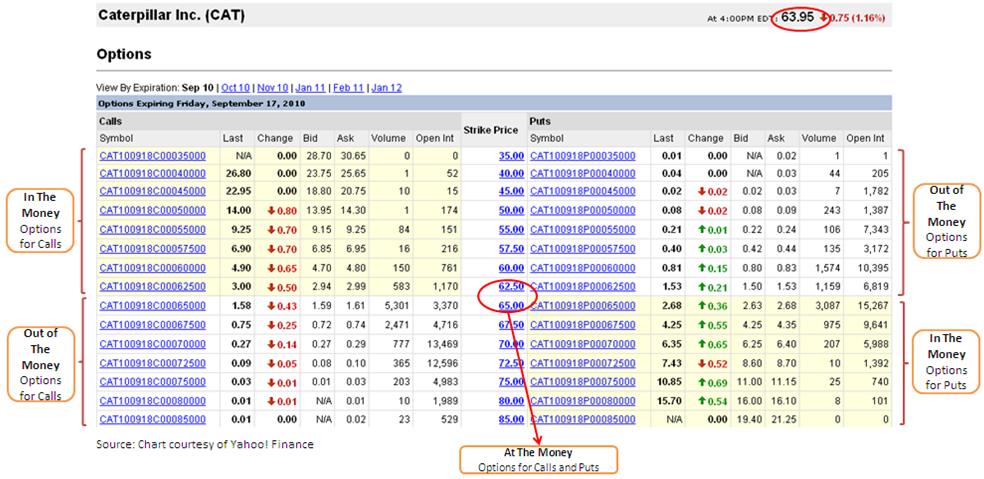

Options are classified into two primary types: calls and puts. Calls confer the right to buy an underlying asset at a specified price, while puts provide the right to sell. Options are further categorized based on their expiration dates, which can range from short-term (weekly or monthly) to long-term (annual). Option trading strategies are multifaceted, encompassing a wide range of approaches. Investors can employ covered calls, put options, straddles, and strangles to manage risk and enhance potential returns.

Image: unbrick.id

Benefits and Risks of Cash and Option Trading

Cash trading offers simplicity, transparency, and immediate execution. However, it exposes investors to the full risk associated with price fluctuations. Option trading, on the other hand, provides flexibility, income-generating opportunities, and risk management tools. However, it also involves higher complexity, the potential for substantial losses, and time decay considerations. Understanding both cash and option trading empowers investors to make informed decisions based on their investment objectives and risk tolerance.

What Is Cash And Option Trading

Image: ujejocykixova.web.fc2.com

Conclusion

Cash and option trading serve as keystones of financial operations, granting investors access to a vast array of investment opportunities. While cash trading offers immediate trade execution and straightforward entry into the markets, option trading introduces strategic flexibility and income-generating potential. Understanding the intricacies of each approach empowers investors to navigate market complexities, manage risk, and pursue tailored investment strategies. Whether an individual seeks to execute immediate transactions or implement nuanced strategies, embracing cash and option trading broadens the horizons for financial success.