In the realm of financial trading, standard cash option trading stands as a beacon of opportunity, offering investors the potential to navigate the ever-changing market landscape with precision and efficiency. Defined as the simultaneous purchase and sale of an equal number of options contracts with the same underlying asset, expiration date, and strike price, this strategy empowers traders to capitalize on price fluctuations and optimize returns.

Image: truyenhinhcapsongthu.net

The allure of standard cash option trading lies in its versatility, catering to a wide range of market conditions and risk tolerances. Whether seeking to generate income, hedge against potential losses, or take advantage of market volatility, this strategy provides a flexible framework to tailor investment strategies and achieve financial objectives.

Essential Elements of Standard Cash Option Trading

1. Options Basics

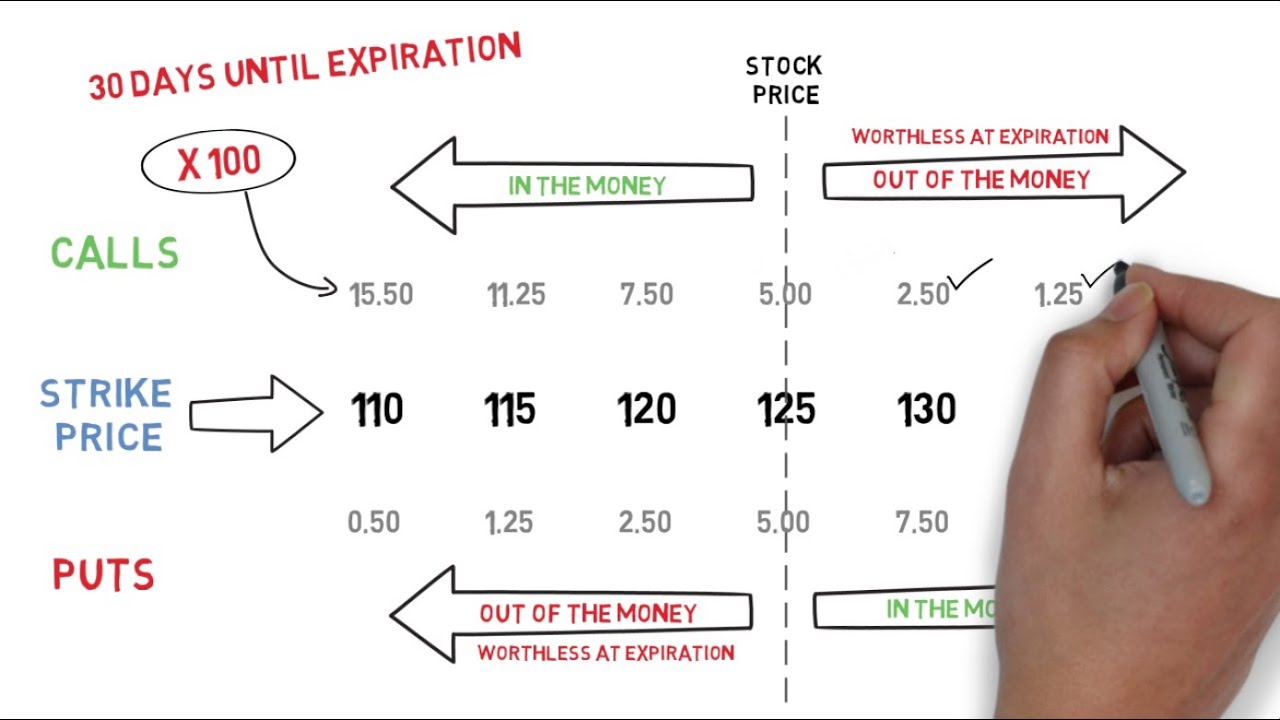

At the heart of standard cash option trading lies the concept of options. An option contract grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). The two main types of options contracts are calls, which confer the right to buy, and puts, which confer the right to sell.

2. Standard Option Trading

In standard cash option trading, investors simultaneously enter into a long position in one option and a short position in another option with identical characteristics except for their positions (call or put). This synchronized transaction results in a net premium payment or receipt, representing the difference between the purchase price of the long option and the sale price of the short option.

Image: shortthestrike.com

3. Risk-Return Spectrum

The inherent flexibility of standard cash option trading empowers investors to calibrate their risk-return profiles. Long positions in call options offer upside potential but carry the risk of losing the premium paid if the underlying asset price falls. Conversely, long positions in put options provide downside protection but expose traders to limited profit potential if the underlying asset price rises.

Real-World Applications of Standard Cash Option Trading

1. Income Generation

Standard cash option trading can be employed to generate passive income through the sale of options premiums. By selling at-the-money or slightly out-of-the-money options with long expirations, traders can earn consistent revenue while mitigating potential risks.

2. Hedging

Options play a pivotal role in hedging strategies, allowing investors to protect their portfolios against adverse market movements. By purchasing out-of-the-money put options, investors can establish a downside buffer that safeguards their long positions in the underlying asset.

3. Volatility Trading

Traders adept at anticipating market volatility can leverage standard cash option trading to capitalize on price swings. By selling options with short expirations and high implied volatility, they seek to profit from rapid price fluctuations.

Evolution of Standard Cash Option Trading

The advent of electronic trading platforms has revolutionized standard cash option trading, offering traders unprecedented speed, liquidity, and transparency. These platforms connect buyers and sellers instantaneously, facilitating efficient order execution and enabling traders to adapt quickly to changing market conditions.

In addition to traditional exchanges, over-the-counter (OTC) markets have emerged as viable venues for standard cash option trading. OTC markets provide greater flexibility and customization for investors seeking to tailor option strategies to their specific needs and objectives.

Standard Cash Option Trading

Conclusion

Standard cash option trading empowers investors with a versatile and effective tool to navigate financial markets and pursue their investment goals. Through a deep understanding of option basics and trading strategies, traders can harness the power of options to generate income, hedge against risks, and capitalize on market volatility. As the financial landscape continues to evolve, standard cash option trading will undoubtedly remain a cornerstone of successful investment portfolios.