In the bustling world of financial markets, investors often seek innovative ways to amplify their profits and mitigate risks. Enter option trading standard cash, a strategy that empowers traders to harness the potential of market fluctuations and capitalize on both upward and downward price movements. This article delves into the intricacies of option trading, offering a comprehensive guide to this multifaceted strategy.

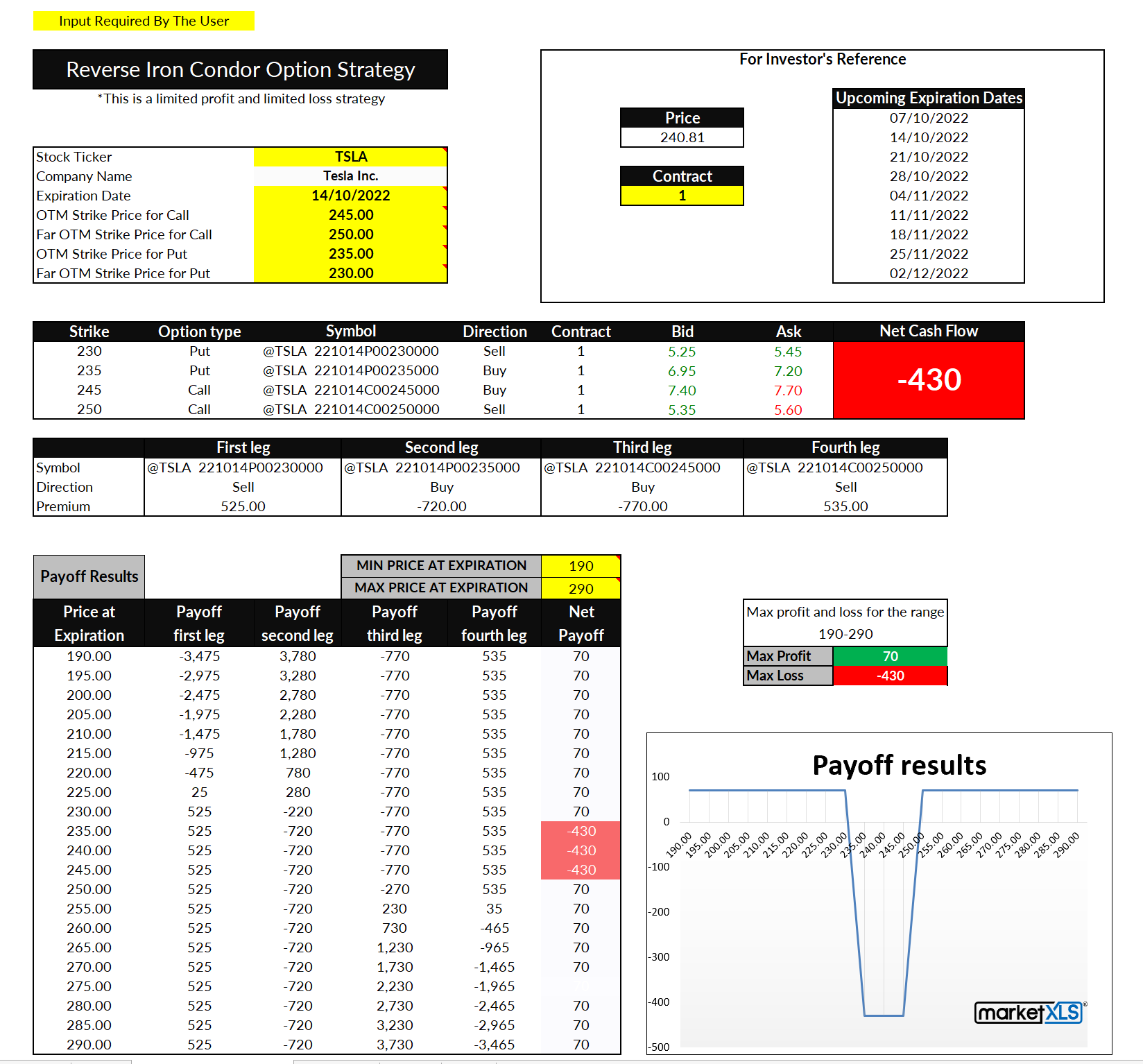

Image: marketxls.com

Understanding the Basics of Option Trading Standard Cash

An option is a financial contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. When trading options for standard cash, the underlying asset is typically a stock or an exchange-traded fund (ETF). The price at which the buyer can buy or sell the asset is known as the strike price.

The two main types of options are call options and put options. A call option gives the buyer the right to buy the underlying asset, while a put option gives the buyer the right to sell. Standard cash options expire on a specified date, and if the option is not exercised before expiration, it becomes worthless.

Benefits of Option Trading Standard Cash

Option trading standard cash offers several advantages to traders:

-

Leverage: Options provide traders with the ability to leverage their capital, allowing them to control a larger position with a smaller investment.

-

Hedging: Options can be used as a hedging strategy to protect against potential losses in other investments.

-

Income generation: Option premiums can generate income if the option is not exercised before expiration.

Risks Involved in Option Trading Standard Cash

While option trading can be rewarding, it also carries risks:

-

Loss of premium: If the underlying asset does not move in the desired direction, the option may expire worthless, resulting in the loss of the premium paid.

-

Unlimited risk: The potential loss in option trading can be unlimited, unlike traditional stock trading.

Image: www.rockwelltrading.com

Practical Tips for Successful Option Trading Standard Cash

-

Understand the risks:** Before venturing into option trading, it is crucial to have a thorough understanding of the risks involved.

-

Set realistic goals: Have realistic profit targets and risk-tolerant limits.

-

Do your research: Conduct thorough research on the underlying asset, market conditions, and option pricing models.

-

Start small: Begin trading with small positions until you gain experience and confidence.

-

Seek professional advice: Consider consulting with a financial advisor who specializes in option trading for personalized guidance.

Option Trading Standard Cash

https://youtube.com/watch?v=o01SBb8td68

Conclusion

Option trading standard cash is a powerful financial instrument that can augment returns and diversify portfolios. However, it is essential to approach this strategy with a comprehensive understanding of both its benefits and risks. By adhering to these practical tips and continuously educating yourself, you can unlock the potential of option trading standard cash and navigate the financial markets with confidence and success.