The enigmatic allure of the financial markets has enticed many to seek riches, with options trading emerging as a potent catalyst for both windfalls and despair. For those seeking to venture into this realm, Thinkorswim, a premier trading platform, offers a comprehensive suite of tools, including a dedicated options trading tab. In this guide, we embark on a journey to demystify the process of adding this invaluable feature to your Thinkorswim experience, empowering you with the knowledge to unlock new avenues of financial exploration.

Image: asrposassets.weebly.com

Unveiling the Treasure Trove of Options Trading

Options, often shrouded in obscurity, are financial instruments that confer upon their holder the right, not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. They are a versatile weapon in the trading arsenal, allowing speculators to express bullish or bearish views, hedge existing positions, and amplify potential returns.

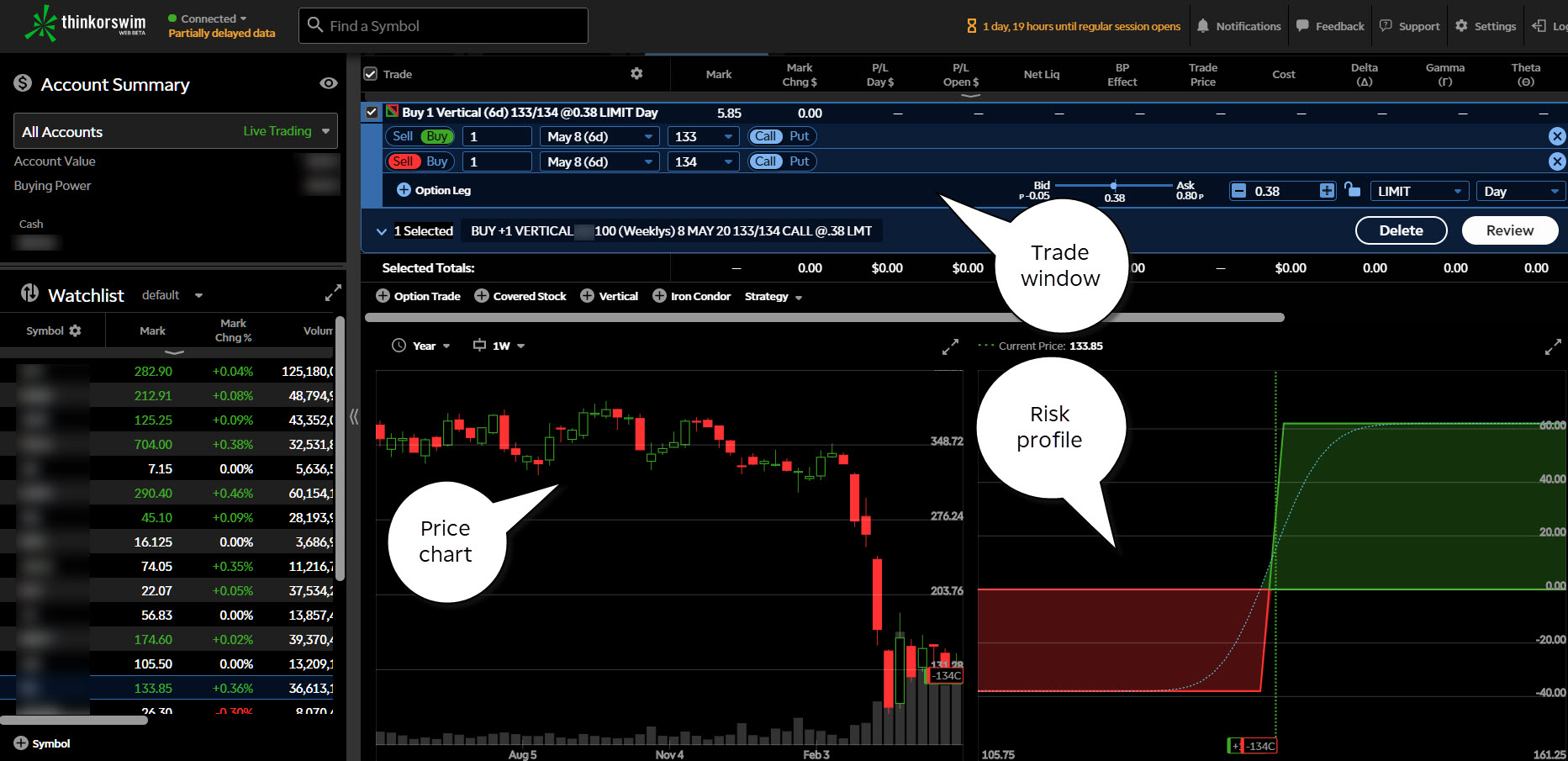

Thinkorswim, a pivotal force in the trading landscape, provides a robust platform that seamlessly integrates options trading into its feature-rich ecosystem. By adding the dedicated options trading tab, you gain access to a treasure trove of analytical tools, real-time market data, and sophisticated order entry capabilities, all tailored to the unique demands of options traders.

Configuring the Options Trading Tab: A Step-by-Step Guide

- Navigate to the Platform Settings: Embark on your journey by launching the Thinkorswim platform and navigating to the platform settings. This can be achieved by clicking on the gear icon located in the top right corner of the interface.

- Delve into the Interface Section: Within the platform settings, locate the “Interface” section and click on it to reveal a plethora of customization options.

- Discover the Workspace Tab Options: Under the “Interface” section, seek out the “Workspace Tabs” tab. This tab houses a comprehensive list of all available workspace tabs within Thinkorswim.

- Activate the Enigmatic Options Tab: Scroll down the list of workspace tabs until you encounter the enigmatic “Options” tab. Place a checkmark in the checkbox adjacent to it to unveil its hidden powers.

- Conclude the Transformation: To finalize the process, click on the “Apply” button at the bottom of the platform settings window. This action will activate the options trading tab, transforming your Thinkorswim interface into a veritable options trading powerhouse.

Harnessing the Power of the Options Trading Tab

With the options trading tab now at your fingertips, a world of possibilities unfolds before you. This dedicated workspace is a symphony of features designed to elevate your options trading experience to new heights.

- Real-Time Market Data: Stay abreast of the ever-changing market landscape with real-time market data streamed directly into the options trading tab. Monitor bid and ask prices, implied volatility, and historical volatility, empowering you with the knowledge to make informed trading decisions.

- Comprehensive Option Chains: Explore a universe of options contracts with comprehensive option chains that provide a detailed overview of all available options for an underlying asset. Analyze key metrics such as strike price, expiration date, and open interest to identify potential trading opportunities.

- Advanced Order Entry: Effortlessly place orders with the advanced order entry functionality embedded within the options trading tab. Specify order types, limit prices, and stop orders, enabling you to execute trades with precision and efficiency.

- Interactive Charts and Analysis: Delve into the intricate world of technical analysis with interactive charts and analytical tools integrated into the options trading tab. Identify trends, patterns, and potential trading signals to enhance your decision-making process.

Image: haikhuu.com

Latest Trends and Developments in the Options Trading Arena

The options trading landscape is an ever-evolving tapestry, constantly adorned with groundbreaking innovations and strategic enhancements. Stay abreast of these developments to remain at the forefront of this dynamic market.

One notable trend is the rise of exchange-traded options (ETOs). ETOs provide a convenient and standardized way to trade options on various underlying assets, including stocks, indices, and commodities. Their liquidity and transparency have made them increasingly popular among options traders.

Another significant development is the advent of artificial intelligence (AI) in options trading. AI-powered algorithms are increasingly employed to analyze vast amounts of market data, identify trading opportunities, and even automate trade execution. While AI can enhance trading efficiency, it is crucial to use these tools judiciously and with a thorough understanding of their limitations.

Expert Advice and Best Practices for Options Trading Success

Venture into the realm of options trading armed with the wisdom of experienced traders. Heed the following expert advice to increase your chances of achieving success:

- Master the Fundamentals: Before diving into the intricacies of options trading, lay a solid foundation by studying the fundamentals of options, including their terminology, pricing, and strategies.

- Stay Informed: Follow financial news and market updates to stay abreast of economic events, company announcements, and market trends that can impact options prices.

- Manage Risk Prudently: Options trading involves inherent risks. Implement risk management strategies such as stop-loss orders, position sizing, and diversification to limit potential losses.

- Seek Professional Guidance: If you are new to options trading or need specialized advice, consider seeking guidance from a financial advisor or experienced options trader.

- Practice Patience: Options trading is not a get-rich-quick scheme. Develop a trading plan, stick to it, and be patient in waiting for the right trading opportunities.

Frequently Asked Questions (FAQs) About Options Trading

To address common questions and provide further clarity, here is a comprehensive FAQ section:

- What is the difference between a call option and a put option?

- A call option gives the holder the right to buy an underlying asset at a specified price, while a put option gives the holder the right to sell.

- What is the meaning of “in the money” and “out of the money”?

- “In the money” refers to an option with a strike price that is favorable to the holder, while “out of the money” refers to an option with a strike price that is unfavorable.

- What is implied volatility?

- Implied volatility is a measure of the expected future volatility of an underlying asset, as implied by the prices of its options.

- How do I determine the value of an option?

- The value of an option is determined by a complex formula that takes into account factors such as the strike price, time to expiration, underlying asset price, and implied volatility.

How To Add Options Trading Tab On Thinkorswim

Image: tradersfly.com

Conclusion: Embark on Your Options Trading Journey

The realm of options trading beckons you with immense potential for financial gains and intellectual stimulation. Equipped with the knowledge imparted in this guide, you can now confidently add the options trading tab to your Thinkorswim interface and unlock the gateway to a boundless world of trading possibilities. Remember, the path to success in options trading is paved with knowledge, prudent risk management, and an unyielding desire to learn and grow.

Let us know if you found this article informative and intriguing. Are you ready to embrace the challenges and rewards of options trading? Share your thoughts and experiences in the comments section below, and let us embark on this enthralling journey together.