Introduction to LEAPS

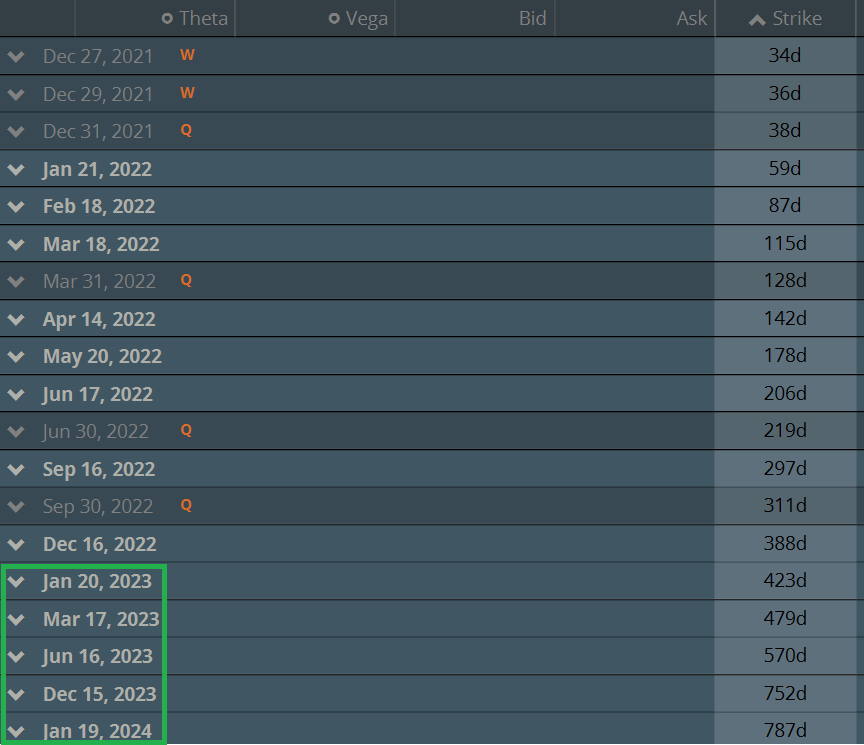

Leaps options, also known as Long-Term Equity Anticipation Securities, are a type of equity option with extended expirations, typically ranging from 9 to 36 months. Unlike traditional options contracts that expire monthly or quarterly, LEAPS offer traders greater flexibility and time value. This unique feature makes LEAPS a suitable choice for investors seeking strategic exposure to underlying stocks without the immediate obligation to exercise or sell the option.

Image: learninginvestmentwithjasoncai.com

Understanding LEAPS Trading

Trading LEAPS involves buying or selling contracts that represent the right to buy (for call options) or sell (for put options) a specific number of shares of an underlying stock at a pre-determined price (strike price) on or before the contract expiration date. However, unlike short-term options that focus on short-term price movements, LEAPS are often utilized for longer-term investment strategies or to speculate on the future direction of the underlying stock.

Advantages of LEAPS Trading

- Extended Time Value: LEAPS’ long expirations reduce the impact of time decay, offering traders more time to realize potential gains.

- Lower Margin Requirements: Compared to short-term options, LEAPS typically have lower margin requirements, making them more accessible to investors with limited capital.

- Flexibility: LEAPS provide traders with the flexibility to adjust their positions based on market conditions and long-term investment horizons.

Strategies for LEAPS Trading

- Long LEAPS Calls: This strategy involves buying LEAPS calls when the trader expects the underlying stock’s price to rise. It offers levered exposure to potential stock appreciation.

- Long LEAPS Puts: Buying LEAPS puts allows traders to hedge against future declines in the underlying stock’s price or speculate on a bearish outlook.

- Vertical Spreads: Using a combination of LEAPS calls and puts creates vertical spreads, such as credit spreads or iron condors, to generate income and manage risk in different market environments.

Image: www.projectfinance.com

Tips for Trading LEAPS

- Choose liquid stocks: Opt for high-volume stocks with liquid options markets to ensure easy execution and exit strategies.

- Consider market conditions: LEAPS should align with your trading strategy and market outlook. Research the overall market environment and stock-specific factors before making trades.

- Manage risk: Implement proper risk management techniques, such as stop-loss orders and position sizing, to limit potential losses.

- Monitor closely: Track your LEAPS positions regularly and adjust or close them as needed based on market changes and your investment objectives.

FAQ

Q: What is the difference between LEAPS and traditional options?

A: LEAPS have extended expirations, typically between 9 and 36 months, while traditional options expire monthly or quarterly.

Q: Do LEAPS have the same rights as regular options?

A: Yes, LEAPS holders have the right to buy or sell the underlying asset at the strike price before or on the expiration date.

Q: Are LEAPS riskier than regular options?

A: LEAPS typically have lower time decay and can be less risky than short-term options that expire quickly. However, all options trading involves inherent risk.

Trading Leaps Options

Image: investpost.org

Conclusion

Trading LEAPS options offers unique advantages for strategic investors seeking long-term exposure to the equity markets. By understanding the principles, strategies, and tips discussed in this article, you can navigate the LEAPS market effectively and potentially enhance your trading outcomes.

Are you interested in learning more about LEAPS options trading strategies? Let us know in the comments below!