Introduction

In the world of stock market investments, leaps (long-term equity anticipation securities) have emerged as a unique and compelling option trading strategy that offers both potential profits and calculated risks. These long-lived call options provide investors with a magnified yet time-sensitive exposure to underlying stocks, making them an enticing tool for those seeking to amplify returns or enhance their portfolio’s efficiency. In this comprehensive guide, we will delve into the depths of leaps option trading, unraveling their mechanics, exploring their advantages and drawbacks, and equipping you with practical strategies to enhance your trading endeavors.

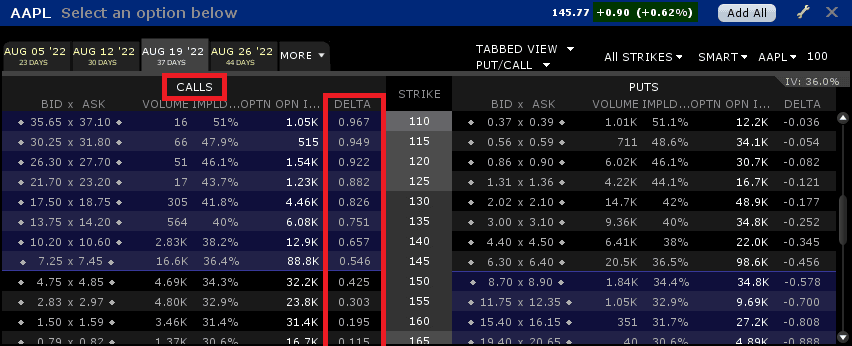

Image: marketrebellion.com

What are LEAPS Options?

LEAPS options are a specific type of call option that distinguishes themselves through their extended expiration dates, typically ranging from one to three years, far exceeding the usual life span of traditional options. This longevity aspect allows traders to maintain their exposure to the underlying stock for an extended period, granting them ample time to capitalize on potential price appreciation while mitigating the impact of short-term market fluctuations.

Mechanics of LEAPS Options

To grasp the functioning of LEAPS options, we must understand the fundamental principles of call options. Call options confer upon the option holder the right, not the obligation, to purchase an underlying stock or other asset at a specified price (the strike price) on or before a particular date (the expiration date). With LEAPS options, these rights are prolonged, granting the holder the extended liberty to exercise their option or to sell it for a profit within the predetermined timeframe.

Advantages of LEAPS Option Trading

The allure of LEAPS option trading lies in its unique set of advantages. Firstly, their extended expiration dates provide ample time for the underlying stock to appreciate in value, potentially leading to substantial profits. Secondly, LEAPS options offer leverage, enabling traders to control a larger position in the underlying stock with a relatively modest investment outlay. Moreover, LEAPS can be an effective diversification tool, allowing traders to mitigate overall portfolio risk by balancing their holdings between stocks and options.

Image: marketrebellion.com

Strategies for LEAPS Option Trading

Strategic implementation is crucial in LEAPS option trading. One popular strategy involves utilizing LEAPS options for long-term stock exposure, where traders purchase LEAPS call options on stocks they believe will appreciate in the long run, holding them until expiration or selling them for a profit. Conversely, the short LEAPS option strategy involves selling LEAPS call options with the anticipation of the underlying stock’s value decline, aiming to profit from the decay in the option’s time value as it approaches expiration.

Examples of LEAPS Option Trading

To illustrate the practical application of LEAPS option trading, let’s consider a hypothetical example. Suppose an investor anticipates a rise in Apple Inc.’s (AAPL) stock price over the next two years. They could purchase a LEAPS call option with a strike price of $150 and an expiration date of two years from now. If AAPL’s stock price rises to $170 before the expiration date, the investor could exercise the option to buy the stock at $150 and immediately sell it at the higher market price, generating a profit.

Things to Consider

Before venturing into LEAPS option trading, it is imperative to acknowledge the potential risks and considerations involved. LEAPS options involve greater time decay compared to short-term options, meaning their value will erode over time regardless of the underlying stock’s performance. Additionally, the extended duration of LEAPS options requires traders to have steadfast conviction in their predictions and the ability to tolerate potential fluctuations in the underlying stock’s price.

Leaps Option Trading

Image: optionstradingiq.com

Conclusion

LEAPS option trading represents a sophisticated strategy that can potentially enhance returns and portfolio efficiency for astute investors. By leveraging the extended expiration dates and amplified leverage of LEAPS options, traders can harness the power of calculated risk-taking. With a thorough understanding of the mechanics, strategies, and considerations involved, investors can navigate the complexities of LEAPS option trading, unlocking the potential for substantial financial gain and diversifying their investment portfolio effectively.